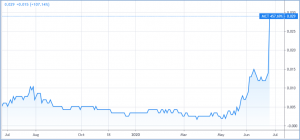

Metalicity Limited – (ASX: MCT, Share Price: $0.029, Market Cap: $40m, coverage initiated @ $0.025 in Oct 2015)

Key Catalyst

Assays from first 11 holes of 44-hole initial program confirm significant and extensive high-grade, near-surface gold mineralisation at the Leipold Prospect, within the Kookynie Gold Project in WA.

MCT underwent a major operational refocus during 2019, with the introduction of new exploration projects in Western Australia, specifically gold-focused projects. Through a Farm-In Agreement with Nex Metals Explorations, MCT has gained access to the prolific Kookynie and Yundamindra Gold districts within the Eastern Goldfields of Western Australia. The company’s flagship project, the Kookynie Gold Project, is an exciting, underexplored area. The Farm-In agreement is an excellent pathway to earn-into this project, as it allows MCT ‘to invest money in the ground.’ In addition, MCT has secured exploration licence applications in the Paterson Province, through to the Musgrave Area and the Fraser Range, of Western Australia, which is rapidly growing into one of the most prolific exploration regions of the world. At present, MCT’s exploration focus is on its Kookynie project, where renewed RC drilling is underway.

Latest Activity

Kookynie Gold Project Update

MCT has provided an exploration update with respect to the June 2020 Phase One drilling program at its Kookynie Gold Project in the Western Australia’s Goldfields region. MCT’s share price closed up by 107% – or $0.014 – to $0.029 in Thursday’s trade.

Overview

In our most recent coverage of MCT on 2nd June, we outlined that an expanded RC drilling program was underway at the Kookynie Project, with the first stage concentrated on the Leipold and McTavish Prospects. This work is aimed at following up on the significant intercepts generated from the company’s December 2019 drilling program, which confirmed that mineralisation extends past previously developed and drilled areas. The first assay results have been released today and they are very encouraging indeed.

Results

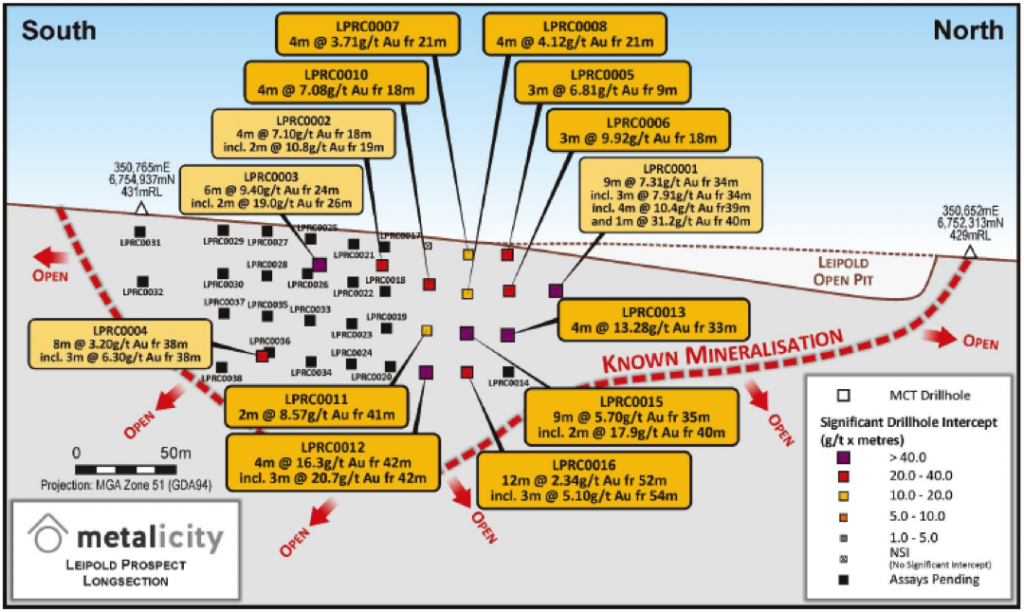

MCT has today reported assay results for the first 11 holes of its 44-hole initial program covering the Leipold and McTavish Prospects, which have confirmed significant and extensive high-grade, near-surface gold mineralisation at the Leipold Prospect. A further 33 drill-holes are pending results, which are due for release in the coming weeks.

The initial results from the current program have delivered near-surface, high-grade intercepts, including:

o LPRC0012 – 4m @ 16.3g/t Au from 42 metres, including 3m @ 20.7g/t Au from 42 metres

o LPRC0015 – 9m @ 5.7g/t Au from 35 metres, including 2m @ 17.9g/t Au from 40 metres

o LPRC0013 – 4m @ 13/g/t Au from 33 metres

o LPRC0006 – 3m @ 9.92g/t Au from 18 metres

o LPRC0010 – 4m @ 7.08g/t Au from 18 metres

o LPRC0005 – 3m @ 6.81g/t Au from 9 metres

o LPRC0016 – 12m @ 2.34g/t Au from 52 metres.

Technical Significance

The June 2020 Phase One drilling program has been designed to step out and continue to confirm the mineralisation observed in previous drilling programs. Encouragingly, MCT’s drilling programs have managed to intersect the mineralised structure at all prospects, especially at the Leipold Prospect.

MCT has completed 34 RC drill-holes at the Leipold Prospect for a total of 1,721 metres, in an area that is below the known historical workings and significantly up and down dip and along strike from historical drilling. It is very encouraging that each of the drill holes intersected the structure, with 10 of the 11 available drill hole results generating a significant intercept, demonstrating the up-dip and strike continuance of mineralisation beyond the previously defined limits. Importantly, the results generated are from very shallow depths, which if converted to resources and reserves, could be potentially open-pittable.

What is also noteworthy is the consistent widths and relatively consistent grades observed at Leipold in relation to the structural framework that hosts the mineralisation. The structural framework appears to be a general north-south-trending auriferous vein, with a moderately shallow dip towards the east, but with cross-cutting south-west-trending cross structures with south-easterly dips interacting and producing these plunging higher-grading shoots.

Therefore, with the exceptions of significantly wider mineralised intercepts, MCT is observing a general halo of mineralisation but with higher-grading, southerly-plunging shoots within the mineralised envelope.

Figure 1: Leipold Plane of Vein Section with recent drilling.

Summary

MCT has been busy at Kookynie since it became involved during late 2019, conducting drilling programs that have delivered consistently strong results – including significant intersections from each of the historically-mined prospects, with elevated grades. When combined with the latest review of historical geophysics, there is excellent potential for gold mineralisation to exist beyond areas historically mined and drilled. The results have gained strong market recognition, with MCT firming from a March low of just $0.002 to a current price of $0.029 – a gain of 1,350% in just a few months. We await further results with great interest.