by Elfreda Jonker, Client Portfolio Manager

Eighteen months ago, the world first got introduced to COVID-19. A type of Coronavirus that caused a global pandemic, leading to lockdowns which crushed the world economy and transformed our lives, as well as the fortunes of our businesses, potentially forever. For equity investors it has also been a wild ride, with COVID propelling certain companies forward at record speed, while others suffered against stronger headwinds, resulting in the highest valuation gap in history between the winners and the rest.

The mostly well-known so called “COVID beneficiaries” include companies that benefit directly from pandemic-related demand for products such as COVID treatments (e.g. Pfizer), digital entertainment (Netflix), e-commerce (Amazon), and those that found themselves at the epicentre of a new way of living and working from home (Microsoft).

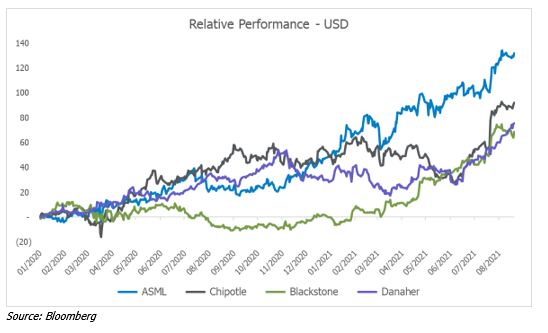

In this note we explore a few lesser-known companies which are thriving through COVID by changing the rules of the game in their respective sectors. Blackstone, Danaher, ASML and Chipotle are four interesting Alphinity holdings, that have been doubling up on their good fortunes through innovation and investment, enjoying a permanent pull forward of pre-and post-COVID benefits.

Relative performance to MSCI World Index since COVID hit

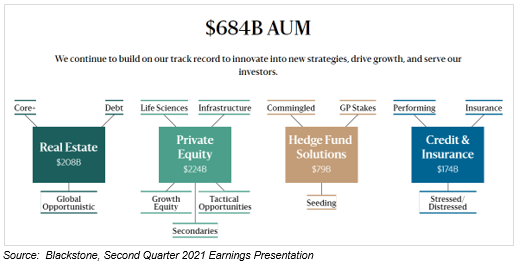

Blackstone – Deep pockets and widening distribution channels

Who are they? Blackstone (BX) is the world’s leading alternative investment firm, benefitting from a structural shift towards private assets as investors continue to search for yield and non-correlated sources of out-performance. Their investment strategies stretch across Real Estate, Private Equity, Hedge Fund Solutions and Credit and Insurance. BX’s current Assets Under Management (AUM) of $684bn includes ~$500bn in fee-earning assets and ~$170bn in ‘dry powder’, providing unrivalled scale and operating leverage. So-called ‘perpetual capital’ of $169bn, which grew 55% year-on-year in the second quarter, underpins long term earnings visibility.

How have they performed during COVID? BX has reported four strong quarters over the last year with a clear improvement in both the quantity and quality of earnings. BX entered the pandemic with a strong, capital light, balance sheet and with multiple funds across different asset classes and sectors, which have broadened out even further over the last 18-months with various new products and capabilities.

View ahead: BX has a dominant position in private markets, accelerating growth within large and exciting new verticals including retail and insurance, an enviable brand, strong performance and robust inflows. We expect that significant investments in retail distribution over the last few years is likely to drive margin expansion going forward. This high-quality business is the leading alternatives manager, with a wide competitive moat and a long growth runway ahead of it.

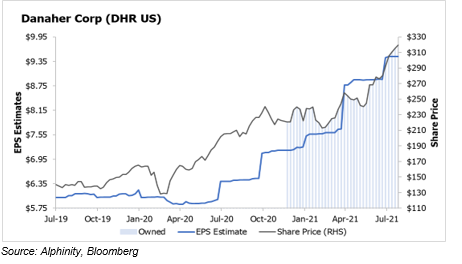

Danaher (DHR) – A high quality compounder – Biologics, Vaccines and Environmental

Who are they? DHR is one of the largest and most diversified Life Science and Environmental Tools companies. The company has leading brands in analytical instruments and consumables for life sciences research, lab diagnostics, and equipment and services used in water quality and product testing. In the last few years, DHR has spun off and divested its lower-performing industrial and dental businesses and acquired GE’s life sciences business. DHR recently announced another significant acquisition within gene and cell therapy.

How have they performed during COVID? DHR’s structural transformation has sharply improved organic growth, margins and cash flows. Their flawless execution over the last 12-18 months has seen both their ‘base business’ and COVID-related operations (vaccine & test equipment) report higher than expected sales growth and margin expansion.

View ahead: DHR has a great portfolio of businesses exposed to structural demand growth and a strong tilt to the sustainability theme, not least in bioprocessing which feeds into pharma and biofuels. Near term, the Delta strain, new variants and ongoing booster shots will continue to drive vaccine demand ahead of current expectations. Danaher sits in the category of ‘high quality compounders’ and acts as a good defensive in times of market turbulence.

Danaher – enjoying ongoing positive earnings upgrades

ASML – Benefiting from chip shortages

Who are they? ASML is at the forefront of digital transformation, providing lithography machines (use ultraviolet light to print tiny patterns on silicon) that help build semiconductor chips, with applications spanning the smart home, connected wearables, self-driving cars, mixed reality and more. ASML has a dominant market position with over 60% market share, and effectively “owns the space” in the next generation of lithography, which uses extreme ultra-violet (EUV) light to allow etching of ever-smaller components.

How have they performed during COVID? ASML has delivered very strong results since the start of COVID with sales and margins beating expectations, benefiting from strong demand across their products and markets as digital transformation accelerates. Order bookings for EUV lithography tools continue to grow as more chip makers embrace the next innovation leap from ASML, and sales in the service segment have also strengthened as customers look to squeeze every ounce of capacity out of their machines in a very tight market.

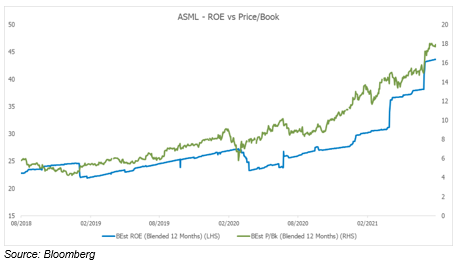

View ahead: Beyond 2021, three accelerating trends underpin earnings momentum: cyclical trends (chip shortage, supply chain constraints, multi-year capex cycle from major customers), secular trends (Artificial Intelligence, Internet of Things, 5G) and technological sovereignty (China, US and Europe all wanting to add domestic semi capacity) ahead. The metrics the business generates are exceptional, with FY21 Return on Equity 39% and a gross margin of nearly 50%. These metrics will improve further as growth continues in 2021 and beyond.

ASML – PB (valuation) vs Return on Equity (quality metric) – Ongoing improvement

Chipotle Mexican Grill (CMG) – Mexican food in a sustainable way

Who are they? Chipotle develops and operates fast-casual, Mexican food restaurants primarily located in the USA, with more than 2,700 Chipotle restaurants throughout the US, 40 international restaurants, and 4 non-Chipotle restaurants. Revenue is derived from company-owned (not franchised) restaurants and e-commerce sales via chipotlegoods.com.

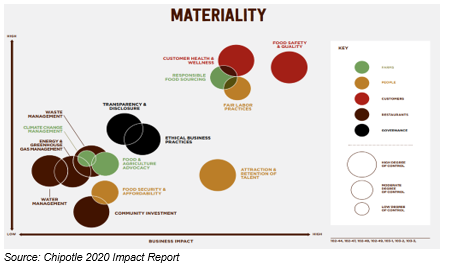

Sustainability and Environmental, Social and Governance (ESG): CMG has made food sustainability a key brand attribute by striving to ‘Cultivate A Better World’. The company began publishing sustainability reports in 2016, targeting over 20 goals across food, people and the environment. To reduce its environmental impact, the company is targeting 50% waste diversion, recycling in 95% of stores and composting at 25%. Chipotle established employee resource groups, training & development plans and executive compensation is linked to sustainability/ESG goals.

A broad-based approach to sustainability

How have they performed during COVID? While the restaurant industry has obviously struggled during the pandemic, CMG managed to report exceptional results despite lockdowns and lost foot traffic. Strong sales growth (80% of digital sales retained and restaurants back at 70% pre-COVID capacity) and the new ‘Chipotlane’ store formats (with a drive-thru option), have seen their restaurant average unit volumes spike.

View ahead: CMG has a long runway to expand across the US and abroad, a strong balance sheet and new store formats accelerating unit growth and returns per unit. CMG is an exciting, quality company in a well-structured industry, which should be able to grow earnings by 15% p.a. for several years.