Matt Peron – Director of Equities Research

While the equities rally since the pandemic low has been largely uninterrupted, its leadership has undergone a marked transition. In 2020, stocks rebounded on the strength of the stay-at-home stocks that allowed societies to work, learn and shop remotely. Overlapping this group were the mega-cap internet platforms and cloud computing companies aligned with what are considered to be durable, secular-growth themes. In a world of rapid economic contraction, investors were willing to pay a premium for the rare growth story.

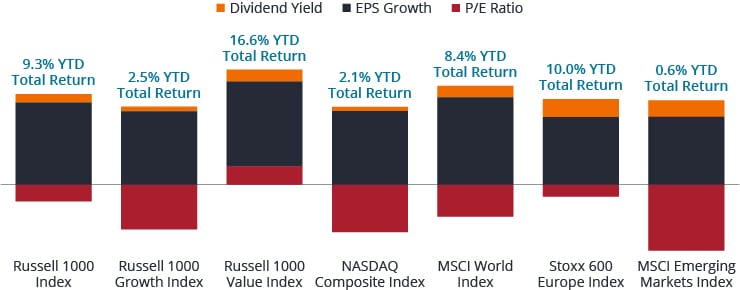

This year, optimism surrounding a broader economic reopening has placed more cyclically oriented stocks at the rally’s forefront. In contrast to late 2020 when vaccines were on the cusp of approval, improving earnings – rather than hope – are now driving markets. Consequently, leadership has rotated toward beaten-down market segments that are expected to perform well during an economic recovery. Year-to-date returns for value stocks have more than doubled those of growth, and small caps are starting to place distance between themselves and large caps.

Although this rotation largely follows the market-cycle playbook, 2020 was no ordinary recession and investors should be mindful that the recovery may unfold in an atypical manner. A favorable interpretation is that economic disruptions caused by natural phenomena are typically short-lived. A broadening economic recovery, however, may mask the large-scale disruptions to business models caused by shifting consumer behavior and an acceleration in the transition toward a digital economy that occurred during the pandemic. At the same time, unprecedented levels of monetary and fiscal intervention have been unleashed. The ultimate impact of these developments on certain segments of the market and the economy are far from certain.

An improving economic backdrop may tempt investors to believe it is smooth sailing for stocks. And while we share the sanguine view on near-term earnings, we believe one cannot simply “buy the market.” This is because market dynamics are bound to shift, and add to that any number of risks – from policy error to inflation and liquidity-driven market dislocations – that could result in a quick withdrawal of support for rally participants that do not possess the strategy or financial strength to deliver earnings growth over the entire business cycle.

Still early innings

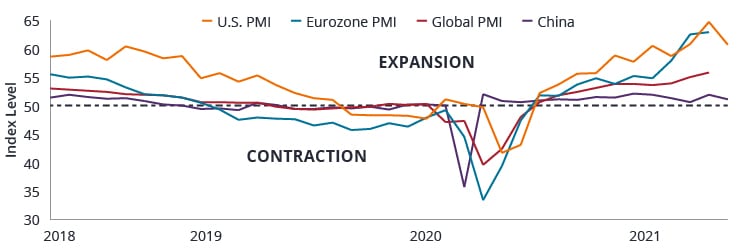

Economic recoveries tend to mirror the trajectory of their downdraft. Unlike the Global Financial Crisis (GFC), this appears the case with the emergence from the COVID-19 pandemic. Driving this are considerable vaccination efforts that have allowed an increasing number of countries to reopen their economies. Global gross domestic product (GDP) is now expected to reach 5.8% this year and, as evidenced in Figure 1, regional purchasing manager indices (PMIs) indicate that a “V-shaped” recovery is underway. Owing to the nature of this recession, all geographies contracted together. The recovery, on the other hand, is shaping up to be asynchronous and iterative.

Figure 1: Global PMIs indicate “V-shaped” recovery

Source: Bloomberg, as of 14 May 2021.

Soon after last year’s stay-at-home orders were administered, the global economy received a lifeline as China’s central government unleashed a wave of stimulus via its favored policy lever: construction spending. Once the country gained sounder economic footing, and mindful of the threat excess leverage may pose, it adopted a less accommodative stance. By this time, however, signs were emerging that the U.S. was beginning to see the light at the end of the tunnel. Given the substantial role that U.S. consumption plays in global economic growth, the American shopper – buttressed by high savings rates and stimulus checks – is positioned to take the handoff from China and propel the next stage of global recovery.

With vaccination rates climbing in key regions such as the UK – and more recently continental Europe – sources of growth, in our view, should become more dispersed as 2021 progresses. India and Brazil, however, are only now experiencing their most recent waves, and vaccination efforts will be pivotal in tamping down on outbreaks and placing these economies on sounder economic footing.

“The American shopper … is positioned to take the handoff from China and propel the next stage of global recovery.”

Building a foundation

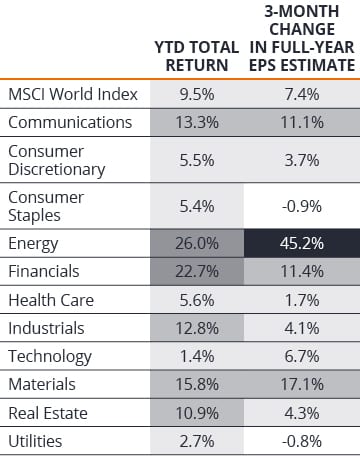

Equities’ gains in 2020 were largely a story of multiple expansion as investors bid up the price for growth-oriented, mega-cap stocks. This year, it is rising earnings growth expectations fueling market advancement (see Figure 2). Equities’ earlier re-rating as vaccination research gained momentum has continued as the global economy records concrete progress. In the past three months, through 13 May, aggregate earnings for the MSCI World Index have been upgraded by over 7%. Importantly, the greatest improvement has been registered by cyclical sectors, including energy, materials, financials and communications. While the latter category was also a driver of the 2020 rally, its repeat appearance has less to do with its exposure to secular growth than to internet platforms’ dominant position in online ad spending, which is primed to rise as corporations fight for consumers’ attention.

Figure 2: Earnings growth expectations fueling market advancement

Source: Bloomberg, as of 13 May 2021.

The market has taken notice as these four sectors have been among the best-performing components of the MSCI World Index through late-May. Anticipation of rising demand for industrial inputs has propelled commodity-related sectors, while financials benefited from the early-year yield curve steepening, which bodes well for lenders’ operating margins. Historically defensive sectors have, thus far, fallen behind. Among these is the tech sector, which in 2020 assumed the peculiar mantle of “defensive growth,” meaning that at the depths of the crisis, investors gravitated toward the fortress balance sheets and defensible strategic positions of mega-cap sector members.

Priming the pump

As COVID mandates are eased in the U.S. and other regions make progress on vaccinations, we expect the economic recovery to broaden. The next stage will likely be driven by consumers eager to re-engage in travel and social activity. Until then, factories scrambling to procure inputs as they ramp up capacity should contribute to growth. This is easier said than done given how the slashing of industrial orders in 2020 disrupted supply chains across a range of industries, with the persistent shortage of semiconductor chips being the highest-profile example. Steps to reestablish these links should fuel early-cycle recovery, albeit with possible hiccups as setbacks could lead to impediments to growth and transitory inflation.

Once industrial capacity rises and consumers open their wallets, purchases have to get settled. While banks stand to benefit from steeper yield curves associated with economic growth, rising transaction volumes should support increasingly prominent financial technology companies, chiefly payment processors. After accelerating during the pandemic, digital transactions, in our view, are likely not going away as consumers and small businesses experienced the ease and efficiency of online payments.

Other activities adopted during the pandemic are also likely to maintain momentum. While e-commerce has been de rigueur for years among digital natives, other demographics – especially the elderly – were won over during lockdowns. Whether with payments or online shopping, individuals and entities are unlikely to return to a less efficient way of conducting business.

Another category may not maintain its pandemic-level of activity but will likely remain part of the economic fabric. Hybrid work and learning models as well as certain online social interactions are not going away. A new equilibrium between the “old” and the “new” must be established. Case in point: A surprise winner during the pandemic was online dating as singles were stuck at home. As in-person contact reemerges, we expect some – but not all – digital engagement to abate.

Lastly, some pandemic-era activities are bound to decline. Video games for example, cannot expand in perpetuity as there are a finite number of hours in the day. As people grow more comfortable with other pursuits, online games will find it difficult to match 2020 levels. Still, this category is better off than the host of businesses that likely will not fully recover due to pandemic-induced behavioral changes. We expect travel and social activities to rise, but for those where there are suitable digital alternatives, their path forward appears challenged.

“While e-commerce has been de rigueur for years among digital natives, other demographics – especially the elderly – were won over during lockdowns.”

A unique recovery brings unique risks

Nearly every early recovery enjoys the support of accommodative policy. Consequently, each cycle is at risk of policy error. To be sure, we believe that the driver of the current recovery is a favorable earnings backdrop but given the magnitude of government intervention in the global economy, the scope of unforeseen outcomes, in our view, has widened.

On one hand is the adage that the death knell of every cycle is tighter monetary policy. Markets got a remedial course in this during 2013’s taper tantrum, when the Federal Reserve (Fed) hinted at culling its balance sheet. The opposite risk is central banks doing too little, thus creating conditions for accelerating inflation. Given the Fed’s firm rhetoric on maintaining an accommodative stance over the midterm, inflation may be the risk meriting greater attention. Simmering concerns about higher prices were likely behind this winter’s rise in Treasury yields.

“We believe that the driver of the current recovery is a favorable earnings backdrop but given the magnitude of government intervention in the global economy, the scope of unforeseen outcomes, in our view, has widened.”

While some inflation is a welcome sign of an improving economy and enables companies to raise wages and pass along higher prices, difficult-to-control inflation would diminish the present value of all riskier assets – not just corporate bonds. Furthermore, aggressive rate hikes, as central banks play catch-up, would fulfill the prophecy of restrictive policy being an expansion’s executioner.

Thus far, the Fed seems circumspect in the uptick in mid- to long-dated Treasury yields. It likely views this as a “push-forward” of year-end rates. And while yields have stabilized, any additional growth-restricting upward move would, in our view, be met by more accommodative initiatives.

Massive fiscal and monetary stimulus not only risk distorting the pricing mechanism in the real economy by introducing inflationary pressure, they may also directly affect financial markets. The combination of liquidity and low rates has sent investors scrambling for yield. Often, they deploy leverage to magnify returns. While we view a market dislocation as a low-percentage scenario, it is not zero, and given the post-GFC market structure, a quick removal of liquidity could have unforeseen consequences as investors de-lever and sell what they can.

It goes back to earnings

In such a scenario, selling could be indiscriminate. But once the dust settles, the stocks that would prove most resilient are likely those supported by earnings growth rather than beneficiaries of the sugar high of excess liquidity. Earnings growth has been particularly strong in energy, materials, financials and communications of late, as shown in Figure 3.

Figure 3: Earnings growth key to resiliency

Source: Bloomberg, as of 14 May 2021.

Similarly, should interest rates rise too quickly and the recovery stall, the companies that stand to weather the storm best are those capable of delivering earnings growth over the full business cycle, highlighted by themes associated with an increasingly digital global economy. But as our base-case for the remainder of 2021 is for a broadening recovery, we believe investors would be well served by balancing their secular exposure with higher-quality names whose earnings should receive a multi-quarter boost in rising economic activity.

GLOSSARY

Cyclically oriented: Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Earnings per share (EPS): The portion of a company’s profit attributable to each share in the company. It is one of the most popular ways for investors to assess a company’s profitability.

Multiple expansion: The expansion of a stock’s price to earnings ratio based on investor willingness to place more value on the company’s earnings.

Price to earnings (P/E) ratio: A popular ratio used to value a company’s shares. It is calculated by dividing the current share price by its earnings per share. In general, a high P/E ratio indicates that investors expect strong earnings growth in the future, although a (temporary) collapse in earnings can also lead to a high P/E ratio.