Over the previous eighteen months, lithium has well and truly established itself as the key driver of the electric vehicle battery movement. Its light weight and high electrochemical potential allow the battery to store more energy than its alternatives. And with the inevitable shift toward renewable energy imminent, the commodity has become a household name, in which it has been the forefront of many critical minerals list worldwide and received a collection of government funding with ease. As such, its price has continued to reach new highs.

However, there is another commodity that has been flying under the radar of many. Sulphate of potash, or SOP, is the main ingredient in the makeup of fertilisers and has also seen its price increase to an all-time high this year.

SOP is considered a premium over its alternate, MOP, since it does not contain chloride, being the ideal option for high-value chloride sensitive crops such as fruit and vegetables, nuts and coffee.

In my “A Primer on Potash” article of earlier this week, I explained why fertilisers are vital, as they replace nutrients that are lost when crops are harvest from the soil.

And with the amount of arable land decreasing per capita, and the world’s population expected to increase, SOP’s usage will become more of a necessity moving forward/in the future.

In addition, its supply / demand dynamics, methods of extraction and concentrated supply chain are similar to lithium.

Despite all of this and the immense impact it is set to have on future global population growth, SOP hasn’t been able to attract the same limelight as lithium. SOP is not included on many critical minerals lists, which in turn has limited the amount of government funding the sector receives, compared to the lithium space.

The Global Supply Chains of SOP and Lithium

SOP and lithium both currently occupy concentrated supply chains, in which the majority of its processing and manufacturing comes from China. As a result, any disruption to the existing supply chain – be it in the form of a natural disaster, such as fire, flood, or earthquake, or related to geopolitical tensions – would pose a serious threat to the price of the commodities.

It is critical to mention that China has previously used their power of another supply chain as a geopolitical weapon before.

In 2010 China minimised their rare earth exports worldwide and cut off Japan entirely to pressure them to release a detained Chinese fishing trawler captain.

China’s actions caused the average price of global rare earth imports to soar from US$9,461 per metric ton in 2009 to nearly US$66,957 in 2011.

In regard to the global supply of MOP and SOP, China, Belarus, and Russia account for roughly 50% of its trade.

And in regard to SOP, China alone accounts for two-thirds of the global production, and 60% of the global consumption.

So, any interference with China’s SOP market would hav devastating impacts to its price.

This was evident last year, when the Chinese government ordered major Chinese fertilisers to slow down exporting to combat the growing concerns of price movements, whilst securing its own domestic food supply.

As a result, the price shot up from below US$600 per tonne to above US$800 per tonne within 6 months.

Currently, the Chinese policy, the Russia-Ukraine conflict, and the sanctions on Belarus for assisting Russia have caused the price to spike to above US$1,100 per tonne.

In regard to lithium, the global supply chain is slightly less concentrated than SOP, however in terms of processing and refinery, China completely dominates that space.

The majority of lithium comes from the “lithium triangle” in South America, referring to Bolivia, Argentina, and Chile.

The U.S. Geological Survey stating that this region controls about half of the global supply.

However, there is still large amounts of extraction in Australia, China, Portugal, The United States, Brazil, and Zimbabwe.

Despite having only 7.9% of global lithium reserves, China controls roughly 65% of the world’s lithium processing and refining capacity, according to international energy research and business intelligence company Rystad Energy.

And in regard to the EV battery space, China accounts for 89% of the world’s lithium hydroxide processing.

Whilst lithium carbonate associates with carbonates to become a salt, lithium hydroxide is a lithium-based compound, and has a distinctive property compared to lithium carbonate. It decays at a lower temperature, allowing for a more sustainable process of producing battery cathodes and for the final product to be long lasting.

This makes lithium hydroxide the preferred option of an EV battery.

Currently this concentrated supply chain of lithium poses a threat to the price and availability of the commodity.

And with renewable energy and zero-emission targets the forefront of government policies around the world, that mean it poses a threat to the transition to clean energy.

Government Funding

With these government renewable energy goals and targets comes massive amounts of government funding, and as lithium is a key player in the EV space, it has and will continue to receive funding in the forms of grants and loans.

Just this week, the Biden-Harris Administration, through the Department of Energy (DOE), revealed that a list of 20 companies operating in the U.S. EV supply chain were awarded with grant packages totaling US$2.8 billion.

Piedmont Lithium (ASX: PLL), Sila Nanotechnologies, and Albemarle U.S. Inc (NYSE: ALB) were some of the lithium companies that were included, being funded US$141.7 million, US$100 million and, US$149.7 million respectfully.

The country also passed a $1 trillion infrastructure bill this August, which will look to provide copious amounts of funding to all players in the EV supply chain, including lithium players, to ensure a stronger stance to combat climate change, whilst incentivising the onshoring of renewable energy production.

In the UK, there will be over £30 million of government investment to boost batteries and hydrogen vehicles.

Of that, £9.4 million of government funding for 22 studies to develop innovative automotive technology, including the establishment of a lithium extraction plant in Cornwall.

In addition, lithium has been placed on the critical minerals list of many jurisdictions worldwide, including the EU, the US, Japan, Canada, and Australia, meaning that it is recognised with a certain level of economic and strategic importance.

To be on such a list also enables government funding.

In Australia, the Federal government has recently committed $50 million to the critical minerals industry.

In addition, the Australian government has stated that it will issue a loan facility worth A$2 billion for Australian critical mineral projects. The fund will help fill finance gaps in critical minerals resources developments to get them off the ground.

The picture is vastly different for SOP, which is not included in the critical minerals lists of many jurisdictions and therefore receives minimal funding.

As a vital part of the global food supply, the lack of funding is quite surprising.

The picture is slightly brighter in Australia, in which the government has established the Northern Australia Infrastructure Facility (NAIF).

The NAIF had a total of $5 billion in lending facility to provide for infrastructure projects in northern Australia.

In mid-2021, the NAIF approved the provision of a A$48 million Infrastructure Development Facility and a Project Development Facility of up to A$26 million. On 26th of August 2021, the NAIF Board made an Investment Decision to offer an additional Financing Mechanism of $10 million to support Kalium Lake’s Beyondie Sulphate of Potash Project.

Demand Factors

A recent tweet from Lake Resources (ASX: LKE) states, “By 2040, all of the lithium mined last year will only meet one month’s demand.”

As is well known, demand for EV purchasing has and will continue to increase as a direct response to the global transition and focus to renewable energy.

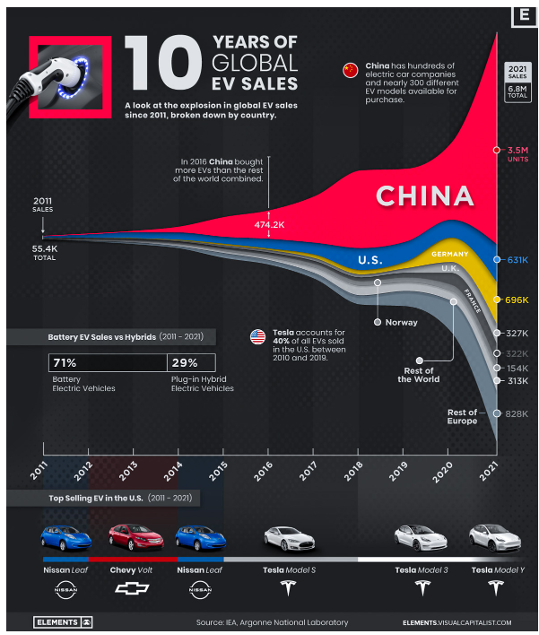

The International Energy Agency (IEA) has recently stated that EV sales will hit an all-time high in 2022, with both EVs and EVs and lighting being “fully on track for their 2030 milestones” in its net-zero by 2050 scenario.

The picture is quite similar for the SOP space, in which a growing population and the rise in China’s middle class, has and will see an uproar in the demand for the SOP fertiliser.

In a report made by the United Nations, the world’s population is expected to grow to around 8.5 billion in 2030 and 9.7 billion in 2050, before hitting 10.4 billion in the 2080s.

With this growing population, comes a greater demand for food, resulting in a significant rise in the number of agricultural activities worldwide.

Urbanisation and industrialisation have also resulted in the shrinkage of availability of land, forcing more farmers to increase the use of fertilisers to enhance the yield per hectare, boosting the demand for potash rich fertilisers.

China’s dominance in the SOP space, combined with the rise in the middle-class income earners, sees more residents demanding better diets, including fruits and vegetables, which requires SOP in fertilisers.

Conclusion

Concentrated supply chains in combination with excess levels of demand are major problems for both SOP and lithium.

China has already been forced to reduce its exports of SOP to control local supply levels, whilst the country’s harsh lockdowns and heatwaves have also caused many companies to stop producing lithium.

Both scenarios have seen their prices shift to all-time highs over the past year.

While global government aid toward lithium will aim to minimise or completely eliminate these issues, for now at least the same cannot be said about SOP – which, for all its undeniable benefits, has not received the same funding or supply chain restructuring and will therefore remain exposed to these supply-demand issues in the future.