Visible gold at 175m depth at M1 South – Portfolio Stock (initial coverage @ $0.08 in Sep 2015)

West African Resources (ASX: WAF, Share Price: $0.205, Market Cap: $77m) remains one of our favoured emerging African gold producers. Operating in Burkina Faso since 2007, it ranks as the largest ASX-listed acreage holder within the country and has accelerated its progress towards production status via the 2014 takeover of Channel Resources, significantly enhancing its overall gold resource position.

The company has advised of further significant high-grade drilling results from the M1 prospect within its 100%-owned Tanlouka gold project in Burkina Faso, with extensive visible gold intersected in diamond core at 175m depth – the deepest hole to date at M1 South – confirming significant gold potential at depth.

Market Significance

WAF’s share price has surged from a recent 12-month low of $0.048 during February to a 12-month high of $0.225 in May. The strong price move reflects growing market recognition of the company’s high-grade Tanlouka mineralization, reinforced by strong diamond and RC drilling results, which have the potential to boost overall project economics. WAF has also maintained strong production momentum by boosting its resource base via the takeover of Canadian-listed Channel Resources, the procurement of a second-hand heap-leach plant, completion of a PFS and ongoing work on a Definitive Feasibility Study (DFS).

Announcement Detail – Further High-Grade M1 Drilling Results

In our recent coverage, we’ve extensively highlighted the consistent release of extremely high-grade RC drilling results from the company’s M1 prospect, situated within its 100%-owned Tanlouka gold project in Burkina Faso.

Encouragingly, the trend has continued – with the release of more high-grade gold assay results from recent drilling work, at both shallow and greater depths.

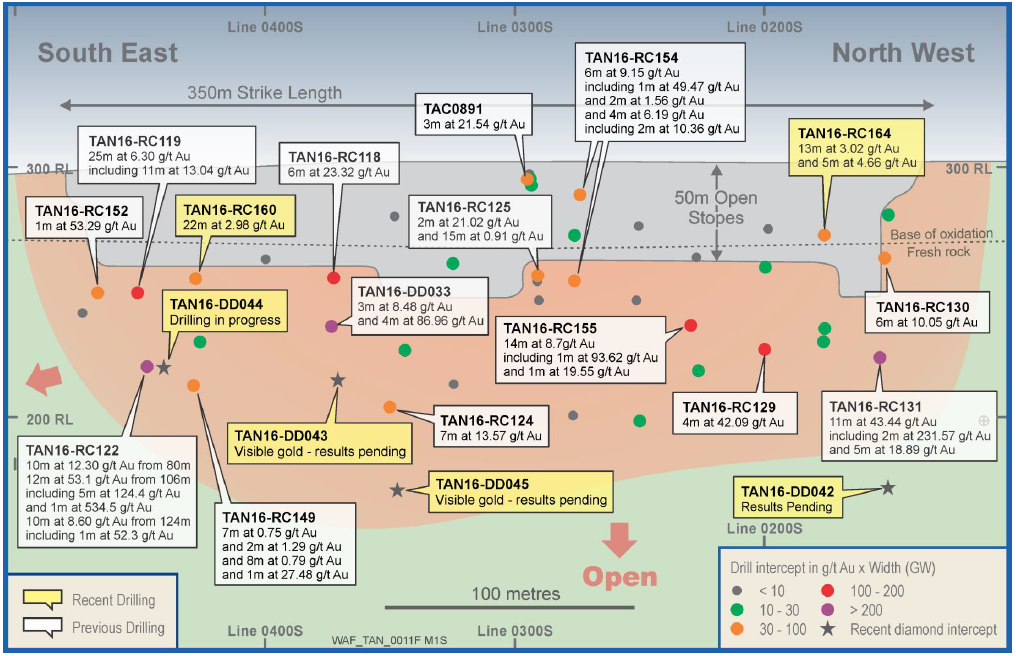

Extensive visible gold has been intercepted from diamond-core drilling at 175 metres within TAN16-DD045, which is the deepest hole drilled to date at M1 South. At the same time, strong results have been obtained from shallow resource drilling with TAN16-RC160, returning 22 metres at 2.98g/t Au from 47 metres depth.

Figure 1: M1 South Long-section

Technical Significance

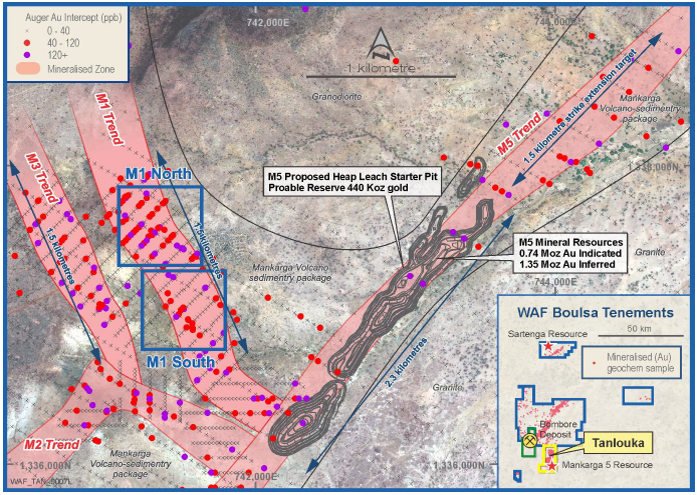

Drilling is currently focused on open-pittable mineralisation at M1 South and North ahead of a maiden resource at M1 during Q3 2016.

Diamond drilling at M1 South has successfully intercepted visible gold mineralisation in holes TAN16-DD043 and TAN16-DD045 (results pending), with the intercepts indicating the high-grade shoots have a steep northwest plunge. The mineralisation exhibits strong shearing and silica-sericite-albite alteration. Much of the gold at M1 south is in free form, but also associated with pyrite and pyrrhotite sulphides.

The intercept within TAN16-DD043 is 20 metres down-dip of TAN16-DD033 which returned 4 metres at 86.96g/t Au – whilst the intercept within TAN16-DD045 is 40 metres down-dip of TAN16-RC124 which returned 7m at 13.57g/t Au.

Results for TAN16-DD043 and TAN16-DD045, which finished at depths of 151 metres and 224 metres respectively, are expected within the next two weeks (as holes are currently being logged in detail by WAF geologists, ahead of sampling and assaying).

Shallow infill RC drilling at the M1 South prospect has also been in progress and continues to show good continuity, with strong results from TAN16-RC160 returning 22 metres at 2.98g/t Au from 47 metres (including 1m at 27.41g/t Au). Shallow holes continue to hit open stopes and back-fill material from historic artisanal mining.

Figure 1: Tanlouka Gold Project – Mineralised Trends and Prospect Locations

Capital Raising

WAF recently completed the placement of 70.2 million ordinary shares at an issue price of $0.125 per share to domestic and international institutional and sophisticated investors. This represented the final step in the $12.5 million capital raising process originally announced to the market back in April 2016.

The funds raised are being applied towards aggressive exploration and resource definition drilling programs at the M1 deposit. In parallel with the drilling programs, the company has also commenced a Definitive Feasibility Study (DFS) based on a larger-scale CIL development scenario at the Tanlouka Gold Project.

Summary

We initiated coverage of West African Resources around $0.08 during September 2015 – representing a current gain of 156%.

Importantly, gold mineralisation at the M1 and M3 deposits lies less than 2km from the proposed heap-leach starter-pit at M5. The company has so far done very little work outside of the M5 resource area and the new gold discoveries at M1, M2 & M3 would all help boost the already-robust economics of the heap-leach starter project. The mineralization is so robust that the company in now investigating a larger-scale CIL development scenario.

The key is the high-grade nature of the mineralization being encountered, which should enhance project economics and boost overall mine life. WAF is continuing to maintain strong development activity and accordingly therefore will remain firmly held within our Portfolio.