The National Australia Bank (NAB) supported its share price yesterday, and those of other banks, by undertaking to boost dividend payout to shareholders despite revealing a shock 14% fall in 2013-14 profit because of another bout of write-downs in the UK and Australasia totalling just on $1.3 billion.

The NAB’s move to confirm a final dividend of 99c a share (up 2.1%), the same as the interim, making for a small rise of 5 cents a share for the year to a total of $1.98 a share, helped support its shares and those of the rest of the sector.

Indeed it helped (along the relief rally imported from Wall Street in the wider market) NAB shares to close up 1% to $32.47.

In turn the NAB’s confidence boosting dividend move was helped by a solid full year profit report from the Bank of Queensland (BOQ), which in turn contained a generous payout to shareholders (see separate story).

That boosted BoQ shares by 3.5%, and the combined effect was to halt the recent rot in the banking sector and push the wider market up by more than 60 points for the ASX 200.

The confidence flowing form the NAB’s moves (especially on the dividend) saw the Commonwealth Bank (CBA) shares rise 1.6% $76.23 while Westpac Banking Corporation (WBC) shares added 1.8% to $32.87; the ANZ Banking Group (ANZ) was up 1.7% at $31.82.

ANZ and Westpac shares have been the weakest performers among the big four in the past month. And after the big sell off overnight, those rises will be reversed today.

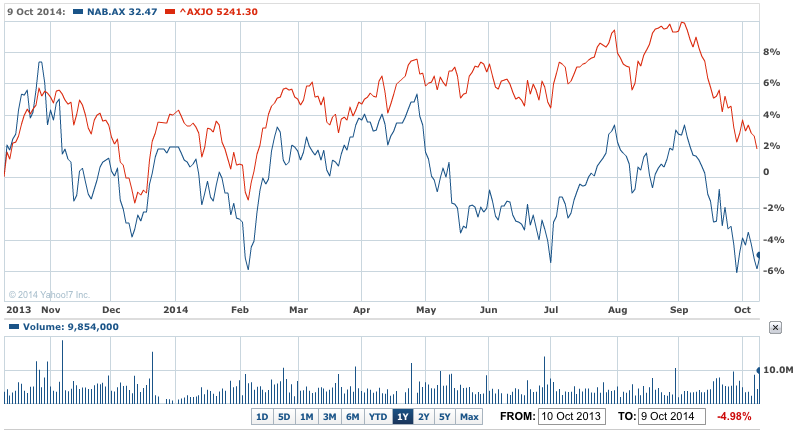

NAB vs XJO – NAB records 14% dip on FY cash profit

In the wake of the write-down, the NAB says it will now report a net cash profit in the range of $5.1 billion to $5.2 billion, compared with year-earlier profit of $5.94 billion, and market forecasts of up around $6.3 billion.

The bank will take a $605 million after-tax provision ($964 million before tax) for its payment protection insurance in the UK (an ongoing and expensive scandal for miss-selling financial products offering income protection to UK bank customers which has cost the sector an estimated $10 billion in fines, charges and losses).

As well there’s an additional provision for its interest rate hedging products of $359 million, it said in a statement to the ASX yesterday.

It also announced a capitalised software impairment of $220 million after-tax mainly in its Australian wealth and banking businesses as well as smaller assets in the UK and New Zealand.

All up the move has the whiff of a bit of house cleaning by the new CEO Andrew Thorburn, on top of a necessary extra provision in the UK where the bank warned its third quarter trading update that it might be forced to look again at the situation at its UK banks.

NAB owns the Clydesdale and Yorkshire Bank and they have been very much smaller players in all the UK banking scandals.

But that smallness hasn’t meant they have escaped the continuing charges and other costs to the profit and loss accounts, on top of continuing (but improving) pressures from dodgy property loans made years ago.

And besides the generous dividend payout, the bank also said it intends to raise $1.6 billion in share capital via a discounted dividend reinvestment plan.

"In addition, NAB intends to operate the dividend reinvestment plan (DRP) with a discount to encourage shareholder participation. NAB has also arranged the underwriting of the issuance of an additional $800m of NAB shares over and above the expected take up under the DRP.

“Assuming a DRP participation rate of 35%, these initiatives will provide an expected increase in share capital of approximately $1.6 billion and a 44 basis point increase in NAB’s CET1 ratio,” the bank said yesterday (the CET1 ratio is the top tier of capital a bank has to hold and has to be of the highest quality).

Mr Thorburn said in yesterday’s statement that reporting larger UK conduct charges and impairments "is disappointing but is being dealt with transparently and quickly and the underlying performance of the NAB Group remains strong".

“Taking these decisions gives us more clarity going into the future and allows us to focus on the core Australian and New Zealand franchises, which remain in good shape. NAB is committed to including these types of adjustments within cash earnings now and in the future,” Mr Thorburn said.

“Our leadership team is focused on delivering a better customer experience, and through this an improved performance of the bank. I look forward to discussing this in more detail at our full year results on October 30 when we will provide a full briefing to the market.”

Mr Thorburn is expected to also reveal plans to revamp the bank as well, on our just after the reporting of the profit. He has already shook up the management structure (his first reported act on taking over from Cameron Clyne).

Last week NAB filed a prospectus to the US Securities and Exchange Commission to sell a 27% in its US subsidiary Great Western Bank via a stock market float.