Equity markets have reached new highs as economies around the world emerge from slowdowns forced by COVID-19. Demand for digital infrastructure and recent commitments from governments around the world has once again piqued investor interest for infrastructure as evidenced by the gains of the market benchmark, the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index prior to the new year.

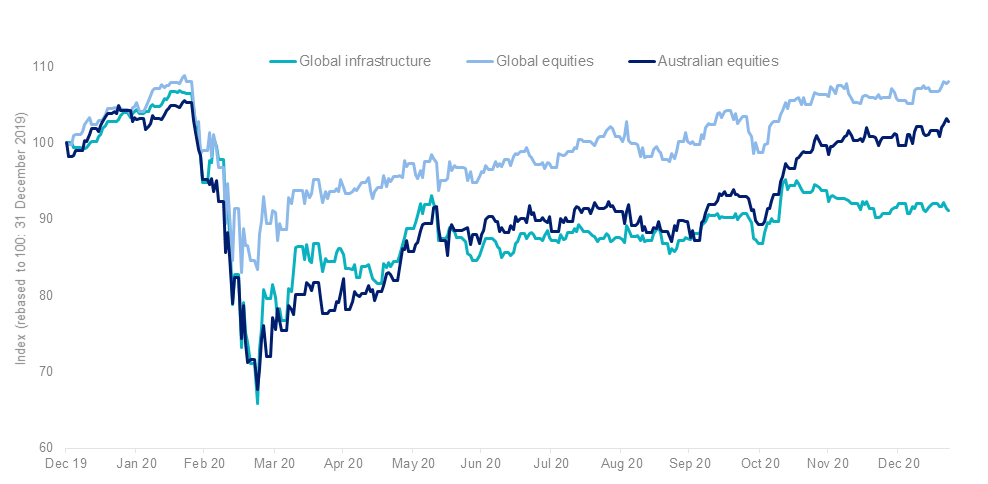

Global Infrastructure as an asset class was hit hard in March 2020, with the infrastructure index falling over 23%. Despite its recent performance, infrastructure’s recovery has not yet matched broader global equity markets.

Additionally, market participants are expecting a continued low rates and a low growth environment for the short to medium term. This coupled with increased infrastructure spending means more savvy investors are considering an allocation to listed global infrastructure securities.

Global Infrastructure’s recovery has so far trailed equities

Infrastructure assets form the backbone of society – they are the basic and irreplaceable public services essential to an economy such as roads, rail, airports, water, power, schools, hospitals and pipelines. When markets retreated in March, infrastructure assets were among the worst hit. While equities have led a recovery, listed global infrastructure has lagged – see Figure 1.

Figure 1: 31 Dec 2019 to 24 January 2021 index performance

Source: FTSE, 31 Dec 2019 to 24 January 2021. Rebased to 100. Indices used, Global Infrastructure: IFRA Index – FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index; International equities: MSCI World ex Australia Index; Australian equities: S&P/ASX 200 Index.

There is no doubt the significant global economic downturn has had an impact on valuations in the short term but the nature of most infrastructure assets is that they are long duration, often 30+ years. Additionally, there are some infrastructure assets such as mobile telecommunications that have not experienced much of a slowdown at all. As such, our view is that most infrastructure assets will not be derailed by a one-or-so-year of revenue shock and we remain positive on the long term case for infrastructure assets in a portfolio.

With financial market returns being so strong for most of the last decade, value opportunities have been hard to come by. Likewise, investors requiring income from their portfolios had a difficult time given the downward trajectory of interest rates. With most economies experiencing low or negative real rates and central banks using unconventional programs in order to stimulate their economies, income investors will have an even harder time as the economy recovers. Against this backdrop, infrastructure can provide both a value and income opportunity.

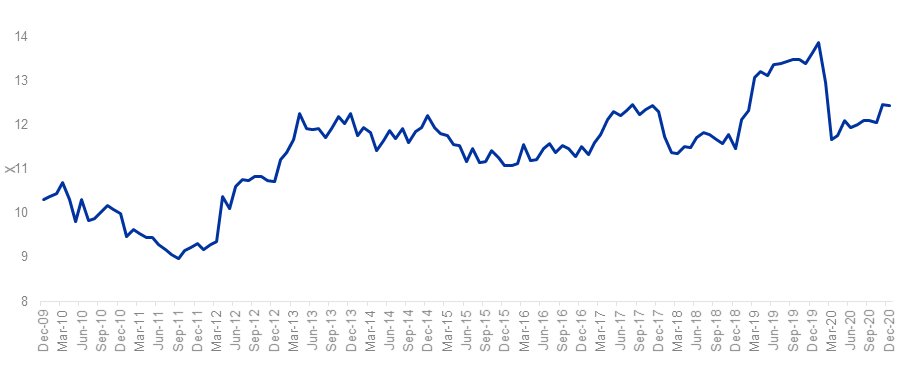

Global infrastructure stocks are still well below 2019 levels, as measured by the EV/EBITDA ratio– see Figure 2.

Figure 2: Global infrastructure EV/EBITDA

Source: FTSE, five years to 31 December 2020. Index used FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index.

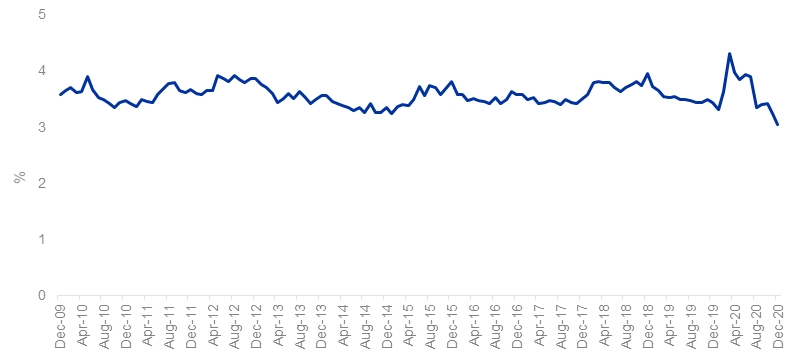

Despite falling yields elsewhere, the dividend yield on the FTSE Developed Core Infrastructure 50/50 Index was relatively high at 3.04% as at 31 December 2020. The 12 month trailing yield rose significantly in March 2020 due to the fall in asset prices – see Figure 3. While there may be some companies that reduce dividends, we believe that a large cohort will not do this, meaning we still anticipate a reliable income stream.

Figure 3: Global infrastucture dividend yield

Source: FTSE to 30 December 2020. Global Infrastructure is FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index. You cannot invest in an index. Dividend yield of the IFRA Index is not a guarantee of future dividends by IFRA. Past performance of the index is not a reliable indicator of future performance of the fund.

The low interest rate environment and demand for digital infrastructure and commitments from governments around the world has piqued investor interest in the asset class. This may continue and investors continue to seek value and income, there are however risks for individual assets. This is why diversification is important.

Diversification is key

Being diversified across a range of underlying infrastructure sectors and stocks is key. Infrastructure represents a range of assets from toll roads, airports, broadcasting towers to railways. Investors can reap income from infrastructure assets that adjusts throughout economic cycles and different interest rate environments, hence its appeal to investors. Such assets aren’t highly correlated with the returns of equities so they provide crucial diversification which can protect portfolios’ value when equity markets sell off.

Yet these assets can be big and illiquid. The advantages of investing in listed infrastructure securities is that they are often more diversified as they generally operate more than one asset. Listed infrastructure also provides greater liquidity. Investors can buy and sell as required on an exchange, whereas an investor in a direct real estate or infrastructure project must first commit to a large capital outlay and then is subject to the risk that no one wants to buy the asset when they need to sell.

In the listed infrastructure space, ETFs have also become highly attractive due to their secondary-market liquidity profile. Furthermore, cost considerations can be accommodated for wholesale investors. It is important too that an ETF tracks the widely regarded and accepted market benchmarks for the relevant asset class, the FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD, which delivers broad exposure across different types of infrastructure assets.