By Matthew Kaleel, Maya Perone and Andrew Kaleel – Portfolio Managers

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

“What brought it on?”

“Friends,” said Mike. “I had a lot of friends. False friends. Then I had creditors, too. Probably had more creditors than anybody in England.”

Hemingway,The Sun Also Rises

In our last piece on trend following in June 2021 (Rising interest rates, inflationary regimes and CTA returns), we looked at the implications of inflation and a rising interest rate regime on various asset classes. We highlighted the potentially positive environment for managed futures, and in particular trend following strategies.

Since writing the article, markets have repriced expectations for both interest rates and commodities, first gradually, then suddenly. The quote from Hemingway’s classic captures one of the main drivers of returns to trend following over time, which is the gradual absorption of new information and then a sudden change in fortunes that occur more often than anticipated in financial markets. While several rationales exist for the success of trend following over time – including as a strategy that naturally participates in risk transfer between hedgers and speculators – we believe that trend following also picks up on the behavioural bias of underreaction, where ‘a delayed reaction exists as investors respond gradually to new information’.[1]

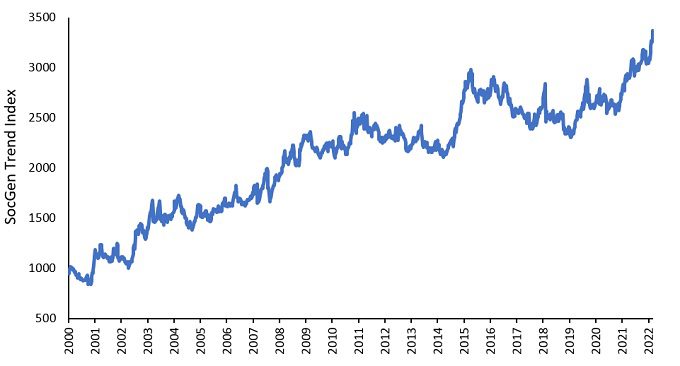

‘Gradually then suddenly’ captures a particularly favourable setup for trend following strategies, which have been recent beneficiaries of exactly that shift in bond markets (the normalising of interest rates and the resetting of inflationary expectations), and the growing awareness of the underlying constraints in commodity markets, and hence high sensitivity to any supply shocks. The ability of trend following to effectively pick on these themes has seen the SocGen (SG) Trend Index move to all-time highs (Exhibit 1). This gradual then sudden repricing of financial assets is one of the drivers for trend following strategies continuing to offer the ‘crisis protection’ characteristic of absolute returns during dislocated market conditions.

Exhibit 1: The SG Trend Index has broken new ground

Source: Bloomberg, 1 January 2000 to 4 March 2022. Note: The SocGen Trend Index calculates the daily rate of return for the 10 largest trend following CTA funds that are open to new investment. It is designed to be representative of the performance of trend followers in the managed futures space. Past performance does not predict future returns.

The ‘gradually then suddenly’ trend following setup

The returns for trend following strategies, which constitute the bulk of assets in the managed futures industry, are driven by two primal forces – price and volatility. Price, or more particularly the change in the price of a given asset over specified time intervals (the short-, medium- or longer-term trend) – determines directional positioning. Any given market moving higher for a sustained period will result in a long position, and vice versa on the short side.

The strategy is agnostic to market direction but relies upon a continuation of a move higher or lower to generate attractive returns. Volatility is the second driver. A typical trend following strategy will target a particular level of volatility on an ex-post basis, both to control risks between portfolio constituents and to manage overall realised volatility at a portfolio level.

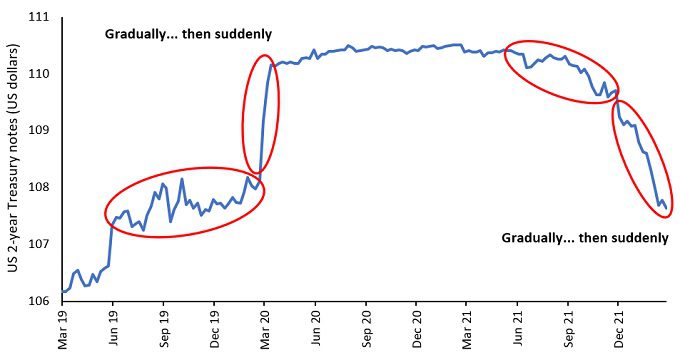

One sector that has reflected the ‘gradual then sudden’ movement in markets over the last two years is bonds. Bond markets have provided a window into the ability of a trend following strategy to participate in extended market dislocations, specifically when markets gradually move in one direction (allowing the trend strategy an opportunity to be positioned well in both size and direction), then adjust suddenly.

One of the main Treasury Futures markets is in US 2-Year Treasury notes, which has highlighted the round trip that markets have taken over the last two years, moving gradually, then suddenly, on both the upside and downside (Exhibit 2).

Exhibit 2: US 2-year Treasury notes have gone both ways during the COVID era

Source: Bloomberg, shows price for US 2-year Treasury note futures, in US dollars, 1 March 2019 to 28 February 2022. Past performance does not predict future returns.

The ‘gradual’ phase

The periods preceding both the run up in US 2-Year Treasury notes in February and March 2020 and sell off between September 2021 and the end of February 2022 were environments in which we saw markets gradually processing new information:

- Markets were slow to adjust to the risk of a dramatic impact from COVID in the first quarter of 2020. Trend signals were indicating a buy on US 2-Year Treasury notes.

- Markets were hoping for a more transitory inflationary environment as we entered the final quarter of 2021. From June to September, markets gradually moved lower, as markets hedged bets that the US Federal Reserve (Fed), European Central Bank (and others) would gradually pull back from monetary tightening, and that an end to the ‘Powell Put’[2] would not result in a dramatic shift higher in interest rates. Trend positioning moved short during this period.

In both instances, a low level of realized volatility allowed for a relatively large position to be taken, both long and short.

The ‘sudden’ phase

The gradual, benign environments highlighted in the ‘gradual’ phase were followed by periods of dramatic change, as markets suddenly priced in new information:

- Q1 2020: As the full human and financial impacts of the COVID-19 pandemic became evident, financial markets moved suddenly. Long positioning benefited in this move.

- Q4 2021/Q1 2022: During this period, inflation turned out to be less transitory than hoped, and much stickier than forecast.

- December 2021: Powell’s ‘Pivot’[3] specifically moved away from language of transitory to stickier inflation.

- January 2022: Goodbye Mr Gradual, Hello Mr Nimble[4] – a gradual tightening cycle suddenly morphed as measured indicators from the Fed were replaced by an increasing urgency to normalise interest rates.

In both the first quarter of 2020 and the fourth quarter of 2021, markets provided trend following strategies with a window of opportunity to position going into the trend. Sudden and significant moves during these periods resulted in a reduction in position sizing to recalibrate portfolio volatility, which had the effect of locking in profits.

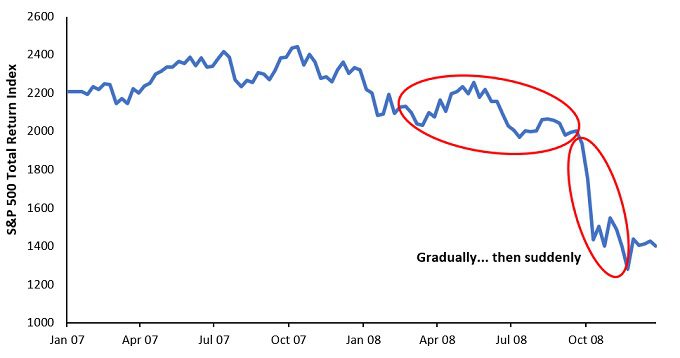

Another such instance of the ‘gradually then suddenly’ phenomenon occurred in late 2007/early 2008, prior to the start of the financial crisis. At that point, markets were gradually processing information that indicated stress in credit and financial markets. This turned into a far more dramatic ‘suddenly’ moment as these underlying influences flowed directly into stress in companies (Exhibit 3).

In much the same way as we have seen trend following benefit from the ‘gradual then sudden’ move in price and volatility in short term rates over the past two years, trend followers were able to take short positions in stock indices (amongst other positions), which made 2008 one of the best years on record for trend following strategies.

Exhibit 3: Positioning in the S&P500 during the ‘gradual phase’ in 2008 reaped benefits

Source: Bloomberg, S&P 500 Total Return Index, 1 January 2007 to 31 December 2008. Past performance does not predict future returns.

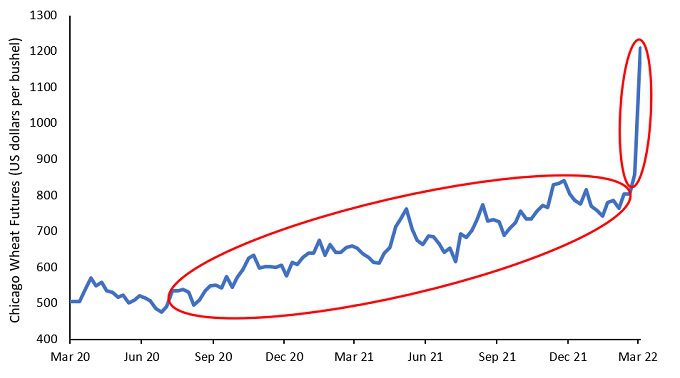

In a final example, relevant at the time of writing, the events occurring in Russia and Ukraine have had significant consequences across markets, with an outsized impact upon supply constrained energy, industrial metals and grain markets. The gradual assessment of risks has transformed quite suddenly into something far more acute, as shown by the step change in wheat prices over the last fortnight (the two weeks to 4 March 2022) – see Exhibit 4.

Exhibit 4: The ‘gradual’ bull market in wheat has transformed into a more sudden market spike

Source: Bloomberg, Chicago Wheat Futures (US dollars per bushel), 4 March 2020 to 4 March 2022. Past performance does not predict future returns.

Conclusion… with caveat

The ‘gradual then sudden’ moves in markets exemplified by the above examples represent a potentially favourable setup for a trend following strategy. But it is important to recognise that these trade setups are not the norm. Trend following strategies tend to have payoffs in clusters, either preceded and/or followed by trendless regimes with variable volatility and non-committal moves. These are periods that may not be conducive to trend strategies, and it is in these environments that more dynamic approaches to both defining trends and managing position sizing come to the fore.

Much like Bill in Hemingway’s classic, markets often process information gradually then suddenly. While this is not the default state, these occasional environments are highly conducive to positive performance for trend following strategies. The key with trend following is patience; remaining allocated during less conducive periods to ensure you reap the potential rewards when information is absorbed into market pricing, first gradually then suddenly.

—–

[1] Bianchi, R., Drew, E., Fan, J., 2016. Commodities Momentum: A behavioural perspective. Journal of Banking and Finance.

[2] The Powell Put: The point where US Federal Reserve (Fed) Chair Jerome Powell indicated he would intervene with stimulus measures/looser monetary policy in the event of a financial crisis (first aired in early 2019). This echoed a similar policy by former Fed Chair Alan Greenspan.

[3] Powell’s Pivot is the right move – Washington Post, December 2, 2021 https://www.washingtonpost.com/business/powells-pivot-is-the-right-move/2021/12/02/fde9b968-5378-11ec-83d2-d9dab0e23b7e_story.html

[4] Goodbye, Mr Gradual, Hello Mr. Nimble: Fed Chair Powell tears up rate-hike script

https://www.reuters.com/business/goodbye-mr-gradual-hello-mr-nimble-fed-chair-powell-tears-up-rate-hike-script-2022-01-26/