Returns of 5% are feasible for stable, utility-based socially responsible investing. Just recently technology has turned the tables so that solar power generation is now cost-competitive to fossil fuels – and is getting more competitive. We’ll explore the reasons why and the key mile stones every investor should check for.

Just five years ago almost every adviser in the country would tell you “sure, socially responsible investing is possible – you just have to give up your expectations of investment returns”.

Although technological advancements in renewable energies, namely solar, have now made investments producing solar energy competitive with coal, natural gas and energy.

The chart below shows that solar energy can be produced at $60/MWh when in a utility-scale. That is cheaper than Coal at $66/MWh or Nuclear at $92/MWh.

.png)

For those involved with the industry, there is little surprise of this transition. The early markers of the solar efficacy have been building in the US jobs data. In the US, there are now more existing jobs in the renewable energy sector than the coal industry.

The chart below shows that solar energy production alone has been creating more jobs in the US than the coal industry, and last year solar eclipsed the oil and gas production industry too.

.png)

The trend is not isolated to the US, but also thriving here in Australia too. The Australian Institute’s chart below shows the rapid rise of Solar industry employment within Australia

.png)

Although before we run down the corridor to forecast the recent US presidential elections to shake the renewable energy foundations from a Trump perspective it’s worth noting some key facts. The renewable energy jobs have a higher average skill-set, education level and wage than that of coal.

In the election campaigns Trump called climate change a hoax and declaring to tear apart Obama’s clean-energy policies to revive coal mining. These claims seem counterattractive to the prosperity of the US as an economy, especially after seeing a recent report from Bloomberg. Their report states that many Fortune 500 companies now have aggressive plans to adopt renewable energy in the immediate future seen in the chart below.

.png)

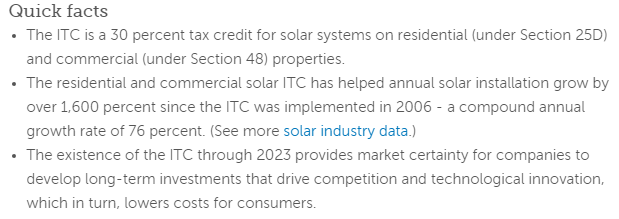

When looking beyond large US corporates and the jobs growth trend, pulling the rug out from renewable energy is still low-risk from a legislative perspective. The US government just extended their tax incentive program out to 2019 and stepping down until 2021. This incentive provides a 30% tax deduction for the cost of the renewable energy development available the day the site is completed.

Here’s an excerpt from the Solar Energy Industries Association summarising the tax incentives:

The Social Impact Investing Checklist:

Social impact investing in energy production with real returns is only a recent development. That means there’s not a lot of examples for investors to look at of strong, successful and reliable investments.

Here are the three key points all investors should check before investing in social-impact projects, namely energy:

1. Longevity

The term to look for in energy production is ‘offtakers’.

Offtakers are the consumers that sign up for buying the energy produced.

The larger, more stable the offtaker/buyer is, the better.

The longer the contract, normally the better.

It’s also possible for the offtaker to sign on for 100% of the energy produced too – even better.

Although this is where the detail comes in. Signing a start-up gold mine as the offtaker doesn’t inspire too much confidence for investors. Signing an offtaker with long history and strong credit rating is ideal (think BHP vs a small gold IPO).

Also, if the offtaker is signed at the financing stage, a high quality offtaker like a government means that financing the project can be met at much lower rates, further fuelling the competitiveness of renewable energy projects.

2. Consistency

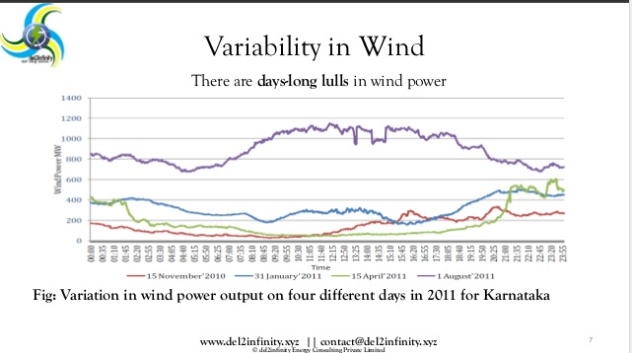

The consistency of energy production was an early argument against renewable energy, although knowing the data helps illuminate the rationale of the social impact investing on energy production consistency.

We all know that:

– Hydro energy works, as long as the drought isn’t too long

– Wind works, as long as the wind blows

– Solar works, during the day, provided the cloud-cover is low

What’s interesting is that on an annual basis winds can vary about 20% (generalised approximation). This data-point is etched in many Australian investor’s memories because of the troubles the Babcock and Brown wind assets had at the peak of their re-financing efforts.

The annual effectiveness of sun/cloud-cover on solar varies about 5% (general approximation). This 5% variance is more dependable for long-term investments (plus it’s notably more predicable than the price of coal as an energy input). This low, 5% variance, is a strong reason why most of the social impact energy production come from solar.

Here are some slides from the India Smart Grid Forum in July 2016 showing wind and solar variances (note, this data is always site specific)

.png)

3. Government Stability:

Many have said that government subsidies are the reason the renewable energies industry is where it is today, and there’s a lot of merit to that statement.

Although, now that solar is cost competitive with fossil fuels, the key point is that economies of scale will take the renewable energies industry further. These advancements will only be amplified by the technological improvements to batteries which is where we are today.

Although sceptical investors still question whether these government subsidies will still be required to keep the industry afloat?

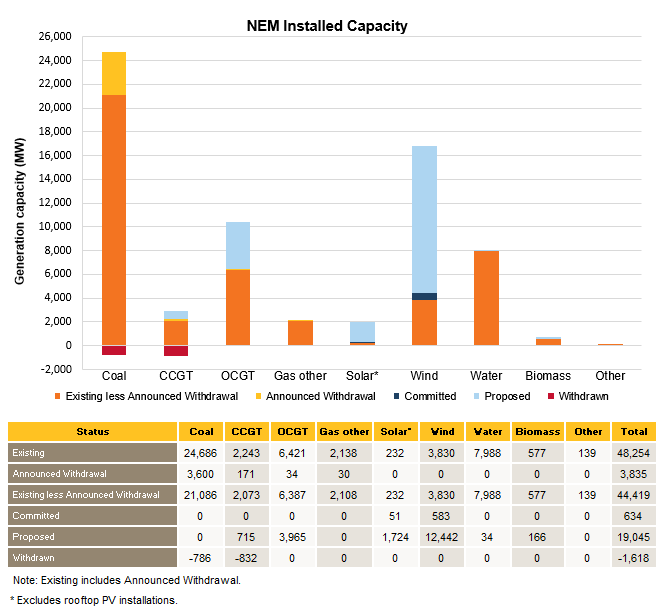

Rightly or, wrongly, the focus here is actually on US policy – because the majority of investable opportunities are in the US, being 10x more than Australia – despite all new electricity generation projects in Australia that are committed are in renewables seen in the table below (source Australian Energy Market Operator).

Today critics have the benefit of hindsight to see that the US government got the incentives for renewable energy right and the AU government got it wrong.

The US government attracted many of the world’s best to develop their technologies on US soil with simple, strong and tangible incentives. Whereas statements from AU politicians about the aesthetics of wind farms, inquiries on solar power and lack of conviction did little in comparison to encourage the renewable energy case.

Clearly the US government subsidies are a welcomed incentive, although the subsidies are no longer necessary to make renewable energies cost-competitive to fossil fuels. When looking from an investment perspective, the preference to solar over other renewables is pretty clear.

When comparing solar energy generation to fossil fuels, it is difficult to look past today’s economies of scale kicking in and lower the cost of solar. This trend is only being amplified by technological developments in energy storage that is akin to the rate of improvement in your smart phone.

Other related Articles: