by Julian Howard – Lead Investment Director, Multi-Asset Solutions

In the famous café scene of 1995 thriller Heat Robert De Niro’s bank robber Neil McCauley faces off with Al Pacino’s obsessive cop Vincent Hanna. The tension and the acting of course made the scene legendary but it also had an important bearing on the plot: the two protagonists run through a reasonable scenario analysis of what each would do should they meet again in less neutral circumstances. Investors, while facing lower stakes, must also perform scenario analyses on a regular basis. Stock markets over the last two decades have charted a generally strong upward course interspersed with violent downward shudders triggered by episodes including the technology bubble, the global financial crisis and the recent pandemic response. With interest rates likely to remain accommodative in the face of an extended period of low growth as the world emerges fitfully from the pandemic response and then almost immediately face a climate, demographic and inequality crisis, we believe a reasonable base case can be made for continued upside potential in equity markets. Faced with low risk-free rates, investors will have little alternative but to hold equities as a major component of their portfolios. But there is also a strong argument for sideways markets, and this will demand a different approach to investing that will need to transcend the standard ‘levers’ at most investors’ disposal, namely how much equities versus bonds to hold.

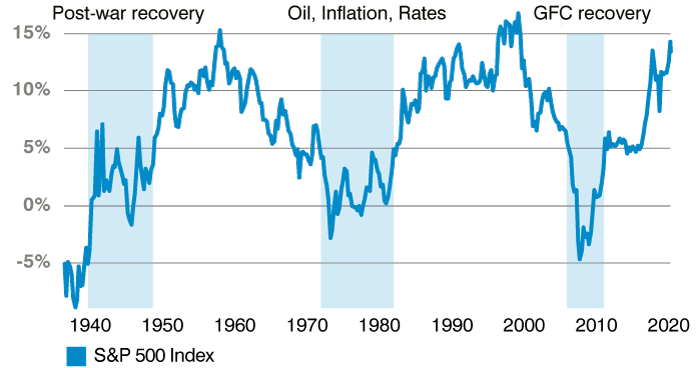

Sideways markets have not been a regular feature of recent stock market history. In the last ten years, just 21% of the S&P 500’s monthly returns have been within the -1% to +1% range, while 57% have been above 1% and 22% have been less than -1%. But going further back there are several eras in which multi-year compound returns were muted. Two in particular stand out. The first was the surprisingly fallow post-war period in which the S&P 500 failed to recover its pre-war highs until the early 1950s. The second is the decade from the early 1970s to early 1980s which was marked by the winddown of government spending on the Vietnam war then the energy crisis, inflation and crushingly high interest rates of up to 20% to control it. The five years from the credit crunch of 2007/ 2008 were also marked by lower rolling historic returns from the equity market until the Bush-Obama stimulus package started to have a positive effect.

Chart 1: Flat spots – longer market history reveals at least two distinct low-return eras:

The case for sideways today rests on a combination of stretched market valuations as well as a sense of permanent crisis in the global economy and geopolitics. The well-respected Shiller cyclically-adjusted price/earnings (CAPE) ratio stands at over 38x, suggestive of both rich valuations and barely positive future compound returns in the S&P 500. At the same time, investor sentiment indicators have been taking a nosedive, for example the American Association of Individual Investors’ (AAII) regular bull-bear sentiment readings reveal increasing gloom amid a slew of bad news. This includes, inter alia, the Delta variant of Covid-19 still in circulation, higher inflation fears, Federal Reserve members speaking more assertively about outright rate rises to deal with said inflation despite the slowing economy and on-going geopolitical turbulence from Afghanistan, Russia, China and Iran.

Should a stalled markets scenario indeed play out, investors will need to seek out sources of return that are at once attractive, consistent, and independent. Within equities, we believe cash-generative and economically agnostic sectors like technology, communications and healthcare should still offer the ability to generate on-going returns. However, the so-called ‘quality growth’ sector cannot do all the heavy lifting alone and will not be able to outright defy broader index gravity in an environment characterised by high valuations and deteriorating investor sentiment. This latter point also rules out long-dated corporate bonds whose spreads over risk-free rates – and by implication principal capital – are vulnerable to rising defaults as the economy slows. Government bonds could also suffer from a slow-motion policy error in which central banks obsess with, and act on, inflation regardless of the highly unusual and temporary nature of the post-pandemic recovery. The Bank of England appears keenest among the big central banks to raise rates first, with 10-year gilt yields jumping from just over 0.5% in early August to over 1.2% in October before settling back down to 0.8% in early December.

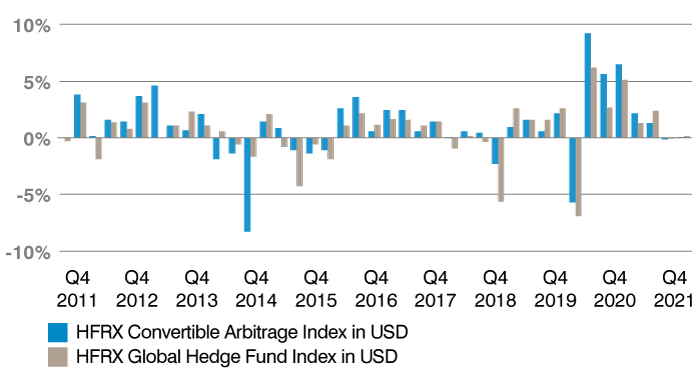

One of the most convincing responses to the sideways challenge surely lies in the field of alternatives. While the hedge fund sector in broad terms has probably suffered from too much correlation to equities, and might therefore struggle in sideways markets, we believe there are pockets of the alternatives world which merit more serious consideration. Within liquid alternatives, one compelling area that might potentially deliver consistent returns of over 5% per annum is that of convertible arbitrage. A well-managed portfolio of convertible bonds should be able to benefit from periods of market volatility by participating in even brief upward moves more than they conversely fall in downward markets. Strategies that also short the equity of the same name as the convertible could benefit further. So even if markets are flat over time, any intervening volatility can be a source of profit. This so-called volatility yield is a unique by-product of enhanced convertible arbitrage investing and could be a way to transcend sideways markets.

Chart 2: Standout alternative – convertible arbitrage has offered better risk-reward than the wider sector:

But it is arguably illiquid investments that offer the most definitive solution to the sideways problem. Investors are of course right to proceed cautiously. J.M. Keynes – arguably as good an investor as he was an economist – once said of real estate investing: “Some bursars will buy without a tremor unquoted and unmarketable investments in real estate which, if they had a selling quotation for immediate cash available at each audit, would turn their hair grey.” Today, professional managers who have spent their entire careers in the sector can steer investors through the world of illiquid assets via dedicated research and clear communication, thus avoiding the premature grey hair outcome. Private credit for example, can potentially offer investors returns from mid-single digits to over 20% according to Cambridge Associates, which would certainly transcend a sideways era in equity markets and brush off all but the most extreme inflationary scenarios. But a manager-investor partnership approach is vital, in our view. The asset class encompasses several sub-strands including distressed, opportunistic and capital preservation which must all be carefully assessed for investor suitability. Time horizons must be determined, risks understood and operational aspects including reporting – which for illiquid assets is usually on an internal rate of return, rather than the usual time weighted basis – agreed on. This holistic approach is vital for mitigating the valid concerns which even seasoned inter-generational or foundational investors might have about illiquid assets.

Sideways markets present a unique and challenging investment scenario to all investors, whether retail, high net worth, charity or institutional. Investment managers will need to bring the full resources and expertise of the house to bear in navigating investors through such an eventuality, even if only part of the portfolio will be assigned to specifically deal with it as will likely be the case. And to avoid the yield over-reach trap that so often catches out both manager and investor, a holistic approach will likely need to replace the hands-off discretionary set-up that characterises standard 60:40-style investing. At the end of the café scene in Heat, McCauley muses to Hanna “Maybe we’ll never see each other again.” But of course they did and investors should similarly be ready for sideways even if they don’t know exactly when it will come.