The Icarus Paradox, posited by Danny Miller in his 1990 book by the same name, refers to the phenomenon of businesses failing abruptly after a period of apparent success, where this failure is brought about by the very elements that led to their initial success. It could be argued that Tesla fits this well as the company’s wings begin to melt after apparently having no bounds in stretching for the sun!

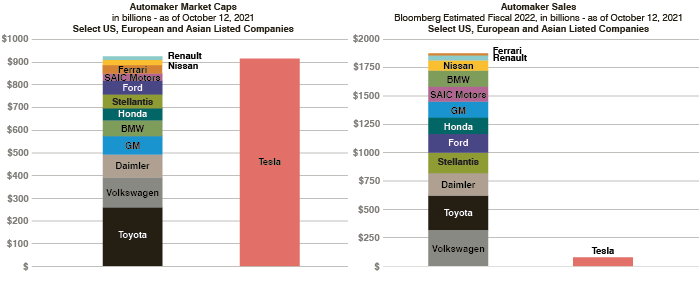

The size of the success, if measured by Tesla’s market value, can be seen below. These charts were produced by Albert Bridge in October 2021 showing the extraordinary value ascribed to the Company compared to its competitors at the peak of inflated expectations (Gartner Hype Cycle!) while at the same time showing revenue comparisons.

Figure 1: Extraordinary value ascribed to Tesla versus competitors

Source: Albert Bridge, October 2021

To be clear, we do not believe that the rapid return to Earth for the share price that accelerated in December (-37.5%) is really attributable to Elon Musk’s tussle with Twitter, his sale of Tesla stock or his often disruptive public profile. In fact, we would argue that the share price fall would have happened regardless. Musk is clearly a genius; almost no one has successfully disrupted so many traditional industries at speed and in parallel. However, his aura had allowed the investing masses to ascribe a far greater premium to Tesla than was deserved on fundamentals. Too many drank the cool aid led by ARK’s Cathy Wood with their price target of USD 1150 or a market value of USD 3.5 trillion by 2026 (the market value at the end of 2022 had fallen to USD 378 billion from USD 1.3trillion at the peak in late 2021).

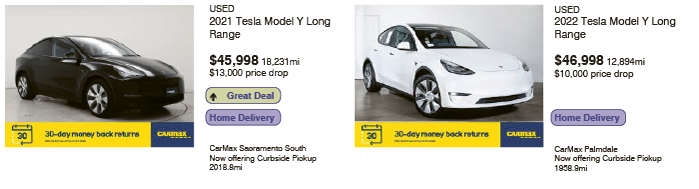

In addition to the share price escalation that started in earnest in late 2019, the aura around the company created other success factors that are now proving potentially harmful to the short-term prospects of Tesla. In particular, the Model 3 and Model Y were so popular that they often topped new vehicle stats in many countries. Long lead times for delivery and tiny deposits (USD 100-200) led to a strong second-hand market in trading and flipping these cars. In general, Teslas became known for holding their second-hand values particularly well. This generated a number of false signals about the true state of demand for what was hardly a cheap electric vehicle (EV). It was possible to lease a Model 3 in late 2019 for around USD 390/month1 . The two key factors for monthly lease costs are interest rates and residual values. Both factors have swung heavily against Tesla in the last six months. The average price of a used Tesla has, according to Edmunds Research, fallen by 17% in the second half of 2022 compared to a -4% average for all cars2 . Together with the sharp rise in interest rates, monthly lease costs have more than doubled for a Model 3 to above USD 900 today. In a world where rates generally are squeezing family incomes, the spectre of USD 900/month for a Tesla is more than offputting. It is no surprise that (again according to Edmunds) one third of used Teslas for sale at the end of 2022 were 2022 registrations compared to 5% across all car brands2. The success of the model pre-downturn ensured that high second-hand values made ownership of an iconic brand an easy choice. That success has built up a significant demand that has now burst with the collapse in second hand values. The Icarus Paradox in full swing.

Figure 2: Tesla fire sale at used vehicle retailer Carmax

Source: www.carmax.com

What happens next?

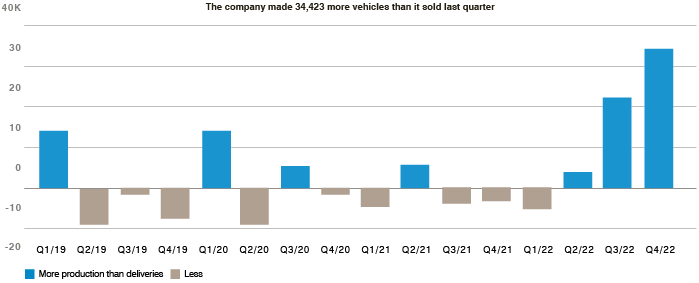

The super strong demand for its cars has led Tesla to ramp up production at new factory facilities in Shanghai, Berlin and Texas just as demand starts to implode. Bloomberg produced the chart below that shows the last three quarters have all seen more cars produced than delivered. Inventory is building and customers are evaporating.

Figure 3: Tesla’s production outpaces deliveries

Source: Bloomberg

This creates an unenviable position for the company. It is essentially left with the choice of slashing prices to stimulate demand with the obvious gross margin impact or to suffer a significant demand shortfall. Tesla announced price cuts in China and the US heading into the 2022 year end.

Analysts continue to forecast significant growth over the next couple of years for the company. Revenues for 2025 are, on consensus numbers, expected to be USD 145 billion, up from USD 80 billion in 20223. It implies an increase in market share from approximately 21% in 2022 to 23% in 2025. Given the significant lease price headwind and the rising competitive backdrop, this seems a very tall order both on the absolute revenue front and also the market share.

Tesla still trades on a significant premium to other car brands on the basis of best-in-class growth and gross margin. Both these metrics may well experience significant pressures in the next two years. We do not think the premium is warranted – Tesla is not the Apple of cars as posited by a number of analysts. Apple holds a 55% share of the smartphone market in the US; the biggest car manufacturer holds just 10% and that manufacturer is Toyota4 . The network effect that binds so many to the Apple ecosystem just does not exist with Tesla; granted it has the network benefits of a huge database of EV miles driven but that is not enough on its own. It seems to us that first mover advantage is really the only true benefit that Tesla had. Its market share is declining rapidly as competition ramps up. According to S&P Global Mobility, its market share in North American EVs has fallen from 80% in 2020 to 64% in 2022, with a forecast 20% in 20255. Will we look back in five to 10 years from now and see Tesla not as the Apple of the car industry but perhaps the Nokia, Ericsson or even Blackberry, the first mover beneficiary but not the final dominant winner?

ENDPOINTS

2Source: www.edmunds.com

3Source: Tesla (Passenger Cars) – Global | Statista Market Forecast

4Source: Automobile market share worldwide: key brands 2021 | Statista

5Source: Automotive Research and Analysis | S&P Global (spglobal.com)