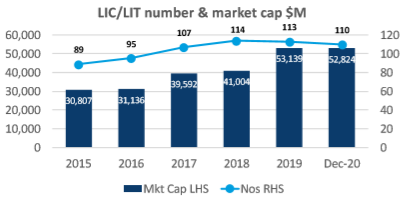

The Listed Investment Company (LIC) and Listed Investment Trust (LIT) sector closed out 2020 with a sector market capitalisation of $52.8 billion, a reduction of just 0.6% over the 12 months. This compares with the S&P/ASX200 benchmark which fell 1.5% over the same period.

“As the sector enters its 98th year of continuous operation in Australia, it continues to provide retail investors and SMSF trustees with access to some of the largest and most cost-efficient actively managed investment entities in Australia. The significant longevity of the sector reflects the benefits of prudent and conservative management over many decades and over many different and at times difficult investment climates,” said Ian Irvine, CEO of the Listed Investment Companies & Trusts Association (LICAT).

Mr Irvine also went on to say “LICs and LITs also provide investors with benefits from their closed end structure and active management style allowing managers to choose where and when to invest capital.”

“This closed end structural trait can be of particular benefit in times of volatility, such as those seen over the pandemic affected months of 2020 where LIC/LIT managers have been free to make investment decisions purely on their merit rather than running with the momentum of the market’ he went on to say.

LIC & LIT market capitalisation comparisons year to end December 2020

Additionally, the closed-end company structure of a LIC can allow it to retain profits after tax and where desirable to smooth the flow of dividends to shareholders. This has enabled some LICs to maintain a far steadier payment of income to their investors over a period when dividend income from the broader market has fallen very significantly. This consistency of income flow can be vitally important for people such as retirees who live off their investment income.

Commenting on the ability of LICs to manage the flow of dividends, Wilson Asset Management Chief Financial Officer Jesse Hamilton said, “all of six LICs managed by Wilson Asset Management were able to maintain or increase fully franked dividends throughout the volatility seen in 2020, due to the benefits provided by the company structure of a LIC”.

“Investors can also receive diversification benefits from the Wilson Asset Management range of LICs, which cover asset classes such as Australian equities, including large, mid and micro-cap stocks, global equities and with our recently added seventh LIC, ‘WAM Alternative Assets’ (ASX: WMA), further diversification within the LIC structure into alternative asset classes”, he said.

An interesting development within the sector over recent years is the continuing growth of LITs, which utilise a closed end trust structure. The value of LITs is now ~$10.6 billion accounting for around 20% of the ~$52.8 billion LIC/LIT sector at the end of December 2020.”

Like other trust structures such as exchange traded funds (ETFs) and managed funds, LITs pass through income to investors untaxed. However, because of their closed end structure, and unlike open-ended ETFs or managed funds, LITs have a fixed capital base and are not forced to sell assets to meet withdrawal requests.

This steady capital base of a LIT allows it to invest in, and provide unitholders with the benefits of exposure to, longer term assets, while still providing those underlying shareholders with liquidity (the ability to buy or sell units at any time on market).

2021 clearly brings many challenges for society and for investors as the world continues to grapple with the complexities of the COVID19 pandemic, low interest rates, combative politics and an increasing urgency to address climate change. “In this environment, the supply of steady long term investment capital to businesses in return for a sound level of investment income is particularly important”, concluded Ian Irvine. “Australia’s closed end investment sector consisting of LICS and LITs continues to be one sector suited to contributing this capital to business on one hand while providing investors with both liquidity and income on the other.”