by James Halse and Tom Tao

The pandemic had a dramatic impact on the US furniture and homewares industry. Consumers stuck at home looking at their tired décor, unable to spend on travel or eating out, and buoyed by stimulus payments, splurged on redecorating. Sales and margins of furniture retailers exploded across the industry, sending stocks soaring. Strong demand led to inventory shortages, which combined with clogged supply chains to cause long wait times. This phenomenon is now reversing, but is impacting industry players differently. In this article, we explore some of these dynamics and discuss a business model we find particularly interesting in more detail.

Online retailer Wayfair, which primarily serves the low-to-mid price segment, was a major initial beneficiary as people flocked online due to store closures. However, its inventory-light dropship model proved to be a major weakness in the tight inventory environment when stores reopened, as its suppliers began to prioritise the certainty of sales at high margins to other retail customers rather than holding inventory in the hope of it selling on Wayfair. This is now compounded by the effects of inflation in necessities on lower-income households, as well as the hangover from the withdrawal of stimulus, which has led to two years of shrinking sales from a former growth darling, accompanied by a precipitous stock price decline.

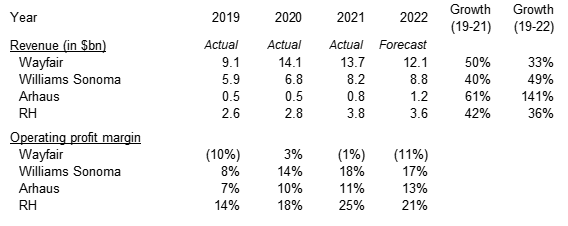

In contrast, Williams-Sonoma (WSM), which serves the mid-to-upper price segment, primarily via its Pottery Barn and West Elm brands, faced an initially more testing time as store closures led to a fall in sales at the outbreak of the pandemic. Fortunately, WSM’s history as a catalogue retailer positioned it well for the transition to e-commerce-only sales, so the damage was largely offset. As demand accelerated, WSM’s operating profit margin improved to 17.6% (for FY21) from the 8-9% generated pre-pandemic, with sales growing 40% over two years compared with 4% year-on-year in FY19 (see Fig. 1). With demand now pulling back, WSM’s reported revenues and margins are nevertheless holding up well as they book sales from product that has been on backorder.

Fig. 1: Revenue and Operating Profit Margin for Listed Furniture Players

Source: FactSet Research Systems, Morgan Stanley.

Of the three major listed furniture players, RH (formerly Restoration Hardware) was initially hit the hardest by the pandemic. It operates large-store formats designed around offering high-income consumers a fantastic retail experience and, as such, had lower e-commerce penetration. When faced with store closures, RH had a harder time offsetting the lost sales, but it quickly rebounded as stores reopened and redecoration spend jumped, with sales increasing 42% over the two years from pre-pandemic levels, and operating profit margin peaking at 24.8% in FY21, up from the 14% generated in FY19.

While we tend to think of e-commerce as being the big disruptor in the retail sector, RH is a great example of how a new store concept can serve a similar purpose. Shopping for higher-end furniture can be surprisingly difficult. The whole experience can be frustratingly opaque and time-consuming. Product manufacturers and furniture designers tend to showcase their latest products in huge wholesale design centres that are only accessible to industry professionals. Consumers are only allowed access to view this huge product range when accompanied by their interior designer. When inside, it is difficult to identify exactly what an item costs due to the lack of pricing on display. Should you want to purchase something, you must do so through your interior designer, who has access to the “trade price”.

However, this is slowly changing. Nowadays, a centre may offer a formal day pass or discreetly allow access (literally via a secret password!). Also, these design centres are so huge that it is recommended visitors plan out their route around the centre in advance. Needless to say, this provides an underwhelming consumer experience.

Source: www.bostondesign.com / Pinterest

Another characteristic of the high-end furniture market is the large degree of fragmentation and, thus, the lack of economies of scale in production and service offerings. High-end furniture is typically hand-made and sold through retail partners or stores owned by the designers themselves, who usually lack the skills or desire to really scale their businesses.

RH is seeking to reinvent this US$60 billion premium furniture industry[1] by addressing the consumer’s pain points via its vertically integrated and transparent model.

Products are designed exclusively for RH by world-renowned designers, with manufacturing outsourced to vendor partners in Asia. Products are beautifully presented in large, multi-storey stores called design galleries. The galleries are so well designed that customers feel as though they have been transported to another place. Inside, products are arranged in complete “rooms” with clear pricing transparency. On the top floor, RH has a restaurant that is a destination in itself, with the average restaurant generating US$10 million in revenue per year.[2] The strategy seems to be working, as RH revenues and margins have steadily increased since 2017.

Source: www.sanfran.com / www.meatpacking-district.com

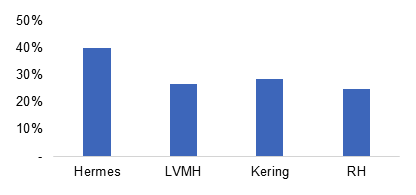

RH is also one of the few premium furniture retailers at scale, with revenue of ~US$4 billion in 2021, and has plans to continue rolling out design galleries to take further share of this large, fragmented market. RH’s model generates an operating profit margin that is in line with world-class luxury brands (see Fig. 2) (although, to some extent, this is elevated by pandemic-related demand), so it should be able to fund its growth while generating solid cash flow.

Fig. 2: 2021 Operating Profit Margin – RH vs. Luxury Brands

Source: FactSet Research Systems.

While this appears to be an interesting business longer term, we remain cautious on the furniture and homewares industry. It is unclear where sales and margins for these companies will settle, with the potential for sizeable disappointment to the downside, especially if the US enters a full-blown recession. That said, we would expect opportunities to arise for investors should the market respond with further negativity to a dramatic reversal of the positive pandemic trends. A highly profitable disruptive innovator consolidating an attractive but fragmented market segment could provide one such opportunity.

The Platinum International Brands Fund primarily invests in listed securities around the world with well-recognised consumer brands names and aims to provide capital growth over the long-term.

[1] Arhaus Prospectus. The premium furniture market is estimated to be US$60 billion as of 2019.

[2] Source: RH Q2 earnings call, 8 September 2022.

DISCLAIMER: This information has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the article, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group or their directors, officers or employees for any loss or damage as a result of any reliance on this information. Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum. The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision.