Some people invest with one lump sum and then leave it alone or try to time the market and buy when they think prices are at their lowest. But they can feel panicked into selling during volatile times and when prices fall. Trying to time the market can be a stressful exercise that even the experts find difficult because it means timing two decisions perfectly: when to sell and when to buy back in again.

As a natural part of your investment journey, there will be periods when prices go down as well as up. Investing in the dips means buying into your long-term investment at a lower price and bringing down the average price you have paid across the life of the investment. In financial terms this is known as dollar-cost averaging.

Seasoned investors reduce their stress with this technique by setting themselves up to take advantage of volatile markets by investing with a regular savings plan. They know that if prices are low when their regular savings are due to be invested, the average price they pay over time for their investments will reduce, and they can get a larger benefit when the recovery comes.

As always with investing it’s impossible to guarantee that dollar-cost averaging will give better returns than lump sum investing, but for seasoned investors, it can help remove the temptation to time the market and let them get on with their lives.

The difficult part is deciding when to invest and this relies on timing the low points – something even investment experts treat with caution. So, investing regular amounts every month helps take the guess work out of it, by helping you catch the high points as well as the low.

Long-term growth potential

Making regular monthly contributions to your investments as part of a regular savings plan can help them grow into a sizeable sum over the long term, even if you’re only investing a small amount. A regular savings plan is effectively a direct debit payment plan which will be collected at a time and frequency of your choosing. You can choose to put this money into cash or into investments which you have selected.

Investing smaller sums on a regular basis might also mean you can start investing sooner, giving you time to take advantage of the growth potential of compounding and the markets themselves.

You may be surprised at how much even small amounts can grow to over a number of years.

How your investment can grow over time

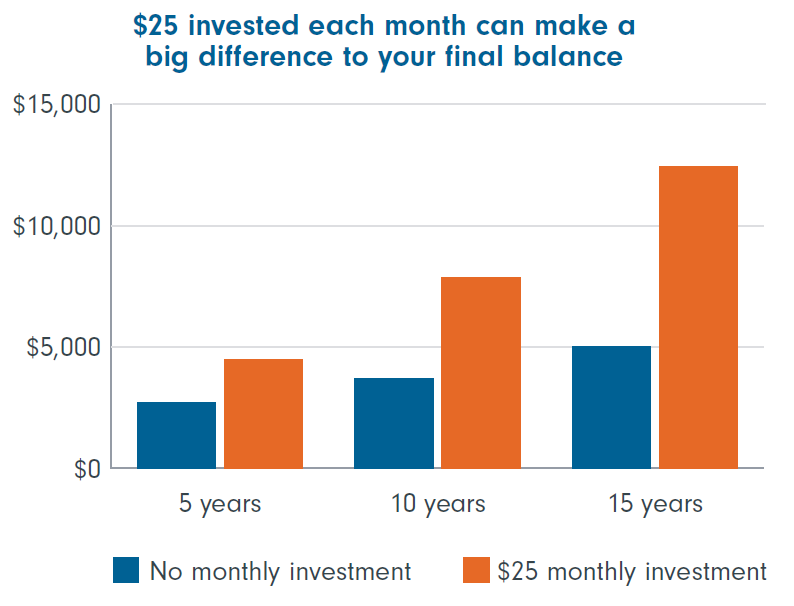

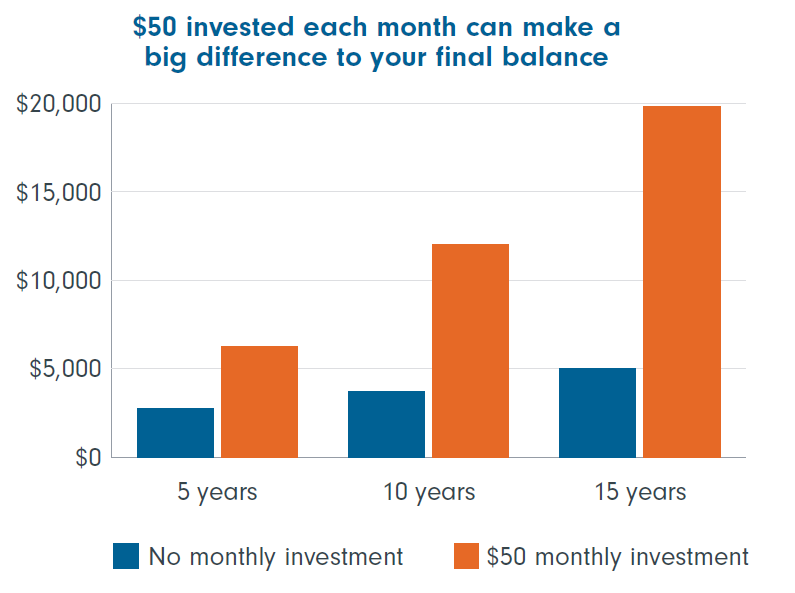

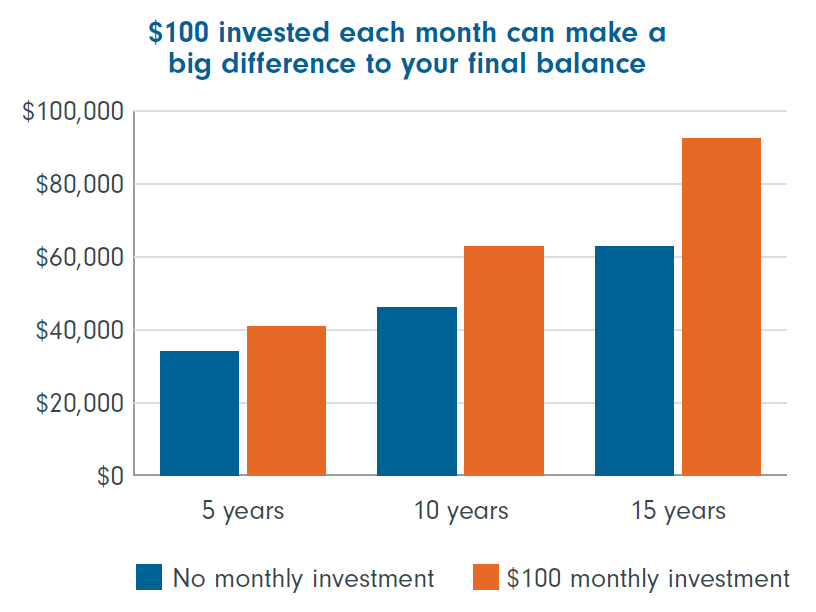

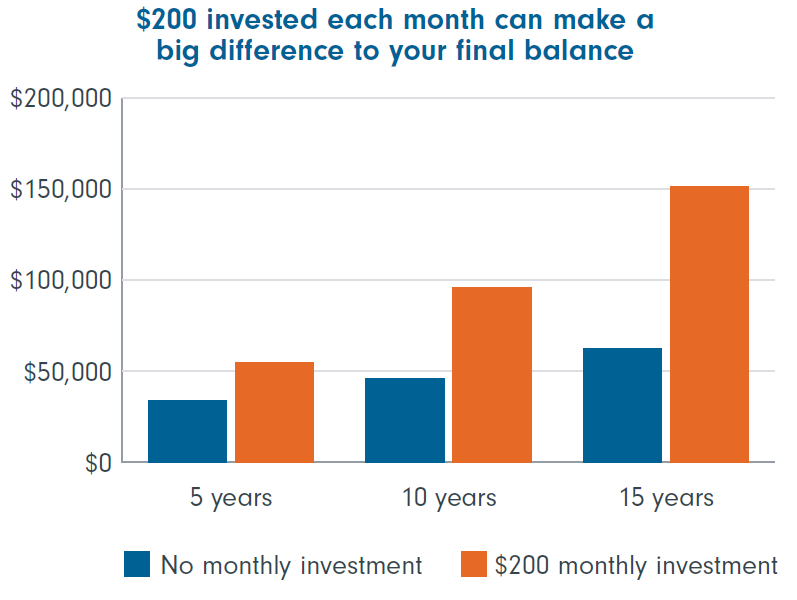

Take a look at the below two examples to see the long-term growth potential as part of a regular savings plan*

1. You have an initial investment of $2,000 growing at 7% per annum with a management fee of 0.85% annually

|

|

No monthly investment | $25 monthly investment | $50 monthly investment | $100 monthly investment | $200 monthly investment |

|---|---|---|---|---|---|

| 5 years | $2,717.91 | $4,477.87 | $6,237.84 | $9,757.77 | $23,837.49 |

| 10 years | $3,693.51 | $7,845.18 | $11,996.86 | $20,300.21 | $53,513.61 |

| 15 years | $5,019.30 | $12,421.20 | $19,823.10 | $34,626.90 | $93,842.08 |

2. You have an initial investment of $25,000 growing at 7% per annum with a management fee of 0.85% a year.

|

|

No monthly investment | $25 monthly investment | $50 monthly investment | $100 monthly investment | $200 monthly investment |

|---|---|---|---|---|---|

| 5 years | $33,973.83 | $35,733.80 | $37,493.76 | $41,013.69 | $55,093.41 |

| 10 years | $46,168.85 | $50,320.52 | $54,472.20 | $62,775.55 | $95,988.95 |

| 15 years | $62,741.30 | $70,143.20 | $77,545.10 | $92,348.89 | $151,564.08 |

*This figure is for illustration, the growth rate isn’t guaranteed, and you could get back less than you invest. All returns are net of fees.