In June 2018, we published an article entitled “It’s not only about what you buy… but what you pay when you buy it”, which compared the valuations of A2 Milk and Brambles. (You can read the article here to understand the reasoning for the conclusions we drew then about the merits of both companies.)

At the time, A2 Milk was a poster child for ‘growth’ investors, with many of these assuming that its growth would extend for years into the future.

The following is typical of what was being written by commentators and brokers as A2 Milk’s shares continued to climb to all-time high after all-time high for the next two years:

“We think given the differentiation of the product and local consumer distrust of local brands, A2 Milk could be more resilient than you think.” (‘A2M Dividends Safe From Australia-China Trade Tensions?’, Dividend Investing, 2018)

Brambles was – and still is – the largest pallet company in the world, and now has over 300 million pallets worldwide.

In June 2018, our contention was that A2 Milk was grossly overvalued, as investors were overly optimistic about its long-term earnings growth. A2 Milk was trading at $18 a share, implying a market value of $18 billion. Meanwhile Brambles, which was trading at around $9.50, was being valued at $14 billion.

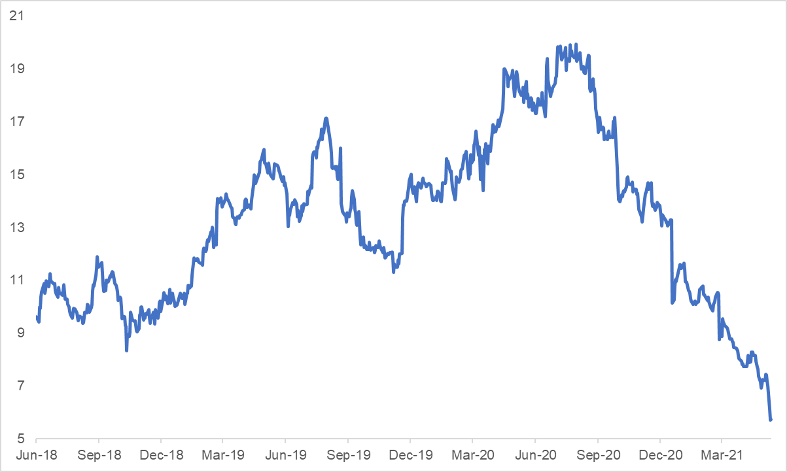

Less than three years later, and after a collapse in its earnings and share price (Chart 1), A2 Milk is now valued at just $4.2 billion, and since 2018 A2 Milk shareholders have received nothing in dividends.

Chart 1: Movement in A2 Milk Share Price, 2018 – 21

Source: IRESS 13 May 2021

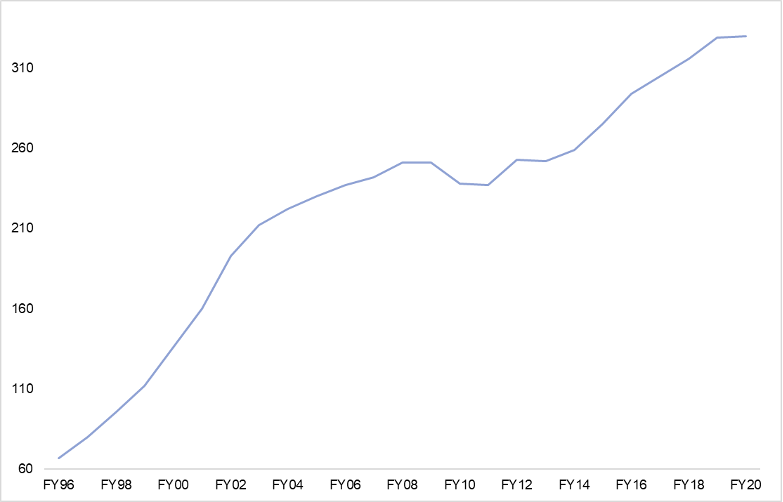

Meanwhile, Brambles’ shares are trading at the time of writing around the $10.60 mark, valuing the company at $15.4 billion, and Brambles’ shareholders have received almost $1 a share in dividends since June 2018 as the company’s earnings have continued to grow steadily and as Brambles has continued to increase its pallet numbers around the world (Chart 2).

In fact, the number of pallets in Brambles pallet pools globally has grown from 316 million at June 2018 to over 330 million today.

Chart 2: Increase in Brambles Pallet Pool Numbers (Millions), 1996 – 2020

Source: Brambles annual reports, 1996-2020

Conclusion

As the case of A2 Milk shows, ‘poster child’ stocks which can generate a lot of hype and capture the headlines for a time are no substitute for quality businesses like Brambles, which possess a sustainable competitive advantage, recurring earnings, and capable management which can grow the business over the longer term, and which are trading at a reasonable price.

At IML, we continue as we have done since 1998 to focus on these fundamentals to make the clear-headed and considered investment decisions which have enabled us to deliver reliable income and long-term capital growth to our investors over our 23 years of existence.

The Investors Mutual Australian Share Fund invests in a diversified portfolio of quality ASX-listed industrial and resource shares identified as being undervalued. The Fund aims to provide a rate of return (after fees and expenses and before taxes) which exceeds the return of the S&P/ASX 300 Accumulation Index on a rolling four-year basis.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Past performance is not a reliable indicator of future performance.