by Dinesh Kuhadas CA CPA, Credit Analyst

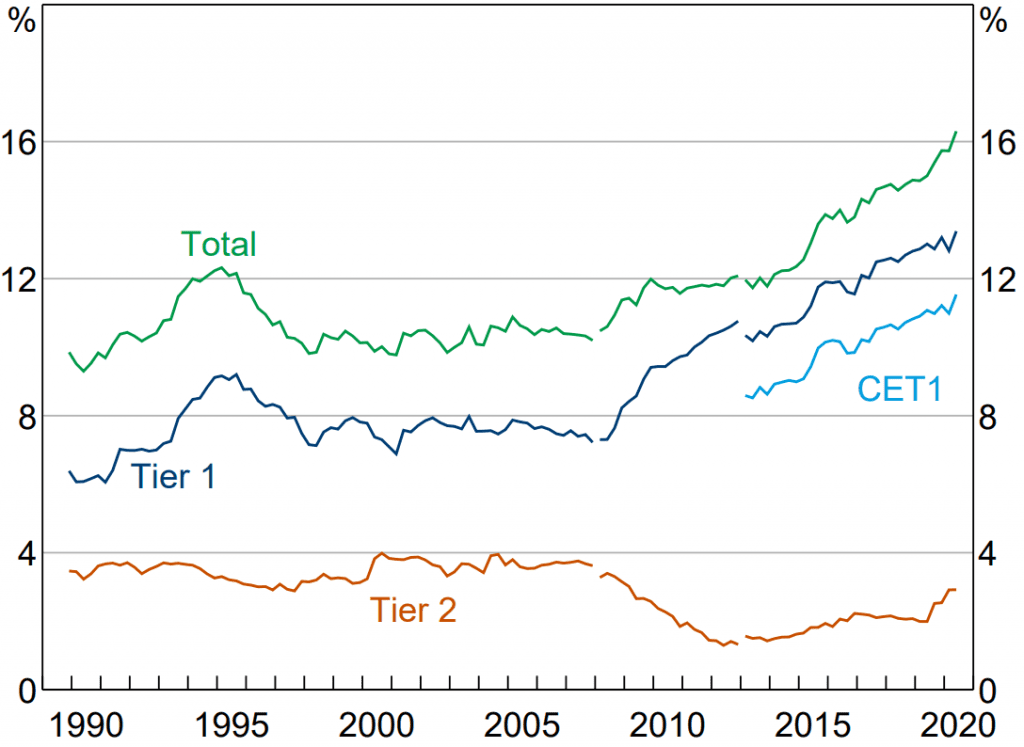

In the period since the Global Financial Crisis (GFC), the global banking sector has significantly de-risked. This is clearly evidenced by the structural increase in banks’ capitalisation levels, which is a key indicator of banking strength.

We believe the banking sector faces the current crisis from a position of strength, particularly given the proportion of Common Equity Tier 1 (“CET1”) capital held.

Driven by the Australian Prudential Regulation Authority’s (APRA) ‘unquestionably strong’ capitalisation framework, the bank sector in Australia is now among the most well-capitalised in the world. The Commonwealth Bank of Australia’s CET1 ratio at June 2020 was more than two times the levels recorded in June 2008, which is indicative of the change in the sector, particularly among the major banks.

Chart 1: Banks’ capital ratios

Source: APRA, Reserve Bank of Australia (RBA) Financial Stability Review October 2020. Note: Per cent of risk-weighted assets; break in March 2008 due to the introduction of Basel II for most authorised deposit-taking institutions (ADIs); break in March 2013 due to the introduction of Basel III for all ADIs.

“National Champion” banks are a vital part of the solution

Unlike during the GFC, liquid, profitable, well-capitalised, “National Champion” banks, are playing a central role in helping their respective economies navigate through the COVID-19 crisis. In Australia, this role is played by the major banks as essential financial infrastructure.

At the direction of APRA, since 2005 the banking sector has been developing pandemic preparation and response plans. These plans were implemented in early February this year, with management teams moving decisively to protect staff, customers and stakeholders, while continuing to fulfil their vital role to society and the economy without interruption.

Unprecedented support and coordination flattens the loss curve

The Australian Government, APRA, the RBA, the Australian Securities and Investments Commission (ASIC) and the Australian Office of Financial Management are working hand-in-hand with the banking sector to cushion the economic impact of COVID-19 and to build a bridge to recovery. In addition to the expansionary fiscal budget and extraordinarily accommodative monetary policy, coordinated packages of measures have been undertaken to support individuals, businesses and the financial sector. This support and coordination across policy makers has resulted in a flatter default/loss curve than initially feared by the market.

Swift and decisive actions by policy makers have meant that consumers’ disposable incomes have been supported and corporates have benefited from liquidity, forbearance and other industry-specific supports. The initially feared spike of unemployment, defaults, foreclosures, bankruptcies and insolvencies, have not materialised so far as a result.

Major banks resilient to-date

The measures taken to navigate the COVID-19 crisis have meant loan books and collateral, particularly housing collateral, have performed relatively well. The initial wave of loan deferrals has moderated, and balances under deferral are trending downwards across both individuals and businesses.

Recognising the highly uncertain outlook, including the impending end of loan deferral schemes and income support measures, management teams have conservatively set aside substantial provisions for future potential losses. In part, they have been able to do so given their historically high profitability, which has allowed the building of reserves without eroding capital.

However, the outlook for profitability, and in turn, organic capital generation, has deteriorated. This is on account of net interest margin pressures in a low interest rate/quantitative easing environment, intense competition, fee income pressure, elevated costs (including COVID-induced costs and ongoing regulatory, remediation and compliance costs) and elevated provisioning.

Notwithstanding, major bank credit profiles benefit from conservative provisioning for expected losses and a solid starting capitalisation position as a mitigant for unexpected losses. This is further evidenced by stress-testing conducted by the regulators, the results of which indicate a low risk to breaching minimum capital requirements, even under a severe downside scenario.

Considerations for the future

During future reporting seasons, we will be monitoring loan book performance as deferrals and support programs come to an end. We will also analyse management teams’ strategies for mitigating revenue headwinds and their progress towards structurally improving efficiency and cost bases. The impact of the trend towards low-cost fixed interest rate mortgage lending on margins and over-all bank profitability is also a key focus, as well as understanding banks’ progress on digital banking initiatives, including partnerships with fintech and the value they generate.

At a national level, there are also a number of important factors to consider, including:

- The potential for targeted stimulus to be rolled out as current support programs wind-down;

- The low interest rate environment and easing of responsible lending to stimulate demand, particularly for housing credit;

- The potential for a COVID-19 vaccine to be found in the medium-term; and

- The possibility that loan loss provisions peak and even reverse in coming quarters.

Investment view

Our base-case is for a recessionary environment with an uneven path to recovery. In this scenario, starting strong capitalisation levels, improvements in underwriting standards since the GFC, improving trends in loan deferrals and unprecedented coordinated fiscal, monetary and regulatory support, give us confidence that domestic banking sector credit profiles will be resilient. As credit investors, we therefore remain comfortable investing in the sector, particularly the ‘National Champion’ major banks.

While acknowledging that credit spreads have rallied-in materially since March this year, we believe fundamental and technical factors mean that major bank paper across the capital structure continues to hold appeal in terms of risk-adjusted return, and our portfolio positioning reflects this view.

Lastly, in a low/zero rate world where income will be bid, we keep an open-mind to the possibility that subject to some of the factors discussed above, credit spreads on capital instruments issued by the major banks can continue to rally-in from today’s levels.

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.