We are bullish on the long-term outlook for carbon permit prices in compliance markets as they remain the policy tool of choice for incentivising abatement.

Morgan Stanley takes a similar view, “We continue to see the case for structurally higher EUA carbon prices ahead to support the decarbonisation of industry. We consider this objective to be synonymous with energy security as much as climate action.”

Citi Bank also note that, “despite a steepening contango of rising costs of carry, we continue to believe the market is underestimating the long-term EUA price.”

Furthermore, over the past year and a half several major commodity houses and corporates in the oil and mining space have expanded their carbon trading desks. Exchanges with futures contracts offerings are expanding rapidly, supporting a new breed of carbon financial products. In turn this is creating enhanced liquidity and enabling different participants to enter the market.

More active involvement of investors should act as a key catalyst for more efficient price discovery, a greater easing of Europe’s energy crunch and therefore a reduced risk of another intervention by policymakers onto the bloc’s carbon market.

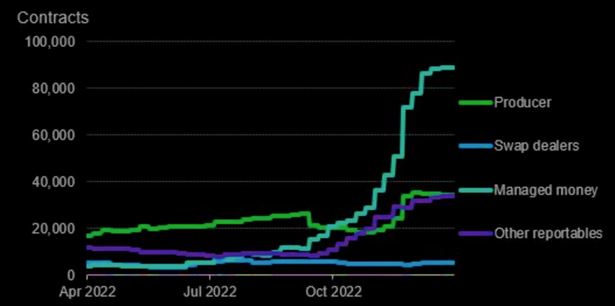

Chart 1: EU carbon market balance (Mt)

Source: Citi,BNEF, Energy Aspects, Macquarie Commdity Startegy, November 2022

2022 Carbon market year in review

EU ETS

The most significant example of the continued trend of rising carbon prices is the EU Emissions Trading Scheme (ETS), but the North American carbon markets (Western Climate Initiative or WCI, which includes the state of California, and the northeast’s Regional Greenhouse Gas Initiative known as RGGI) are also seeing ever higher carbon prices, as is the New Zealand ETS.1

As was the case last year, continued price rallies are an effect of this higher climate policy ambition, reflecting market participants’ expectations for a tight future supply-demand balance.

The price of carbon credits in the EU ETS has climbed fivefold in the past three years, and gains have ramped up pace in recent weeks as the EU has tightened rules to make the system more arduous for polluters.

EU End to free permits

As part of the ETS, the EU gives industry free CO2 permits to help them compete with international rivals. Critics of the scheme say this has removed the incentive to cut emissions, with industrial emissions little changed over the past few years.

Currently 57% of total permits in the ETS are auctioned while 43% are free, but the share of emissions covered by free permits differs between industries.

This is set to change though, with the EU agreeing last month to slowly replace free permits by 2034.

North American ETS

The year 2022 set yet another record for market value in both North American emission trading systems, even though permit prices fluctuated rather than rising steadily as they did in 2021, and despite lower overall volumes than in that year. Combined, the two programmes saw 2.5 billion tonnes change hands and were worth over €60 billion. Besides fundamentals, the policy drivers that influenced prices over the year were related to the stringency of the programs going forward. Regulators in California, the main member of the Western Climate Initiative, finalised a plan for achieving the state’s new, more ambitious emission reduction target – this is bullish for WCI allowance prices, as the caps will have to be made tighter to align with the steeper overall emission trajectory.2

Furthermore, as investors eye markets beyond the EU they are increasingly looking to the North Californian scheme. According to Bloomberg NEF “Managed money, traders engaged in managing and conducting organized futures trading on behalf of clients, have grown their long positions the most in the California market. Their positions have expanded 21% to 89 million allowances in January 2023.”

Chart 2: Vintage 2023 California carbon allowance positions

Bloomberg says, diversification into other carbon markets lowers policy and market-specific risks while still maintaining a focus on decarbonisation. California, for example, provides an inflation hedge as it has a price floor pegged to inflation in its design.

The Caifornian market continues to expand, Pennsylvania and North Carolina are moving towards joining the RGGI.

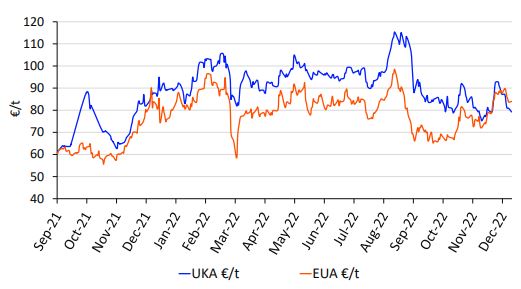

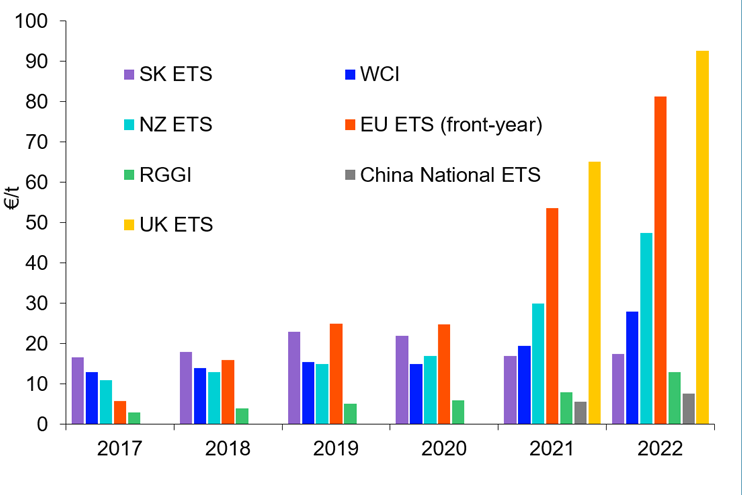

Chart 3: Annual average price per metric tonne

Source: Refinitiv

UK ETS

UK allowances traded at a premium to their EU counterparts throughout 2022, with the spread between the two averaging roughly €12, but followed the same price swings until Q4. Volumes were up from 2021, as trading in that year didn’t begin until May. At about €47 billion, total market value is proportional to that of the EU ETS given the two markets’ relative size in terms of covered emissions.3

Some 431 million UKAs transacted as spot and futures contracts (mainly as December 2022 futures). In addition, 81.3 million UKAs were sold at auctions. In total, this makes for a traded volume of 512 Mt – up 53 percent from 2021, when trading only took place from May through December.4

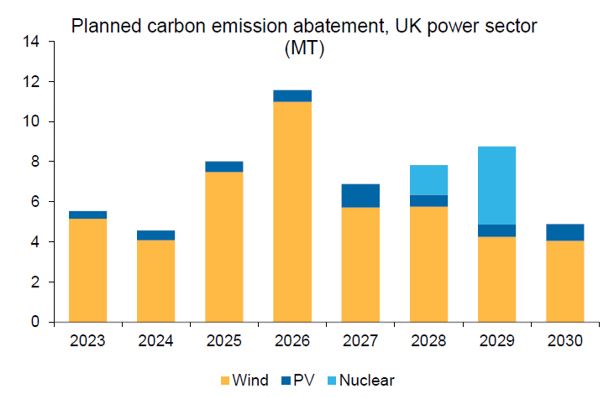

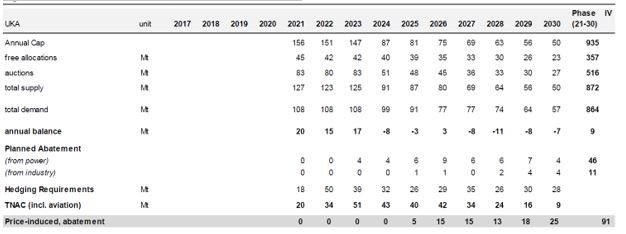

Investment Bank Citi sees even greater upside potential in the UK ETS when compared to the EU ETS as structurally the UK ETS remains a very tight market with the annual cap to shrink from 147 Mt in 2023 to 50Mt by 2030. Displacement of gas-fired power generation and an increase in power imports may be needed to meet the climate target alongside industrial emission reduction. Citi says “estimated planned renewable expansions in the UK will cut power from 44Mt to 26Mt by 2030 but this is not sufficient to meet the climate target (cumulative surplus goes negative meaning there would be a shortage of UKAs leaving compliance entities unable to meet their obligations) a further 10Mt of market-driven abatement is required according to our modelling.”

Source Citi

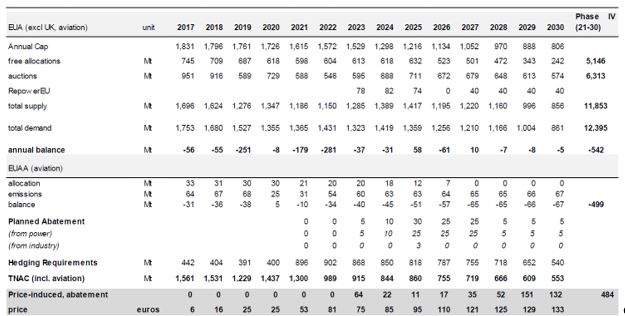

Chart 6: UK carbon market balance (Mt)

Source: Citi,BNEF, Energy Aspects, Macquarie Commdity Startegy, November 2022

1Carbon Market Year in Review 2022” Refinitiv, 6 February 2023 p.3

2Ibid p.4

3Ibid, p.10

4Ibid, p.10