It’s been a volatile year. High inflation, along with actual and expected high interest rates, have roiled markets across equities, fixed income, commodities and real estate. According to the theory, high interest rates stifle economic activity, reducing demand and moderating consumer prices.

A confusing macroeconomic backdrop

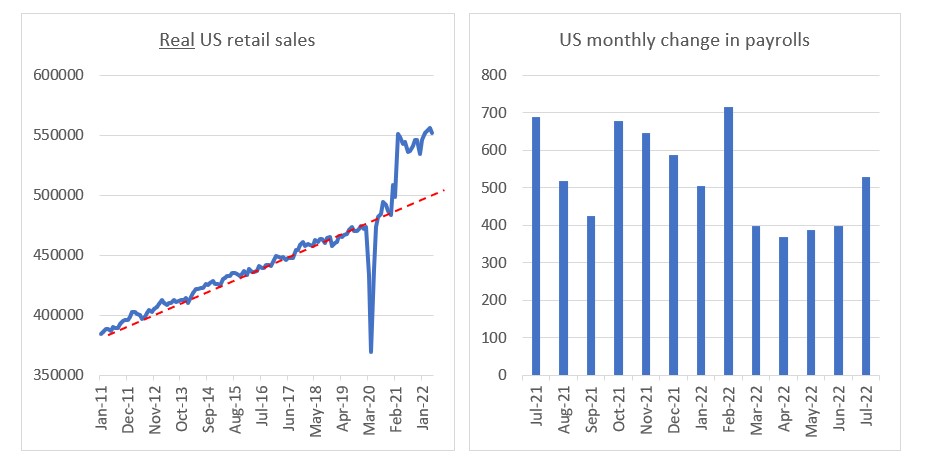

But so far, the reality is not in line with the theory. Recent data across the US shows jobs and retail sales are still quite robust. Australia too has continued to enjoy record low unemployment and strong retail sales. Moreover, recent profit results were better than expected with US earnings (S&P 500) up +6% in the US[1].

Source: St Louis Fred, Quay Global Investors

So, what’s happening?

Of course, we know there is some economic lag in response to rising interest rates, and we also know central banks are not at their ‘neutral rate’ just yet, but we think there is more to the story – especially between countries.

We believe the best framework for understanding the current environment is via the sectoral balances – which we review below.

Sectoral balances (a recap)

Regular Investment Perspectives readers will know that we believe the sectoral balances[2] are one of the best tools for understanding the macroeconomic environment.

In summary, for a country or region with a floating exchange rate:

In other words, one entity’s income is another’s spending. In addition, one entity’s surplus is another’s deficit.

In the above formula, if one entity decides to save, it forces the other sectors (in aggregate) to dissave. This is colloquially known as the ‘paradox of thrift’[3].

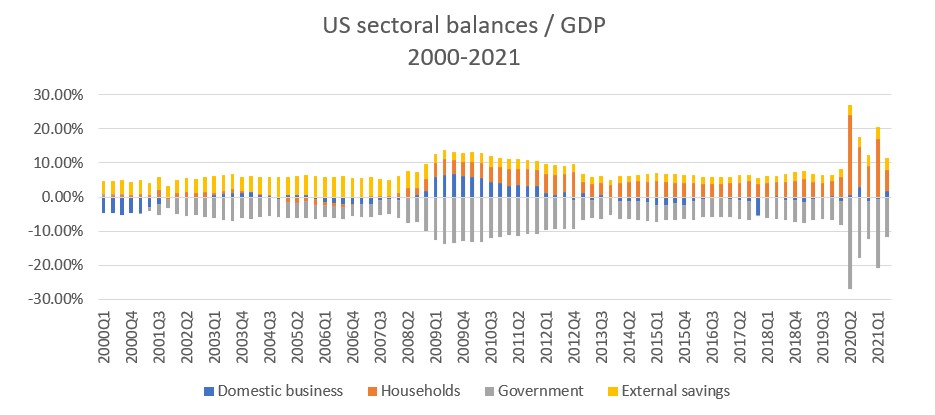

The following chart depicts the US sectoral balance over time. Note the deficits and surpluses offset each other each quarter – to the penny. The notion of sectoral balances is not an economic theory – it’s just plain old accounting.

Source: St Louis Fred, US Federal Reserve, Quay Global Investors

Household balance sheets are in great shape

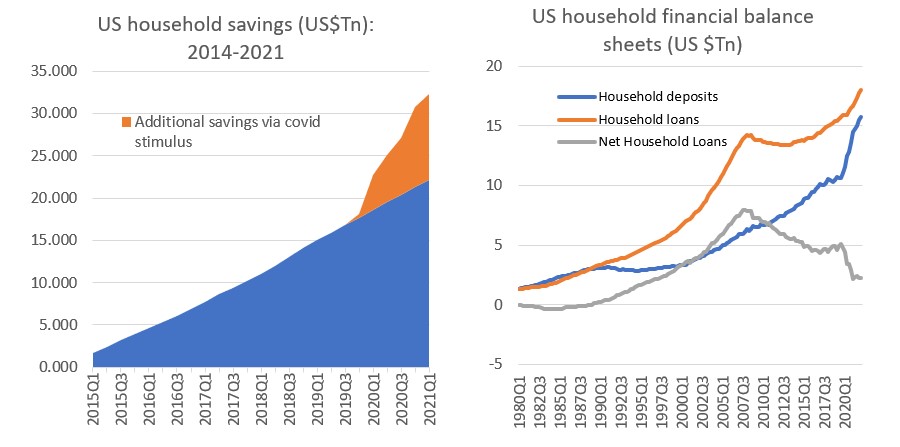

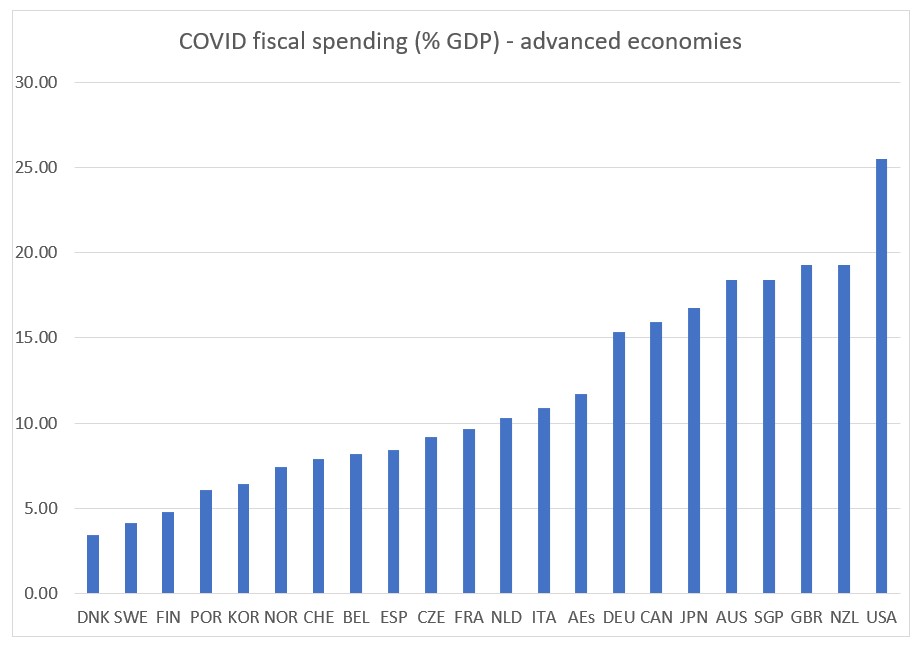

One reason why higher rates have yet to really bite, is that household balance sheets are in great shape. COVID saw governments around the world respond with extraordinary fiscal spending. Some more so than others. As per the sectoral balances, the deficits (the US was among the largest relative to GDP) ended up as savings in the bank accounts of the non-government sector – especially households.

The impact was more profound in the US due to the scale of fiscal transfers (over 25% of GDP). As a result, US household net financial debt (debt less cash on deposit) is back to 1996 levels. And as a percentage of GDP, at levels not seen since the late 1980s.

Source: St Louis Fred, US Federal Reserve, Quay Global Investors

Note the charts above may seem inconsistent (y-axis), however the left chart simply accumulates net quarterly flow of savings (excluding asset purchases), while the right is net of asset purchases.

This raises two important points:

- US households are much less sensitive to interest rate movements compared to any other time in the past 25 years – especially considering most US mortgages are fixed for 15-30 years.

- The household balance sheet recession that caused the GFC in 2007 is obvious in hindsight, but also highly unlikely to occur again in the current environment.

There are, of course, distribution effects to consider. Some households have plenty of debt and some have plenty of cash; but this has always been the case. What has changed is there is a lot more cash / deposits relative to debt than we have had before, and it’s clearly having an impact – especially considering the accelerating growth in retirees relying on passive income for consumption. If you hear a ‘cheer’ every time the central bank raises interest rates, it’s probably coming from a retiree.

It’s also important that the US was a standout when it came to the COVID fiscal response. Fiscal transfers in other countries, in some cases, were significantly lower (especially Europe). The UK, Australia, New Zealand and Japan benefited from significant fiscal transfers, although well below the US.

In short, not all household balance sheets are the same, so increasing interest rates will have varying impacts around the world.

Source: IMF, Quay Global Investors

High interest rates can add to growth and inflation

Traditional economic theory tells us the transmission mechanism of interest rate policy is via the household sector. Specifically, higher interest rates slow housing (pricing and supply) which eventually feeds through to lower sentiment and consumption.

Rarely do commentators speak of the income channel effect. That is, higher interest rates benefit net depositors. And while US households still carry a small net debt position (as per the chart above), it’s worth remembering most US debt is fixed-term mortgages. Meanwhile, any accumulated cash can benefit immediately from higher interest income.

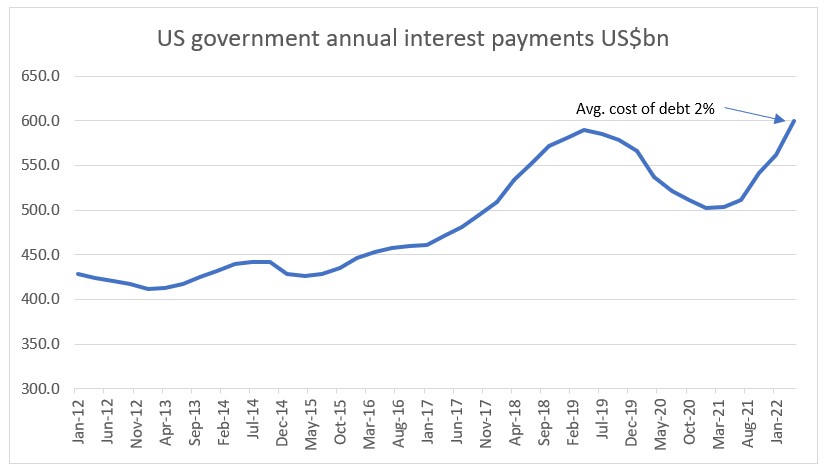

More generally, the entire non-government sector is a recipient of net interest income. How do we know this? Because the US federal government carries a net debt position, and is therefore a net payer of interest income. One entity’s spending is another’s income (as per the sectoral balances).

As the following chart highlights, the US government currently pays $0.6T per annum in interest on outstanding bonds (average rate of 2%). If interest rates double, another US$0.6T will flow as income to the non-government sector, boosting spending power and potentially adding to our inflationary woes.

Source: St Louis Fred, Quay Global Investors

Again, it’s worth differentiating between countries. Australian and New Zealand household debt is very short term (variable and two-three-year mortgages). It means these economies benefit less from the ‘income channel’ of higher interest rates compared to the US. Furthermore, Australia’s federal debt / GDP levels are significantly lower than the US, so we won’t get the same fiscal transfers via high interest rates.

In summary, while Australia has historically been more sensitive to higher interest rates than the US, the impact of the growing income channel effect means the US is becoming, comparatively, even less sensitive.

This may have long-term currency implications for the USD-AUD.

Inflation is more about ‘distribution effects’ than macroeconomic headwinds

Another mystery of the current macroeconomic environment is why consumers continue to remain resilient despite high levels of inflation.

Again, the sectoral balances here can be helpful.

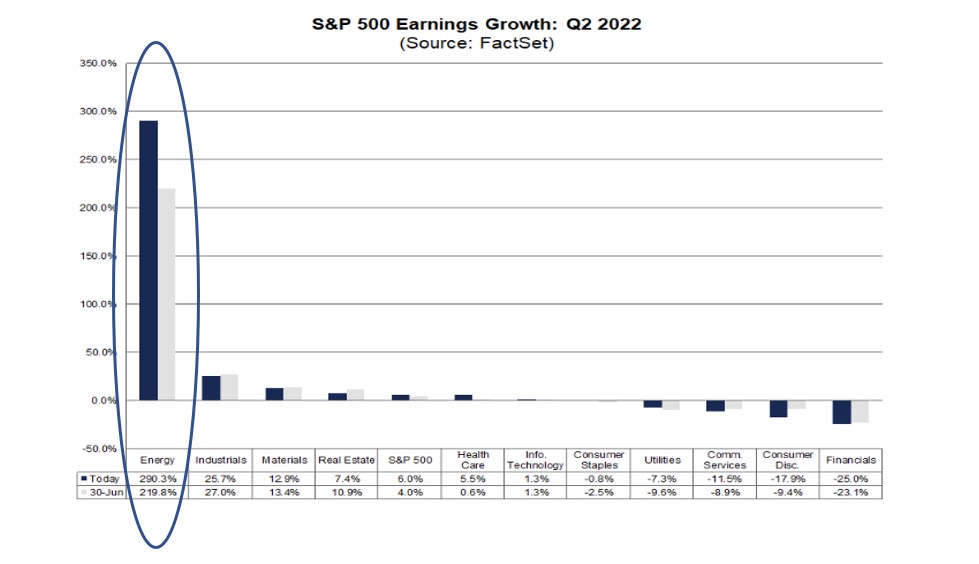

Higher prices via inflation are generally paid to the supplier – so one person’s (rising) nominal expenditure is another’s (rising) nominal income. If real wages are falling, all other aspects being equal, real profits are rising. In this context, is it so surprising that second quarter US profits were up +6% and company margins were at their highest since 1950[4] (despite the headwinds of lower fiscal deficits)? These profits are then used to re-invest or pay dividends to households and other entities.

But what about the 1970s? High inflation was coupled with low economic growth, and we had the dreaded ‘stagflation’. Again, sectoral balances help.

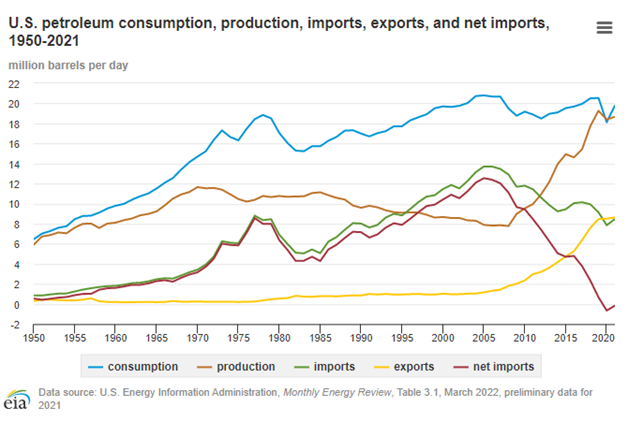

If higher prices and inflation are driven by imports, the net income accumulates to foreign savers (rather than domestic businesses). As per the sectoral balances, if the foreign sector is a net saver, income is drained from the domestic economy, which causes a recession.

This dynamic played out in the 1970s during the oil crisis. At the time, the US was a significant importer of foreign oil (which was a very large percentage of the economy). Inflation via higher oil benefits foreign suppliers, draining the domestic sector of income. A similar episode played out in 2007 (exacerbated by the financial crisis). Today, the US is a net zero importer of oil, and is therefore less prone to rising energy costs outside of the normal distribution effects. So, while the headline associated with rising commodity and energy prices feels scary, the macro impact in the US is quite mild and very different to the 1970s or 2000s.

Of course, the beneficiaries of higher energy prices were energy companies – the same companies that employ (mainly) local workers and pay dividends to (mainly) local investors. This is a good example of the re-distribution effects of inflation (as opposed to a macro-economic headwind); in this case, re-distributed to (very savvy) energy investors.

Source: FactSet

Concluding thoughts

In November 2021, we published the article, Why the boom in household savings ain’t going away. In the concluding thoughts we wrote:

“This is not a normal cycle – not many readers of this article (ourselves included) are fully equipped to understand the macroeconomic ramifications of such an incredible sea change in policy and household financial health.”

The current macroeconomic environment appears to be reflecting this uncertainty. Again, this underwrites our overall investment philosophy that macro investing is hard. We fundamentally believe it’s better to stick to more certain long-term secular themes (for example, ageing demographics) backed by quality companies, solid balance sheets and specialist management teams.

In short, pick good stocks with sensible valuations.

That remains our focus at Quay.

[1] https://insight.factset.com/sp-500-earnings-season-update-july-29-2022#:~:text=The%20blended%20revenue%20growth%20rate,second%20quarter%20(June%2030).

[2] https://gimms.org.uk/fact-sheets/sectoral-balances/

[3] https://www.investopedia.com/terms/p/paradox-of-thrift.asp#:~:text=The%20paradox%20of%20thrift%20is,levels%20during%20an%20economic%20recession

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.