Ashwin Alankar, PhD – Head of Global Asset Allocation

Continuing 2022’s trend, inflation and policy makers’ response to it remain dominant forces in financial markets. With the fate of both stocks and bonds resting on the same macro developments, investors’ inability to rely on the benefits of diversification has amplified market volatility.

Just as elevated correlation among asset classes is resulting in investor consternation, so too is the growing realization that markets will have to adapt to an era of higher inflation and higher rates due to structural forces such as deglobalization, decarbonization, and aging populations leaving labor markets tighter.

Between 2009 and 2020, the Federal Reserve’s (Fed) favored measure of core inflation averaged 1.54%. The U.S. Treasuries market now implies that same measure will average roughly 2.30% over the next decade. During the 12-year period through 2020, the yield on the 10-year Treasury averaged 2.31%; it currently sits below 3.50%.

A higher cost of capital and shifting consumer behavior as a new, more inflationary regime emerges means that the post-Global Financial Crisis (GFC) market playbook is likely outdated, and investors will have to rely on a different playbook to generate attractive risk-adjusted returns.

Rewarding the innovators

Rather than lament the fact that the era of cheap credit and lofty valuation multiples are over, investors should instead recognize that there will be winners and losers in any economic environment. Looking forward, we believe the winners will be dominated by the companies that most effectively harness technological innovation with the aim of improving productivity. Adopting new technologies, in our view, should go a long way toward mitigating the deleterious impact of a higher inflation environment.

There has seldom been a more favorable time to enhance productivity. The digitization of the global economy has provided management teams with myriad tools to optimize their operating models. As economist Robert Solow illustrated in his ground-breaking work on the determinants of economic growth, technological progress is a key driver of worker output. Doing more with less has the potential to offset higher input costs, thus increasing a company’s ability to defend margins and grow earnings, including – and perhaps especially – within periods of elevated inflation.

One must recognize that inflation has two possible drivers: Supply and demand. Monetary policy and central bank tightening aim to contain inflation through the demand channel, but productivity improvements work by increasing supply in a more cost-effective manner.

Conversely, companies that don’t embrace innovation may find it impossible to protect themselves from eroding operating margins. The risk is especially acute for companies that rode the wave of cheap financing, elevated valuations, and demand from yield-hungry investors. Over the past several years, many such companies relied on these anomalies to appear viable rather than invest in the future.

Good-bye Great Moderation

As evidenced by the ascendent trend of deglobalization, the era of cheap money, goods, and labor is over. The so-called “Great Moderation” allowed companies to allocate capital to the lowest-cost production centers. The reprioritization toward supply chain resilience and navigating geopolitical shifts, in contrast, is inflationary. Companies must seek ways to offset higher input costs, driven in part by the need to decarbonize. In our view, that is best accomplished by enhancing productivity.

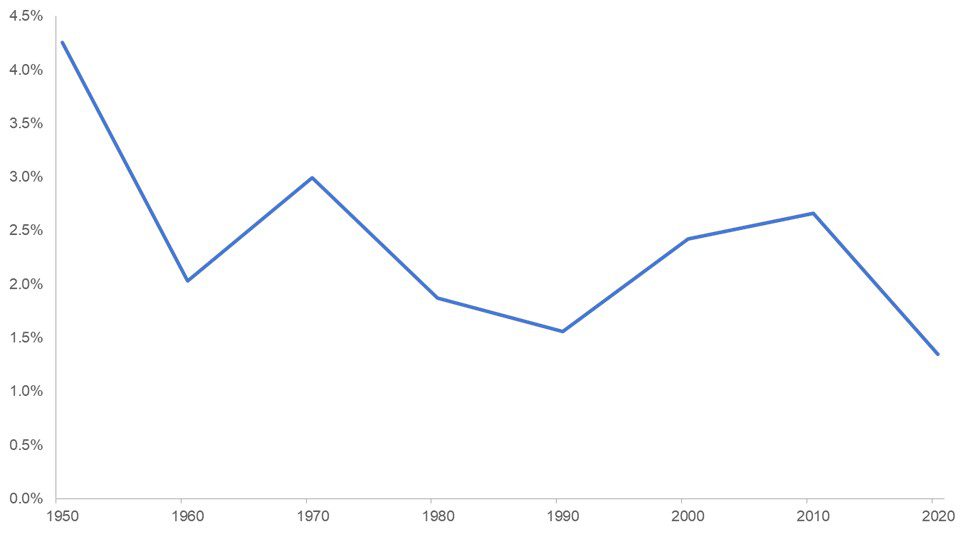

Due to cheap money, the decade of the 2010s was the least productive decade since the 1940s as capital was misallocated and low productivity ultimately fueled inflation – as it did in the 1970s,1980s, and today.

Quarterly change in U.S. nonfarm business productivity, 10-year moving average

Source: Bloomberg, Bureau of Labor Statistics, as of 31 December 2020.

Source: Bloomberg, Bureau of Labor Statistics, as of 31 December 2020.

Embracing innovation has the potential to reverse today’s dismal productivity growth. While the past decade has seen great technological advancements, many of the most promising innovations, such as the cloud, artificial intelligence (AI), and Software as a Service, were geared toward the services sector, which limited productivity gains as service improvements relate to experience and not supply. By applying innovations to the labor-intensive manufacturing segment, a productivity renaissance could be ignited.

An eye on fundamentals

The post-GFC era was one of massive distortions. As borrowing costs and inflation reset higher, investors must look farther back to a period when asset prices were not so egregiously supported by policy largesse. Companies will have to deliver on key performance metrics such as operating margins, earnings growth, and free-cash-flow yields.

Deglobalization, a higher cost of capital, a dearth of workers, and 2.0%-plus inflation all present challenges to management teams. Investors will need to perform thorough, company-by-company due diligence to identify those that are most effectively allocating capital to the initiatives than can catalyze productivity. Many companies will come up short. However, we believe those that recognize both the challenge of inflation and the opportunity presented by innovation will account for an increasing share of aggregate earnings growth and investment returns in the years to come.