by Peter McPhee – Investment Specialist, Global Equities

In recent times, poor returns from cash, bonds and other low-risk investments, combined with a long bull market and new, cheap, easy ways of buying stocks have led more and more people to invest in the sharemarket. In 2020, 35% of Australians held a direct investment in shares, with a quarter of these buying shares for the first time in the past two years.

But while many Australians own shares, only 15% of Australian investors directly own international shares – that’s 5% of all Australians – and the percentage that own small and mid-cap (SMID cap) international shares is even lower. This is partly due to the difficulty for Australians to access this part of the global sharemarket – there are only around 30 funds available with some exposure to it – and partly due to direct investors lacking confidence in picking stocks themselves. There are nearly 8,000 stocks available in the global SMID index, so it’s much more difficult for investors to confidently choose stocks that are likely to outperform their peers – particularly for overseas markets where it’s more difficult to obtain detailed company information.

These factors have led to a significant under-representation of global SMIDs in Australian share portfolios, despite the clear opportunities they offer in both diversification and performance.

Top three reasons for Australians to consider global SMID caps

So why should Australian investors consider adding global SMIDs to their investment portfolios?

- To diversify their portfolios across geography, size and sector.

- There is significant evidence that, long-term, SMID caps’ relative performance is better than many other share classes.

- Capitalise on inefficiencies. With thousands of global SMIDs available, many are very poorly understood by investors, creating significant opportunity for outperformance.

Global SMIDs diversify your portfolio

The Australian sharemarket represents around only 2% of the total investable global sharemarket. While markets are, in general, closely intertwined, limiting your portfolio to companies domiciled in Australia naturally narrows access to the huge diversity of markets, economic cycles, and underlying business drivers that operate simultaneously across the globe.

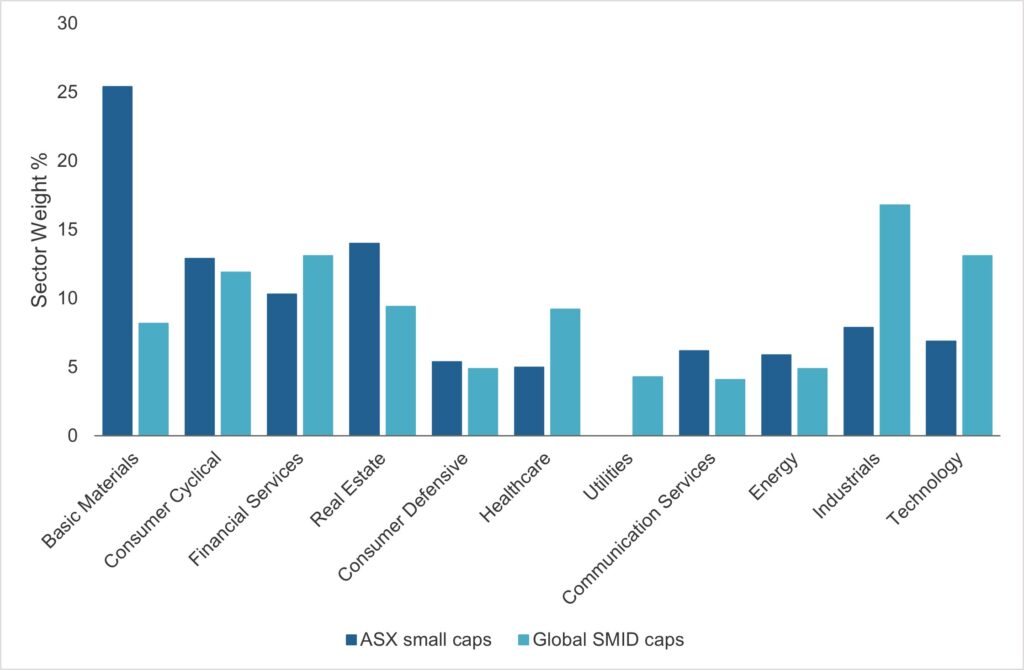

As well as introducing greater geographic diversity, moving some of your portfolio from Australian equities into global equities increases sectoral diversity. The S&P ASX small caps has a very high percentage of Materials (25%), but a relatively small allocation to Technology (7%) whereas the comparative global benchmark, the MSCI ACWI SMID Cap Index, has only 8% Materials, but nearly twice as large an exposure to Technology (13%). There are other significant differences in the comparative weightings of sectors like Real Estate, Healthcare, Industrials and Utilities as you can see in the charts below:

Equity sector weightings taken from Morningstar in June 2022

Another diversification benefit that global SMID-caps offer is size. While some companies are indeed very small, other companies within the global SMID-cap universe are larger than some Australian large-caps, due to the comparative size of the markets. Australian large caps are generally considered to be over A$10 billion, there are currently 760 companies over A$10 billion on the MSCI ACWI SMID Cap Index, and the largest company is A$90 billion – around the same size as CSL, Australia’s third largest company.

SMIDs offer better returns than large caps

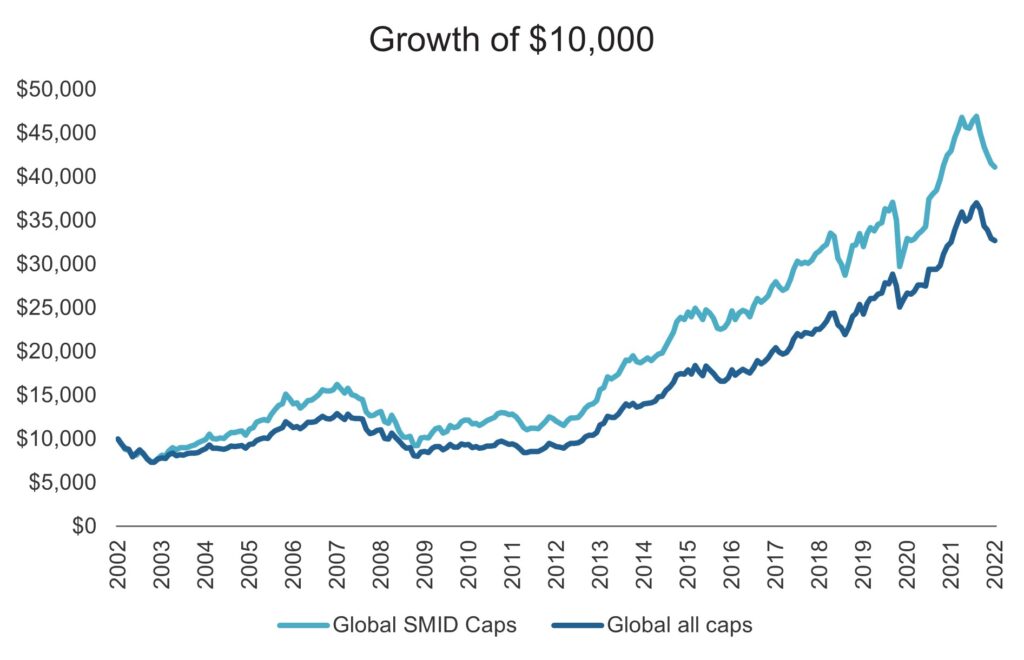

If you look at the relative performance of global SMID caps compared to global large caps over the past 20 years, you can clearly see that they have delivered better returns in the long-term.

The long-term performance difference can be clearly shown in the graph below. If you invested $10,000 in global SMID caps (MSCI ACWI SMID) in January 2001, by the end of April 2022 your investment would have grown to $39,309. Whereas $10,000 invested in the comparable global large cap index (MSCI ACWI) over the same timeframe would have grown to $26,485 – a difference of $12,824.

Past performance is not a reliable indicator of future performance.

Of course, returns for a specific time period can change significantly depending on the start and end dates selected, so looking at rolling returns over the same 20-year period gives a better indication of how often global SMIDs outperform global large caps (rolling returns split the period into multiple monthly increments of the same time period). For 1-year rolling returns over the 20-year period, global SMID caps outperformed global large caps 63% of the time. The difference in relative performance becomes starker the longer the investment period.

Over that same 20-year period global SMIDS outperformed global large caps:

- 69% of the time for 3-year rolling returns

- 69% of the time for 5-year rolling returns

- And 78% of the time for 10-year rolling returns

Past performance is not a reliable indicator of future performance.

Active managers can capitalise on inefficiencies in global SMIDs

Investors choose active investment managers in the hope that they will perform better than the sharemarket as a whole – that they will beat their benchmarks. Active managers have different methods of doing this – whether it’s through assessing companies by quality, value and growth prospects or how macroeconomic factors will cause different companies or sectors to outperform. Whatever their method, or combination of methods, active investment managers try to find companies that they think have been mispriced by the market, and so are likely to perform better in the medium to long term. These mispriced stocks are indicators that the market is operating ‘inefficiently’, as in a totally efficient market everything would be priced correctly.

There are two key drivers of inefficiencies in a sharemarket:

- The number of stocks in a market and

- The quality of the research for each stock

Think of the scale of opportunity in a market like global SMID caps. There you have nearly 8,000 companies spread across 47 countries (around half are developing countries), speaking multiple different languages and subject to a very wide array of different market forces and economic conditions.

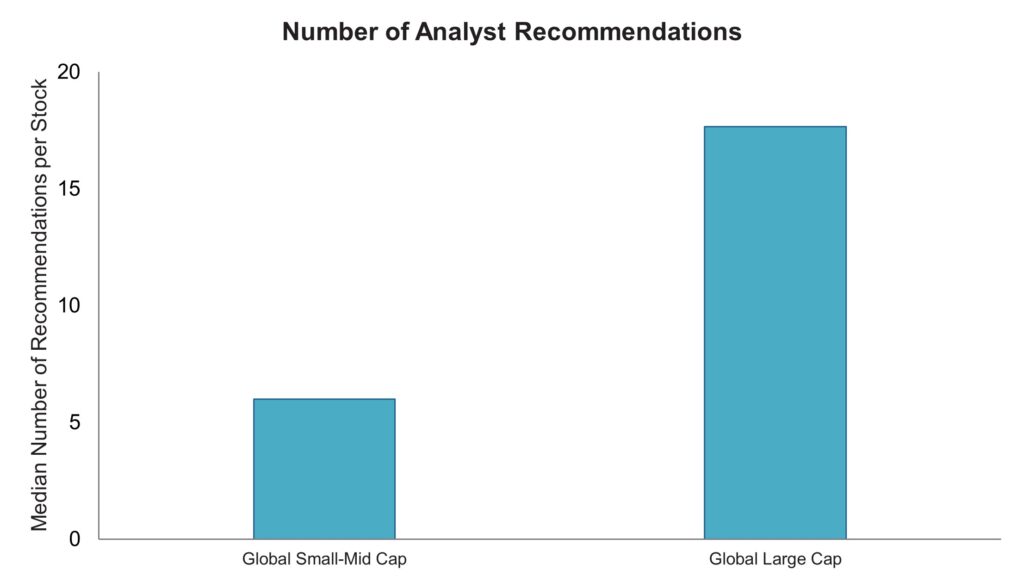

The sheer size, and diversity, of the global small and mid-cap market makes it much more difficult for investors to develop high quality, in-depth stock research. This means that many companies are under-researched, and not well understood by the market in general. This is illustrated in the chart below which shows that international small caps are not as well covered by analysts. Globally, there are 3-4 times as many analyst recommendations per stock for companies in the large cap index compared to the small cap index. This information asymmetry creates an opportunity for astute active managers to add value through rigorous bottom-up research.

This develops inefficiencies that provide great opportunities for specialist active managers, with the requisite skills and experience, to take advantage of. These inefficiencies, or asymmetries, are much greater in global SMID caps than in larger caps and so provide bigger opportunities for active managers to significantly outperform the benchmark.

Summarising the case for global SMID caps

Global SMID caps offer great potential for Australian investors. They offer significant diversification benefits in geography, size and sector for investors with all-Australian portfolios. They have also offered investors better returns than global large caps for a high percentage of the last 20 years.

Lastly, global SMID caps could be a particularly fruitful hunting ground, right now, for active investors looking for stocks with the potential to outperform. Such a large, little-understood index of companies almost always acts more inefficiently than a smaller, more closely monitored index. And these inefficiencies are particularly pronounced right now as high recent volatility has caused significant repricing, and so significant opportunity, across the global SMID cap index for the astute active manager to capitalise on.