Thinking back to the beginning of the year, if markets believed that by April:

- US inflation would accelerate from 7.0% to 8.5% and drag global inflation along with it,

- US bond yields would rise from 1.5% to 2.8%, and

- cash rate increases would be in 50bpts increments per meeting and reach +3.0% by year end,

it would almost be certain the conventional wisdom would have been to “get out of REITs”.

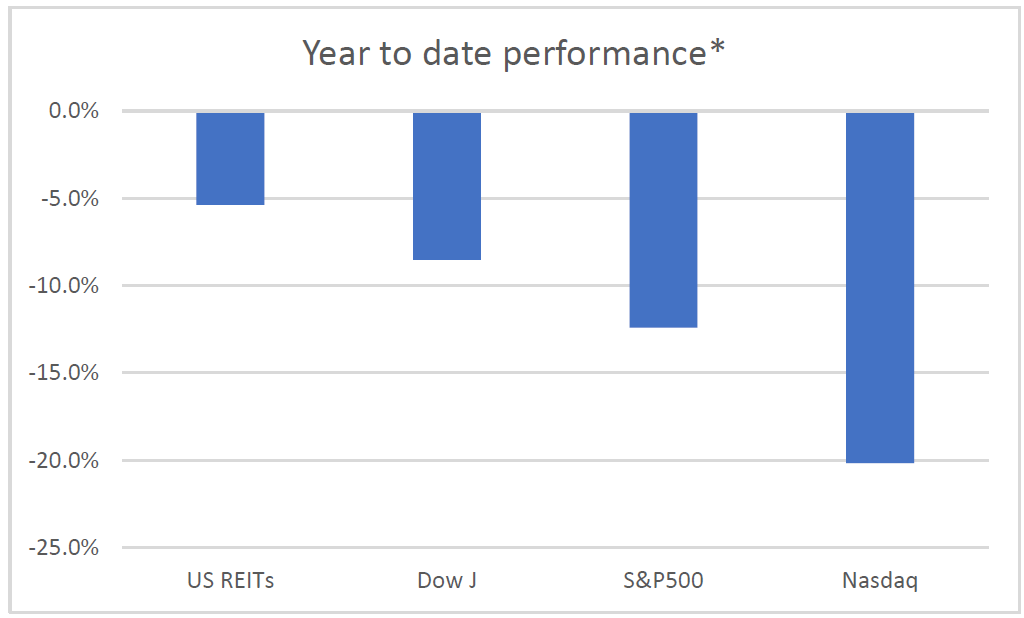

Yet, despite all this coming to pass, listed real estate has performed well relative to broader equities, again proving itself a defensive asset class during periods of high inflation and rising interest rates.

Source: Bloomberg, Quay Global Investors * To April 28

This raises some questions – does REIT performance to date simply mean a coming de-rate? Is the sector about to follow the path of the S&P500 and Nasdaq? Relative to the current bond market, are REITs overvalued?

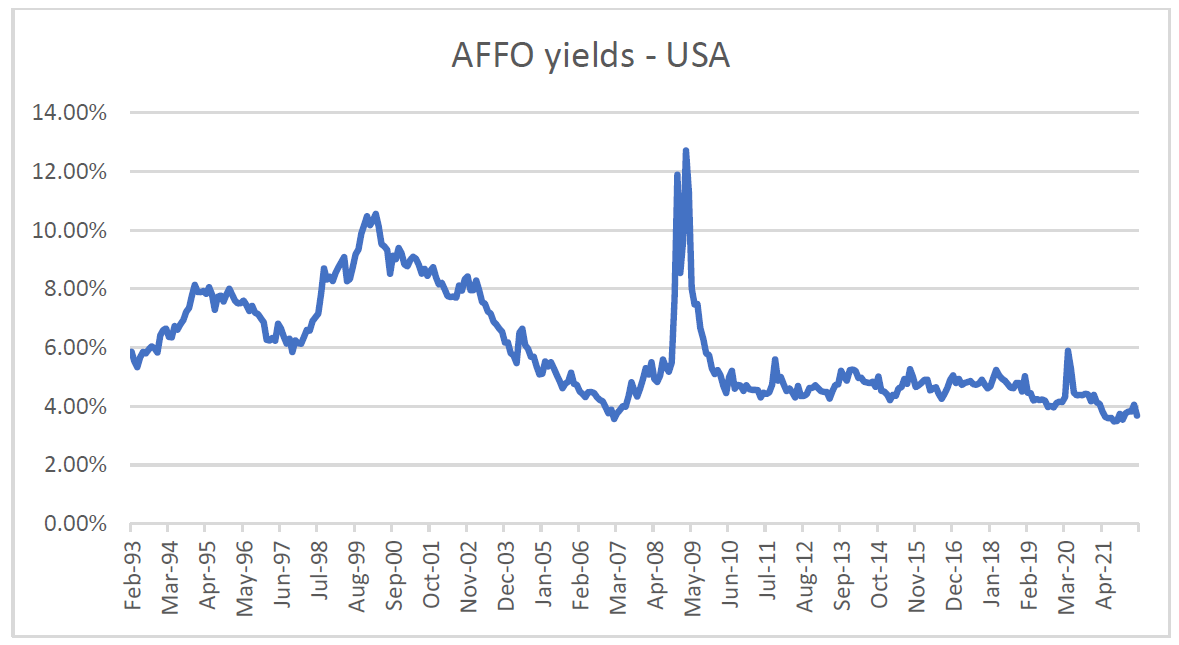

Calculating real estate risk premiums

The best way to measure REIT values relative to bonds is via the equity risk premium (ERP). The ERP is simply the total return an asset is expected to deliver relative to a risk-free return of similar duration. For real estate, this is a relatively straight forward calculation. Since long-run growth in real estate cashflows can be proxied by inflation (due to its anchoring around replacement cost), the best method to estimate the risk premium is to compare post-depreciation REIT earnings to the real bond yield. The breakdown of this calculation is highlighted below.

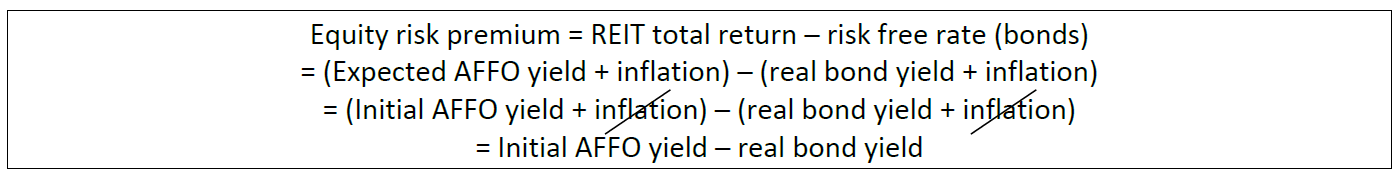

Expected after depreciation earnings (AFFO) yields for REITs are not always easy to get. Fortunately, Greenstreet Advisors keeps an excellent long-term record of such data.

Source: Greenstreet

The difference between this yield and real 10-year interest rates is a good proxy for the real estate equity risk premium, and is therefore a good measure of value relative to bonds.

Source: Greenstreet, Bloomberg, Quay Global Investors

Some observations

A few key observations from the above charts:

- Despite recent outperformance relative to equities, relative to the current nominal and real bond rate, US REITs (a good proxy for global REITs) are currently fair value.

- Despite concerns about rising interest rates and their impact on REIT valuation, the ERP actually declined during the 2004-2007 interest rate cycle and was relatively flat during the 2016-2018 cycle.

- The ERP declined during the last meaningful increase in inflation (2004-2008).

- Equity risk premiums are prone to movement during a significant market movement event, such as the financial crisis and the pandemic.

- Outside of such ‘black swan’ events, the real estate ERP is remarkably stable, and has historically been a good indicator for buy-sell events. However, right now, it tells us neither.

The risks

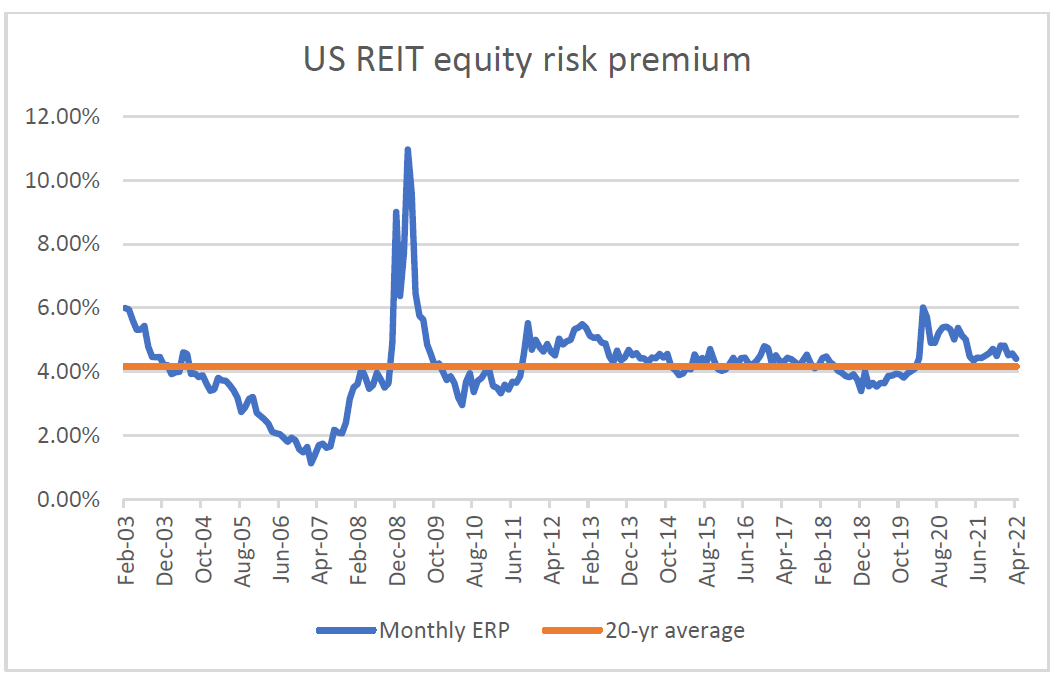

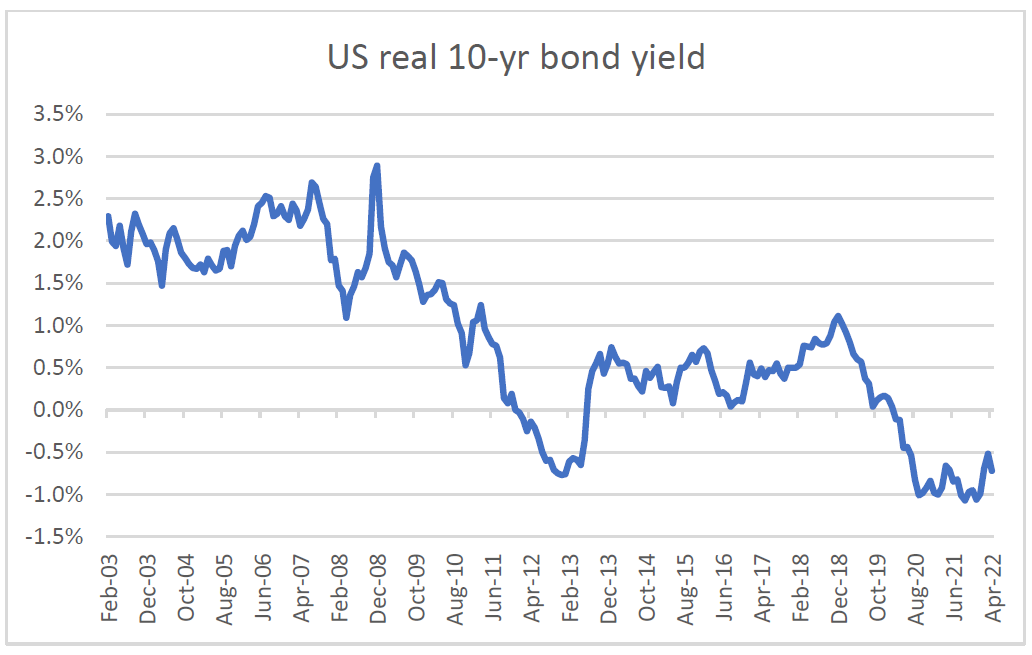

By now, most readers will recognise the inherent risk to real estate valuations based on the ERP. What happens if real interest rates rise? That is not an unreasonable question given the data suggest real interest rates appear to be at a cyclical low.

Source: Bloomberg

Real interest rates (10 year) at the time of writing are -0.5%. If they were to move back to pre-COVID levels of +0.5%, the real estate ERP would decline from ~4% to ~3%. This would result in the US REIT index being ~21% overvalued and at risk of a meaningful correction.

While this seems worrisome, there are a few additional factors to consider.

- The trend in real yields appears to be down and does not show any signs of consistent mean-reversion.

- A similar concern in 2013 would have resulted in investors missing attractive gains from 2014-2020.

- Real estate REIT earnings are growing significantly, driven by excess tenant demand against constrained new supply. Based on our coverage, we estimate our investees will grow earnings and cashflow by 10.1% in 2023 – significantly offsetting any potential increase in real interest rates.

- Interest rates (real or nominal) are not set to pure market forces. That is, nominal bond yields reflect the market expectation of the long-term official central bank cash rate. Bond yields move as investors try to ‘front-run’ central bank policy intentions. If the Fed pivots to an easing policy, bond yields will fall quickly, irrespective of inflation. This means real interest rates could be significantly lower in a slowing economic environment.

Concluding thoughts

As most of our readers know, this is not the way we invest. Quay is slavishly bottom-up in our approach (i.e. we pick what we believe are good stocks with excellent long-term prospects). However, the results from our analysis above do not surprise us. In fact, they are consistent with our stock picking approach. Relative to their long-term prospects, some stocks remain deeply discounted, while others exhibit over-enthusiastic valuation. It really is a stock picker’s market.

The Quay Global Real Estate Fund invests in a number of global listed real estate companies, groups and funds. The Fund aims to generate a real total return of at least 5% above CPI per annum over a 5+ year investment horizon.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.