The shift to renewable energy is inevitable. And its transition is supposed to fulfill environmental, social and governance (ESG) requirements. However, recent reports have found that the manufacturing of the cheapest renewable energy source violates significant human rights issues in China.

Both the U.S. and Europe have since announced plans to ban the importation of solar photovoltaic (PV) panels over these reports.

And with China dominating such a large portion of the manufacturing process, the shift away from this supply chain will be difficult.

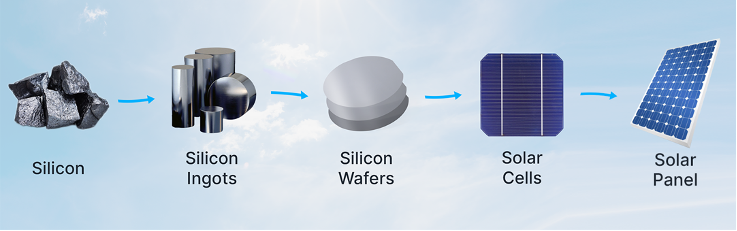

How are Solar Panels made?

Source: SolarReviews. 29/01/2022.

At the most basic level, the key components of a solar panel are silicon or polysilicon, solar cells, metal, glass, and wiring.

Firstly, polysilicon – a high-purity form of silicon – is melted at high temperatures to form silicon ingots.

Then, those ingots are sliced into thin wafer sheets ranging from 150-280 micrometres in thickness.

The wafer is then cleaned and doped to manufacture a crystalline solar PV cell. Solar PV cells are the most important component of the solar PV panel, as they convert sunlight into usable energy.

Lastly, multiple cells are wired together and laminated to form a bunch of modules before being connected to the panels.

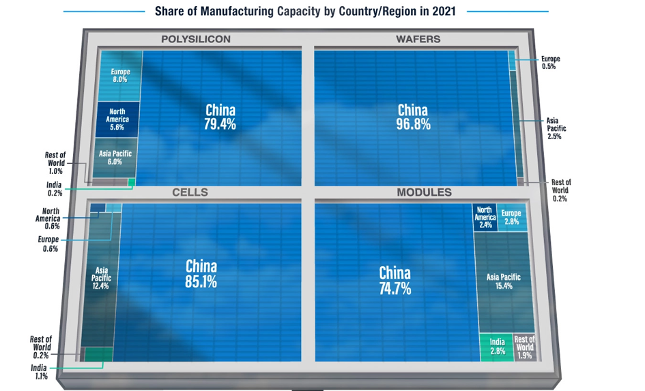

China Dominates the Solar PV Panel Space

Source: Visual Capitalist. Visualizing China’s Dominance in the Solar Panel Supply Chain. 30/8/2022.

In 2010, China made up 55% of the global solar panel manufacturing capacity. In 2021, the average share of the solar panel supply chain increased to 84%, with China controlling at least 75% of every single key stage of the solar PV panel manufacturing process – from forming polysilicon to ingots, to connecting finished solar cells onto panels.

And their control is only expected to grow, with a report from the International Energy Agency (IEA) forecasting that China’s global share of solar PV panels will reach 95%. “The world will almost completely rely on China for the supply of key building blocks for solar panel production through 2025,” the agency stated in their report.

This has both negatives and positives.

This level of concentration represents an immense vulnerability that poses a threat to the transition to clean, renewable energy.

In the case of any disruptions, whether it be a geopolitical issue, or a natural disaster, such as a fire or a flood, affecting a major solar PV panel facility a disruption to the supply chain can have immense repercussions for the movement to clean energy.

It is important to note that China has already used their dominance of another supply chain as a geopolitical tool before. In 2010, China slashed their rare earth exports worldwide and cut off Japan entirely to pressure them to release a detained Chinese fishing trawler captain. China’s actions caused the average price of global rare earth imports to soar from US$9,461 per metric ton in 2009 to nearly US$66,957 in 2011.

So far this year, demand increases and existing bottlenecks in the Solar PV panel supply chain has led to a rise of 20 per cent over the previous 12-months. These bottlenecks have already resulted in delays in their delivery across the world.

With solar energy a key element of the global shift to net zero emission, predicted to account for 33 per cent of the global electricity by 2050, shifting a supply chain away from China is crucial for the security of the manufacturing process of solar PV panels.

However, with such a dominant supply chain, costs to produce all components in the solar panel supply chain are lower by 10 per cent than India, by 20 per cent than the U.S. and by 35 per cent than Europe, IEA’s report outlines.

The IEA also commended China’s expansion of solar panel markets, for their boost to the global solar power uptake, with Executive Director Fatih Birol stating, “the world should be thankful to China” for bringing down the cost of solar PV by more than 80 per cent in the last decade.

However, these price advantages come at a cost.

China’s Human Rights Breach

China’s dominance of the solar PV panel supply chain has come under scrutiny recently, after allegations of human rights abuses and trade violations.

In Sydney, at the Conservative Political Action (CPAC) conference, Environmentalist Michael Shellenberger stated, “the reason the Chinese were able to make solar panels so cheaply is because they use Uyghur Muslims that are housed in concentration camps.”

BBC reports that human rights groups estimate that more than a million Uyghurs have been detained in internment camps in the Xinjiang region of China.

U.S. House of Representatives, and other Republicans on the House Oversight Committee, also raised concerns about the situation.

“If we are not vigilant in our efforts to ensure that no solar panels or components made with slave labour are being purchased with federal dollars from FEMA or other U.S. agencies and used on similar solar projects, it is possible the United States could be directly funding the genocide and abuse occurring in China’s Xinjiang region,” the letter said.

The U.S. took action.

Initially, On December 23rd, President Biden signed the Uyghur Forced Labour Prevention Act (UFLPA). A legislative agreement that target the importation of goods produced in China’s Xinjiang region, with a focus on polysilicon, a key component of the solar PV panel manufacturing process.

The act outlines how Chinese companies operating in Xinjiang must prove that their products weren’t made from forced labour.

Then in June, the act officially went into effect.

The act resulted in several Chinese solar-panel suppliers, among the world’s largest, having their shipments to the U.S. detained or sent back.

Customs officials also asked for proof that a key ingredient of polysilicon, quartzite, wasn’t mined in Xinjiang either.

From late June till late September, Robert Silvers, a U.S. Department of Homeland Security undersecretary stated that 1,452 cargo entries were targeted valued at $429 million.

About a month ago, the EU was also set to ban products made using forced labour over the human rights abuse allegations were made in Xinjiang.

About the proposal, Henrike Hahn, a German Green MEP and member of the parliament’s Chinese delegation, stated, “We are not like-minded friends of the totalitarian regime in China. We demand a ban on imports of products from Chinese forced labour and on products from Chinese companies in general produced with forced labour.”

However, the EU is yet to announce plans, with some believing that it will take some time before an act comes into full effect.

Morgan Stanley analyst Simon Lee told Bloomberg that the act will probably take a couple of years before it is enforced.

Interestingly, last week, the United Nations voted against the motion to discuss further actions about the accused series of human rights abuses and possible crimes against humanity in the Xinjiang region.

The nations voting against a debate were: Bolivia, Cameroon, China, Cuba, Eritrea, Gabon, Indonesia, Ivory Coast, Kazakhstan, Mauritania, Namibia, Nepal, Pakistan, Qatar, Senegal, Sudan, the United Arab Emirates, Uzbekistan, and Venezuela. Whilst the draft decision was put forward by the United States, Australia, Canada, France, Germany, Norway, Sweden, and Turkey, among others.

Amnesty International branded the vote farcical, while Human Rights Watch (HRW) said it betrayed abuse victims.

“This is a missed opportunity by council members to hold China to the same standard as other countries,” Dolkun Isa, president of the World Uyghur Congress, said in a statement. “The international community cannot fail the victims of the Uyghur genocide.”

Price Gauge Concerns

Chinese authorities – the Ministry of Industry and Information Technology (MIIT), the State Administration for Market Regulation and National Energy Administration – have come together to warn the country’s major solar polysilicon producers not to engage in hoarding or price gauging of the highly-valued raw material.

This comes amidst the 10-year-highs in polysilicon prices that have sent shock waves throughout the supply chain.

Covid-19, heatwaves and surging demand for solar panels have, among other factors, boosted the price significantly, not to mention the recent US ban.

The MIIT have also pointed the finger at price gauging and hoarding practices by some of these solar producers.

Conclusion

Solar PV panels will be integral to the inevitable transition to renewable energy, which is why China’s dominant position in their manufacture and distribution at present is so concerning. In order to not only secure a ready supply of these products around the world at stable and reasonable prices, but also ensure that they are being made under proper and humane conditions, other nations need to take the appropriate steps to dilute that dominance and diversify away from being so dependent on it.