Walkabout Resources – (ASX: WKT, Share Price: $0.145, Market Cap: $44m, coverage initiated @ $0.12 in April 2016)

Key Catalyst

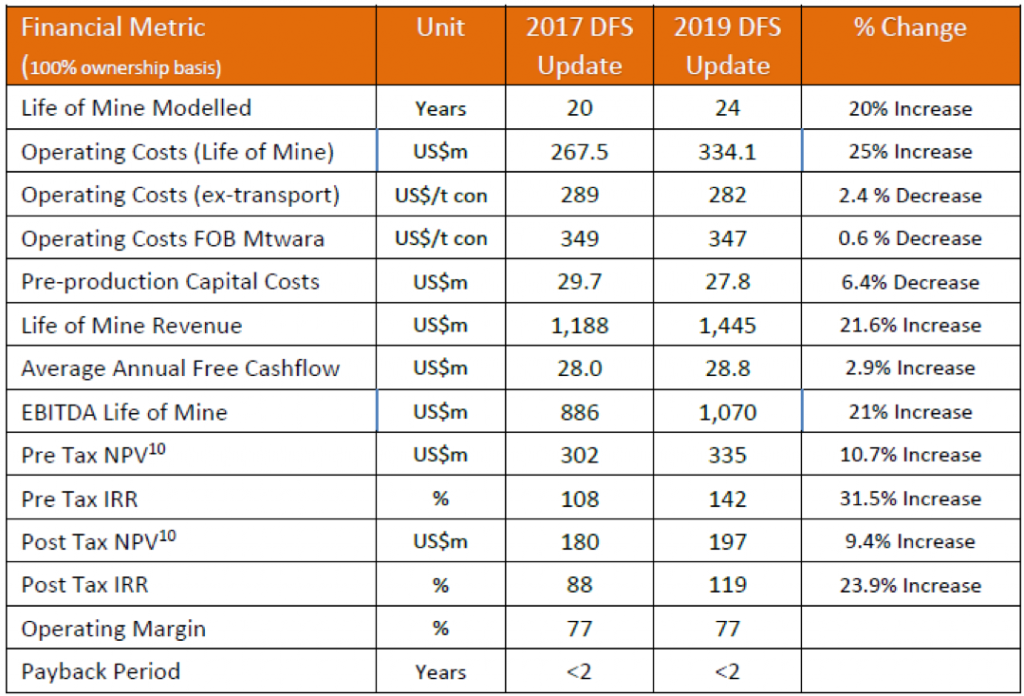

DFS underlines robust margins and profitability of Lindi Jumbo project, delivering compelling economics such as a post-tax IRR10 of 119%, operating costs in the lowest industry quartile.

WKT has been a steady performer since our coverage initiation during April 2016, remaining firmly focused on progressing and commercialising its Lindi jumbo graphite project in Tanzania, which is characterised by its very high graphite grades. WKT has recovered from a period of political uncertainty during 2018 that impacted all resource companies operating in Tanzania, with proactive steps by the Tanzanian government restored confidence in the industry. With approval for the granting of its Tanzanian Mining Licences in H2 2018, WKT has accelerated work on the project, which has culminated in resource/reserve upgrades that have fed directly into the release of a Definitive Feasibility Study (DFS). The results of the study demonstrate that ‘grade is king’, with Lindi’s outstanding grade establishing it as the highest-grade graphite project within its peer group and within the lowest-quartile worldwide in terms of operating costs. These high grades will provide the company with a competitive market advantage and will help insulate it from price fluctuations. WKT’s share price has firmed by 60% since the beginning of 2019.

Latest Activity

DFS Results

WKT has this week released results of its much-anticipated and enhanced Definitive Feasibility Study (DFS) for the project, which refines the outcomes generated in the previous 2017 DFS.

Key Project Highlights:

- Life-of-Mine revenue of US$1.445Bn – a 21.6% increase

- Very high cash margins of >US$1,000 per tonne Free on Board (FOB)

- Payback period of less than 2 years

- High post-tax NPV10 of US$197Mn – a 9.4% increase

- Robust post-tax IRR10 of 119% – a 23.9% increase

- Low development capital cost of US$27.8M – a 6% reduction

- Operational costs within the lowest industry quartile at US$347/t of concentrate FOB

- Long mine life of 24 years – an increase of 4 years at 40ktpa produced

- Robust economics based on current sales assumptions, weighted average basket price reduced to a US$1,515 per tonne

- Low economic sensitivity to operating and capital cost risks

Technical Significance

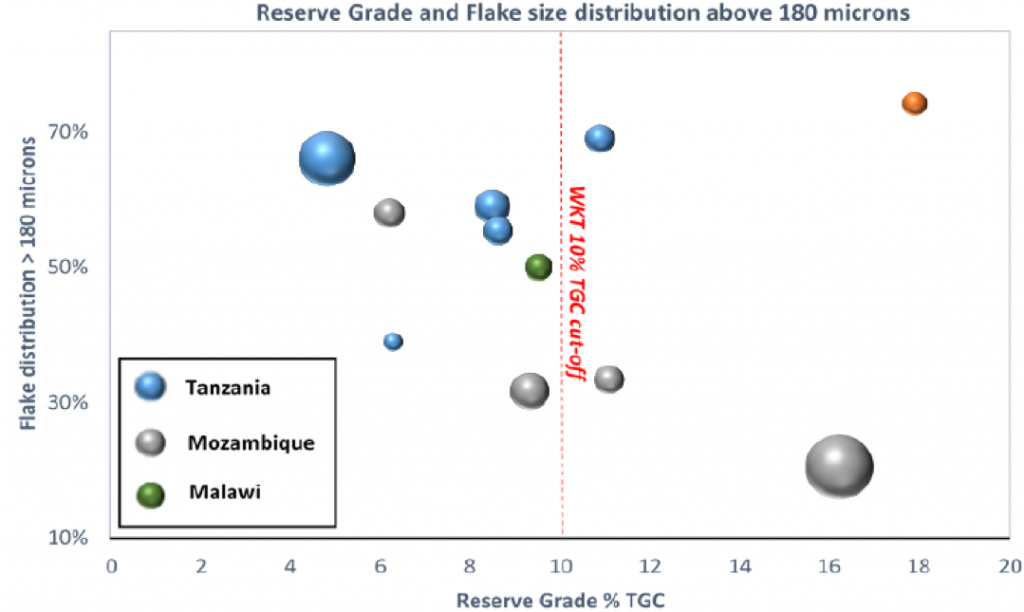

The key factor with respect to both the DFS outcome and the recent ore reserve upgrade, is project grade. Lindi hosts the highest-grade graphite reserve in Africa, with a current life-of-mine of 24 years that can produce 40,000 tonnes of graphite concentrate annually.

WKT’s development philosophy is underpinned by the unique and very high-grade nature of three discrete and visually distinct domains within the Measured and Indicated Resource. Mine planning indicates that these may be extracted with minimum contamination from lower grade associated domains, enabling the production of an average life-of-mine (LOM) mill feed grade above 17% TGC – an outstanding grade.

As a result of the increased life-of-mine grade, the average annual mill feed requirement has been reduced by almost 20% from an average of 280,000 tpa to 230,000 tpa. This has potentially created a near “capital-free” expansion opportunity that will be assessed during future optimisation studies.

This provides a significant competitive advantage in terms of both capital and operating cost reduction, as well as being able to maximise prising through the ability to provide a premium graphite product. This gives WKT a competitive edge over its graphite peers in a crowded market.

Table 1: Project financial indicators as per the Updated Definitive Feasibility Study of 2018

Why ‘Grade is King’

Let’s briefly expand upon exactly why graphite grades are so important to Lindi’s potential success.

Firstly, Lindi’s high-grade ore feed favourably impacts both capital and operating margins, helping to minimise potential start-up risks that are inherent with any new mining operation. A high-grade operation can process fewer tonnes of a higher-grade material to produce the same volume of product. This results in smaller plant being required (minimising capex) and lesser tonnes having to be mined, milled and despatched to tailings storage.

The second key consequence of higher grades is that it allows for the production of a premium product, which is a significant advantage in any market, but particularly with respect to graphite. Higher-grade product is always in strong demand, attracts a higher price, and helps insulate producers from price shocks. Lindi test-work has demonstrated the ability to return favourable ratios of the high-value larger graphite flakes with up to 50% of the total graphite in concentrate in the Super Jumbo (+500μm) and Jumbo (+300μm) categories. The Lindi Jumbo Graphite Project boasts up to 74% of natural flake sizes above 180 μm. The premium products produced could allow WKT to negotiate higher than average prices – as general natural flake graphite product is smaller than 180μm.

Figure 1: The Lindi Jumbo Graphite position amongst its ASX-listed peers in East Africa. The chart is based on publicly available information on ASX listed graphite companies that have reported Ore Reserves and feasibility studies. The size of the bubble represents the annual production target.

Summary

The much-anticipated Lindi Project DFS upgrade has not failed to disappoint. The enhanced profitability and project returns reflect the robust project grades and will help position WKT to potentially deliver the largest margins in the graphite industry. This provides for opportunities in terms of increased market share, as well as providing meaningful downside protection.

WKT will look to minimize production and financial risks by avoiding a large, overly complex operation in the early stages, instead looking to increase production from a stable economic base that utilizes modular design. There is potential for further upside, including the capacity to produce and sell more graphite than designed for, and also expanding into not-yet utilised high-grade deposits to the south.