By Julian Howard – Director, Multi-Asset Solutions

In an interview given just over a decade ago, popular British scientist Professor Robert Winston remarked that one of the most important advances in medical science was in fact exercise. While cessation of smoking, limiting alcohol and consuming a balanced diet have all been proven to be important, physical activity it seems is the most positively influential action we can take for our wellbeing and longevity. Countless studies assessing sports participants’ health outcomes versus more sedentary peers – even ignoring who is smoking or eating poorly – corroborate this finding.

Investors similarly seek out myriad routes to positive financial health. Some are familiar, such as cash, bonds and real estate, and some more exotic such as gold, cryptocurrencies, non-fungible tokens (NFTs) and even virtual property in the metaverse. But over time, the real return on equities has remained compelling. Seminal 2015 National Bureau of Economic Research (NBER) study ‘The rate of return on everything’ placed long term equity returns (of 7%) ahead of real estate (when adjusted for realistic occupancy rates), bonds and cash. Cryptocurrency has not been around for long enough for a fair comparison but the current ‘crypto winter’ of high volatility and depressed prices does not bode well for its ongoing place in serious investors’ portfolios. For those investors understandably feeling uncomfortable with the ‘everything sell-off’ that has characterised 2022 so far, it is worth reaffirming the intrinsic long-term case for equities as well as why, even amid today’s elevated volatility’, there is still no compelling alternative.

The case for equities starts with a concept. At their heart, stocks offer a share of a corporation’s ownership and, as such, a claim on the future cashflows of that business. The returns accrued reflect the listed corporate entity’s ability to harness human ingenuity over time. In practical terms, this return has coalesced around 6.5-7% per annum after dividends and inflation, similar to the NBER study’s figure quoted above. This observation is perhaps most famously articulated by the ‘Siegel Constant’, named after Wharton finance professor Jeremy Siegel, in buy-and-hold bible ‘Stocks for the Long Run’. Professor Siegel happily concedes that his so-called Constant does not play out linearly over time, but each subsequent edition of his work confirms the integrity of the long term trend. Why the Constant has consistently posted said 6.5-7% return level over time is part mystery, but it would be fair to surmise that this might be the natural ‘run rate’ of human progress through the prism of the corporate structure. The historical result is an asset class return that also demonstrates the benefits accrued for taking the risk of holding equities over lending money at fixed rates, ie buying and holding bonds to maturity.

Investing has paid off versus lending over the last century:

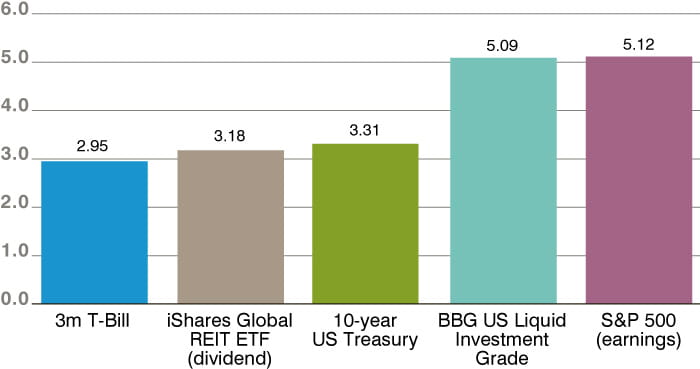

It is of course relatively easy to accept the idea of strong returns over the 50 year+ horizon that investors accept as the ‘long term’, just as many of us conceptualise a new exercise regime at the start of each calendar year. In the abstract we know they both present the right way of thinking, but just as a cold, wet January morning can put off the most committed joggers, years like 2022 have the same effect on even seasoned investors. This year, the S&P 500 is down -13.7% year-to-date to 9 September as markets grapple with war, higher inflation and an uncertain set of policy responses by both governments and central banks. Despite this, the fundamental case for equities today remains undimmed when an assessment of both absolute and relative yields is made. Taking the S&P 500 index for simplicity, the expected earnings yield is currently just over 5%. This compares favourably with the 3.2% yield offered by Real Estate Investment Trusts (REITs) as measured by the Blackrock Global REIT, as well as the 3.3% offered by 10-year US Treasury notes and of course the zero yield offered by gold, cryptocurrencies and other speculative assets. The excess yield enjoyed by equities over other assets such as US Treasuries is known as the equity risk premium (ERP) and while today’s ERP of just under 2% over Treasuries is hardly stellar (it reached around 3.5% at the height of the Covid-19 panic in April 2020), it still suggests that there is no alternative to equities on a purely yield basis. However, what this relative yield assessment does not capture is the enticing prospect, unlike bonds which return merely yield and original principal, of significant additional capital appreciation as equities harness breakthroughs in human innovation commercialised by corporations.

TRINA – there really is no alternative when you consider yields:

Equities will always compete with other asset classes in investment portfolios since many (though not all) investors seek diversification in order to control volatility. An allocation purely to equities demands a time horizon and psychological adjustment that is simply not appropriate for every investor. While the S&P 500 has delivered a cool 10% annualised return in the 30 years to 9 Sep 2022, it has also inflicted an annualised standard deviation of 14.8% on its holders, as the markets faced the tech unwind of the early 2002, Global Financial Crisis (GFC) of 2008, the eurozone crisis of 2011, the China / Trump growth scare of 2016 and most recently the early 2020s Covid-19 panic and invasion of Ukraine with associated inflation. Even allowing for all that, however, the real return equities ‘intrinsically’ offer over time remains compelling. In our view they rightly form a crucial part of portfolio construction after a suitability review of an investors’ needs reveals that at least some long-term growth is desirable. And, for all of this year’s volatility, a reasonable short- to medium-term relative case for the asset class based on yield differentials can still be made today. In financial health terms therefore, equities really are the equivalent of physical exercise, even if other approaches also have a role to play in risk-adjusted outcomes. Time to dust off those sneakers.