Diversified United Investment (ASX:DUI) reported revenue (less special dividends) of $34.9m in FY22, up 71.0% on the pcp and a net profit after tax of $41.5m, an equivalent 63.9% increase on the pcp when excluding both special dividends and net unrealised gains/losses arising from unlisted investments. Ordinary dividends are considered to be more reliable and account for most of the top-line, consistent with the Company’s medium to longer-term view when investing through a composite portfolio of Australian equities, listed property trusts, short term deposits and international equities through exchange traded funds and unlisted managed funds.

DUI has also announced a Share Purchase Plan (SPP) to raise capital and expand the equities portfolio. Eligible shareholders will be able to invest up to $30,000 in new DUI shares. Shares will be issued at the lower of $4.69, representing a 3% discount to the closing share price on the Record Date (17 August); or the VWAP of shares over the 5 trading days up to and including the Offer Period Closing Date (i.e. 20 September to 26 September). Shares issued pursuant to the Offer will rank equally with existing DUI shares but will not be entitled to the 2022 Final Dividend payable 9 September. Dispatch of the Offer Documents and Applications commence from 9 September.

DUI is a good example of how implementing Modern Portfolio Theory (MPT) can enable clients to reduce their unsystematic risk through combining a number of risky assets. The founder of MPT, Harry Markowitz (1952), concluded that investors should not only hold portfolios, but should also focus on how the individual securities in these portfolios relate to one another. Statistical measures such as security variance and correlation bear greater weight here in seeking to minimise the weighted average volatility of a portfolio rather a single investment’s pure performance. Provided that assets are lowly correlated, additions like global equities can decrease portfolio risk without sacrificing return.

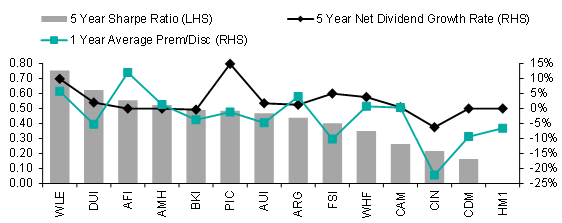

Figure 1 demonstrates the risk adjusted returns across a number of blended and pure Australian equity mandates. On a 5 year basis DUI demonstrates the second greatest Sharpe Ratio, or measure of the excess asset return over a Treasury Bill that is awarded by compensation as a function of asset risk. At 30 June 2022 81.1% of the portfolio was invested in Australian equities, with 18.1% in international equities where exposure is derived through low-cost listed ETFs and in some instances unlisted managed funds. Cash and short-term receivables was 0.8% at the same time.

Figure 1 – Comps for large/mid caps and blended geography mandates

BTI to return cash to shareholders

Bailador Technology Investments (ASX:BTI) reported an increase in the value of the Fund’s non-current financial assets and total current assets by $50.3m in FY22, up 22.7% on the pcp and an increase in the Net Tangible Asset (NTA) value per share before deferred tax liabilities and after all fees of 21.6%.

The Company realised a total of ~$153m in the value of investments during FY22 at strong metrics that the gauge return on investment (e.g. Multiple of Invested Capital and Internal Rate of Return). Investee positions with a full or partial cash realisation during FY22 included Instaclustr at a 14.2x MOIC and 79.8% IRR, Standard Media Index at a 2.7x MOIC and 15.0% IRR; and SiteMinder at a 24.8x MOIC and 40.4% IRR. A total of ~$39m has been redeployed across three seed investments that relate to healthcare, however the Company still remains at elevated cash balances. The investment strategy places a large importance on unit economics and profitable growth that ensures new customers of the investee companies can be acquired, serviced and retained (customer acquisition cost) for much less than they provide in revenue and gross margin over their full lifetime (customer lifetime value). A diligent focus to the timing of these entries and exits over the portfolio also successfully managed the risk around these investments, where the EV/LTM revenue multiple of NASDAQ-listed technology companies now sits below its 5 year average (Bessemer NASDAQ Cloud Index).

The Board have also declared a fully franked Final Dividend (3.7c) and fully franked Special Dividend (3.7c) that amount to 7.4c per share in accordance with the Dividend Policy announced on 1 June 2022 of a regular dividend equal to 4% p.a. of the Company’s NTA pre-tax that is paid semi-annually.

Overall the result is positive, and given the capital growth orientation that is focused on expansion-stage investee positions within the technology sector, investors should view this new directive and the seasoned portfolio as a de-risking event with a pull forward on investment returns, cash validation and liquidity.

The Indicative NTA works best with LICs that have a high percentage of investments concentrated in its Top 20, regular disclosure of its Top 20, lower turnover of investments, regular disclosure of its cash position and the absence of a performance fee. We have also included an adjusted indicative NTA and adjusted discount that removes the LIC distribution from the ex-dividend date until the receipt of the new NTA post the payment date. This report is published each Monday prior to the market open and is available on a daily basis. Intraday indicative NTAs will be available on request through your adviser.

For full details refer to the detailed report below or click here to download your copy.

[wonderplugin_pdf src=”https://www.sharecafe.com.au/wp-content/uploads/2022/08/LIC-Weekly-Report-Indicative-NTA-19-August-2022.pdf” width=”100%” height=”900px” style=”border:0;”]