by Max Andrews – Business Developer / Analyst

Beyond Meat (NASDAQ:BYND) are one of the world’s largest plant-based meat companiesselling meat patties to chicken nuggets.

Wide Open Ag (ASX:WOA) have a lupin processing plant where they produce a brandedprotein called Buntine. WOA also have an oat milk brand, Dirty clean food.

Oatly (NASDAQ:OTLY) is an alternative dairy company that specialises in oat milk andvalue-added oat milk.

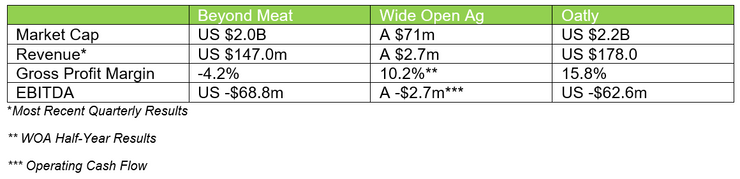

Table 1: Alternative plant-based protein companies quarterly financial summaries

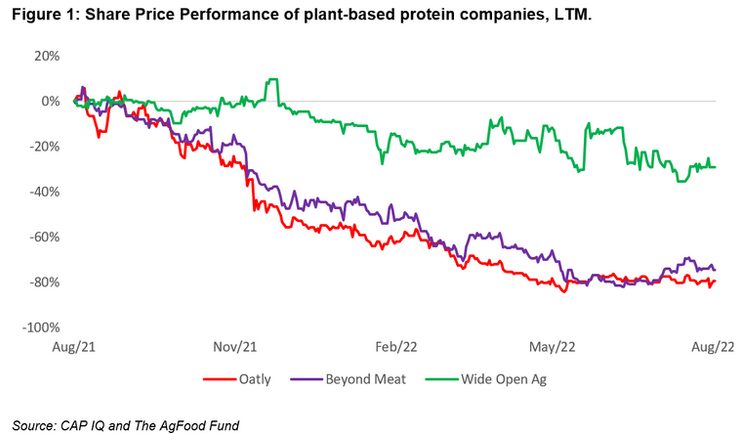

In the past 12-months the market has shifted to a more risk-off approach, which has probably impacted the share prices of Oatly and Beyond Meat, both down -79% and -74% respectively.

The alternative plant-based protein sector appears tough to generate positive cash flow. It seems Oatly and Beyond Meat have reached global scale and gross margins remain low. The problem with the alternative proteins they still need to be relatively competitive with pricing to traditional proteins such as dairy and beef, hence the low gross margins.

In my opinion, it is unclear the path going forward for how branded alternative protein companies can generate meaningful cashflow without very high price rises. In our opinion, the way to play to this high-growth sector is investing in the picks and shovels group that supply the likes of V2 Food and Beyond Meat. We think Cargill and Archer Daniels Midland are well positioned to benefit from the industry. We also believe there could be consolidationin this sector, so it is important that the suppliers have customers outside of the alternative protein sector.

A key investment in the AgFood Fund is Crush Dynamics a Canadian company on the supply side of the plant-based-protein sector. Crush Dynamics ferment wine waste into a “ruby” and “gold” puree end product. The ruby can be associated with beef and sauce products, and the gold can be associated with chicken and dairy. Crush are well diversifiedwith their customer base.

Crush Dynamics are in the early stages of scaling their production and have expanded intoAustralia. Australia offers a good base for supply of wine waste.

We also like Select Harvests (ASX:SHV), the largest almond producer in Australia. SHV produce almond paste which is a key ingredient in almond milk. In our opinion, supplying toalternative dairy companies is safer than alternative meats. It seems margins in alternative dairy are higher than alternative meat (See:Table1).

The AgFood Opportunities Fund is a Wholesale-only fund that invests in both listed and unlisted companies operating in the Agriculture and Food industries within Australia, New Zealand and the Rest of the World.

Disclaimer: The AgFood Fund has an economic interest in Crush Dynamics and SelectHarvests.

Sources: