Bear markets are great! Let me explain. Lower prices mean greater future returns. Bear markets always occur during global slowdowns as investor confidence is shaken from lower growth expectations. It is only when investor expectations are low that the foundation is set for fantastic returns.

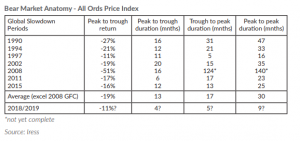

The usual definition of a bear market is based on an arbitrary level of negative returns, such as -20%. While there can be flash crashes during bull markets (for example, 1987 or 2010), in our opinion, proper bear markets occur when global growth slows. Over the last thirty years, there have been eight global slowdowns, which have coincided with significant share market corrections. The anatomy of these bear markets and recovery (peak to trough return, peak to trough duration, trough to peak duration, peak to peak duration) are displayed in the table below:

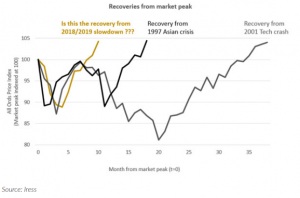

During an economic slowdown, the average peak to trough return was about -19% and the average bear market and recovery duration (peak to peak) was about 30 months (excluding the 2008 GFC period which is yet to complete). Bear markets do not end abruptly. They tend to be drawn out processes with lots of volatility. Hence, something is very peculiar about the recent share market correction. The All Ords index collapsed in the fourth quarter of 2018 which reflected global growth concerns. Despite no sign of a global recovery, the market formed a V-shaped recovery and recorded its strongest half-year return (20%) since 1991. If December 2018 was the market low, then this correction would be one of the most benign in terms of magnitude (-11%) and peak to peak duration (9 months). The correction to date happened so fast that there are not many wounds to lick, unlike previous global slowdowns.

V-shaped recoveries occur infrequently

Historically, V-shaped recoveries are infrequent, occurring twice (1997 Asian crisis and 2001 Technology crash) out of seven prior slowdowns. They also tend to be fleeting as the initial market optimism eventually deflates and morphs into a W-shaped recovery. Volatility prevails when investor expectations are too out of sync with economic reality.

If corrections are the market’s winter season, then the fourth quarter of 2018 saw a quick hail storm before becoming balmy with sunny skies. It saw half the average bear market return, one third the duration and the sharpest V-shaped recovery in history – all extraordinary. Excessive optimism has pushed PE multiples to their historic highs. This is despite negative earnings revisions within the current global slowdown. Investors who adopted the same risk seeking behaviour in prior slowdowns would have been caught in a blizzard with no clothes. While the current market recovery appears to have seen many firsts, perhaps there is another explanation. Maybe the correction process is still underway. With expectations extremely high, this sets the foundation for risk rather than the fantastic returns that is on offer at the bottom of bear markets.