by Paul O’Connor – Head of Multi-Asset

The first quarter of 2023 was rewarding for multi-asset investors, with equities, credit, emerging market debt, government bonds and gold all delivering positive returns. Still, this was no easy ride, with market leadership and direction abruptly changing multiple times as sentiment swung from one investment narrative to another. The mood in the markets was very different each month. While almost every asset class rallied in January as interest rate expectations were marked lower, February saw the complete reverse. March began with investor psychology dominated by concerns about the banking system but ended with markets seemingly shrugging these worries aside and most multi-asset portfolios enjoying positive returns over that volatile month.

Exhibit 1: Multi-asset returns in Q1 2023

Source: Bloomberg, Janus Henderson Investors. Data as at 31 March 2023. Past performance does not predict future returns.

Interest rate volatility

Amid this thematic turbulence, high interest rate volatility has been a persistent feature of the market environment this year. Market pricing for the December 2023 US Federal Funds rate rose from a low of 4.3% in January, to a high of 5.5% in February, before dropping below 3.7% in March, when concerns about the banking sector were at their most intense. Investors have clearly struggled to decide how the conflicting influences shaping interest rates will balance out in the quarters ahead. Options prices show that the level of uncertainty surrounding US interest rates has recently touched heights last seen during the Global Financial Crisis.

As these market gyrations suggest, this is not an easy time to be a central banker, with some data suggesting that more interest rate hikes are needed and others hinting that interest rates are probably high enough. For example, the US Federal Reserve (Fed) currently faces an unemployment rate close to a 50-year low, nearly 10 million unfilled job vacancies and calls from many economists for further monetary tightening. However, at the same time, there are concerns that the economy is already losing momentum and previous interest rates hikes have not yet had their full impact. These reasons justify the Fed to pause hiking to allow time to evaluate how these lagged effects will materialise.

The recent signs of financial stress in some parts of the European and US banking systems has shifted the balance in this debate, pushing interest rate expectations decisively lower in many major economies. Expectations now are that policy rates in the eurozone and the UK are within 25bps to 50bps (0.25%-0.5%) of their peaks for this cycle, one final US hike is now a 50-50 shot and the Fed will be cutting interest rates during the second half of the year. The dovish rethink on monetary policy reflects an emerging consensus view that credit conditions are likely to tighten in many developed economies in the months ahead, which will, to some extent, alleviate the need for further central bank interest rate increases.

Clearly, bank blow-ups in Europe and the US are ominous developments, which serve as a reminder that late-cycle financial stress can often materialise in unpredictable ways. Still, the evidence so far suggests that the bank blow-ups in Q1 were more idiosyncratic than systematic. They appear to be largely reflective of weak business models and questionable decision-making, rather than the sort of bank-wide asset quality concerns that defined previous financial crises. However, while it might be wrong to interpret recent events as early signs of a serious global banking crisis, it might also be a mistake to regard them as one-offs. Since the impact of past monetary tightening is still working through the financial system, Q1’s financial stresses are unlikely to be the last of this tightening cycle.

A feature, not a bug

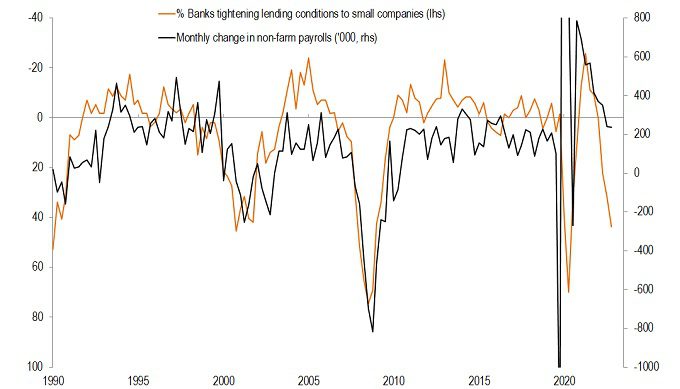

Arguably, the emergence of financial tensions in the banking sector and credit markets is a classic characteristic of a late-cycle economic regime and confirmation that interest rate hikes are beginning to gain traction. Tighter credit conditions is one of the key channels through which monetary policy works, and is not necessarily a sign that something has gone wrong. Rising interest rates and slowing economic growth dampens confidence in the banking and credit sectors, leading to tighter financial conditions which ultimately slow growth further. Exhibit 2 shows US bank lending conditions before March’s high-profile flare-ups in the US and Europe. While conditions then were already consistent with a significant slowdown in economic growth, subsequent developments in the sector can only be expected to have tightened lending further, with adverse implications for future economic growth.

Exhibit 2: US bank lending conditions and job growth

Source: Bloomberg, Janus Henderson Investors. Data as at 12 April 2023.

Downgrades loom

In broad terms, these gloomy predictions from the bank sector are only reinforcing messages from many other macroeconomic and market models, which are already signalling a high risk of US recession starting around the second half of 2023. A wide range of indicators are currently pointing in this direction, including housing market data, consumer and business surveys, money supply measures and yield curves. Against this backdrop, it might seem surprising that consensus forecasts for 2023 growth in most of the major economies have been upgraded. However, we would be wary of extrapolating this trend much further and see the balance of risks as leaning decisively towards growth downgrades being a key market theme for the months ahead.

While economists have been upgrading growth estimates in recent months, analysts have been steadily downgrading company earnings forecasts this year. Consensus analyst estimates are now for 0% global earnings-per-share growth this year and 11% in 2024. These have been downgraded by about 6% from the recent peak. In recessions, downgrades are normally closer to showing a 20% fall in earnings from peak estimates. One specific concern here is the level of analyst optimism embedded in current consensus forecasts for future global corporate revenue growth. While analysts have recently downgraded margin estimates, they have kept pushing revenue projections to all-time highs. This is potentially a big source of downgrade risk if economic growth slows as much as lead indicators suggest it might.

On the defensive

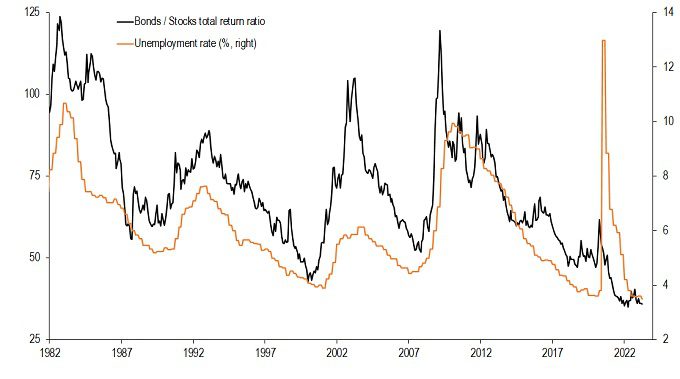

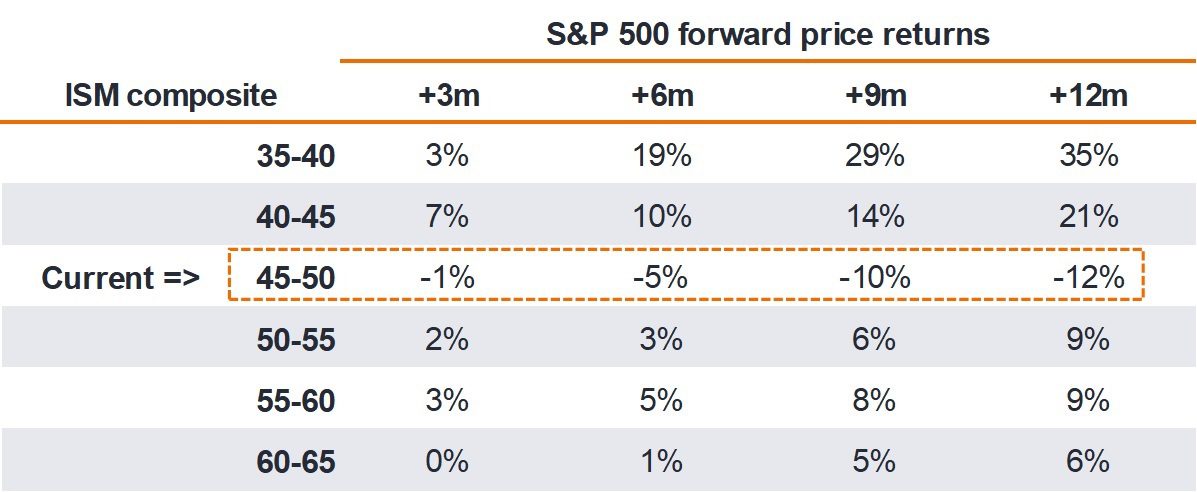

Where financial markets are concerned, history suggests that the downswing phase of the economic cycle is rarely the best time for financial risk-taking. When corporate earnings are being downgraded, low-risk and mid-risk assets (such as government and better-quality bonds) typically outperform stocks (exhibit 3). And government bonds and investment grade bonds usually outperform stocks when unemployment is rising, as we expect it will for the rest of this year, at least. The relationship between business confidence and future equity returns also suggests that this is typically a tricky stage of the economic cycle for equity investors (exhibit 4).

Exhibit 3: Bonds usually outperform stocks when unemployment rises

Source: Bloomberg, Janus Henderson Investors. Data as at 12 April 2023. Note: Stocks = MSCI Index. Bonds = US Aggregate Index. Past performance does not predict future returns.

Exhibit 4: US equity returns and business sentiment

Source: Bloomberg, Janus Henderson Investors. Data as at 12 April 2023. Note: ISM Composite is average reading of business sentiment, as measured by the ISM Manufacturing and Non-Manufacturing indices. The current reading is 49. Note: Past performance does not predict future returns.

The overall message from cyclical asset allocation frameworks is that we are at the stage of the economic cycle in which investors should prioritise defensive investment strategies, higher asset quality and diversification over more cyclical and higher-risk investment exposures. Still, asset valuations offer some reassurance to counterbalance these concerns. In broad terms, asset valuations are now at levels from which investors have typically enjoyed respectable medium-term investment returns from multi-asset portfolios (although past performance is no guarantee of future performance). Here too, the evidence argues for a tilt towards more defensive assets, with both cash and fixed income valuations looking more attractive than stocks, compared to their historical relative valuation ranges.

Time to consider fixed income?

While some measures of investor sentiment regarding equities look fairly downbeat, the overall picture is quite mixed. Speculative investors do appear to be cautiously positioned in stocks, but others have kept buying, even during last year’s market turbulence. Global investors have poured a net $190bn[1] into stocks since the start of 2022. The share of equities in US households’ investment portfolios is currently around the 95th percentile, suggesting limited scope to add exposure here. Arguably, the big positioning washout in this cycle has been in bonds, where last year’s capitulation erased 14 years of institutional fixed income overweights. While current high investor cash allocations have the potential to support both stocks and bonds, this needs to be set against cyclical, valuation and positioning indicators, which suggest that fixed income is more likely to be the beneficiary of any big reallocations in the months ahead.

[1] Source: Credit Suisse Equity Research, as at 5 April 2023.