by Tim Richardson CFA, Investment Specialist

Global smaller companies are under-owned by investors because they are perceived as ‘risky’investments. They are also inadequately analysed and inefficiently priced. Australian investors could enhance their long-term risk-adjusted returns by properly diversifying their portfolios to include some of these over-looked but highly attractive assets.

“Diversification is the only free lunch in investing.”

– Professor Harry Markowitz, University of California, Nobel prize-winning economist

What is a small company?

Small-cap stocks are usually defined in textbooks as those with a market capitalisation of between $300 million – $2 billion. Companies below this range are considered micro-cap stocks, while those in the $2 billion – $10 billion are known as mid-caps.

Most companies are in fact smaller-cap stocks; over 90% of all global listed companies have a market capitalisation under US$3bn. They may be more recently established and focussed on their home markets, not having yet reached a stage where they export globally or establish overseas operations.

Australia, for example, has around 50 large cap stocks, about 50 mid-caps but over 2,000 small cap listed companies. The sheer size of the small cap market impacts the level of professional analysis and pricing efficiency, which highlights the importance of active management.

Why should investors invest in smaller companies?

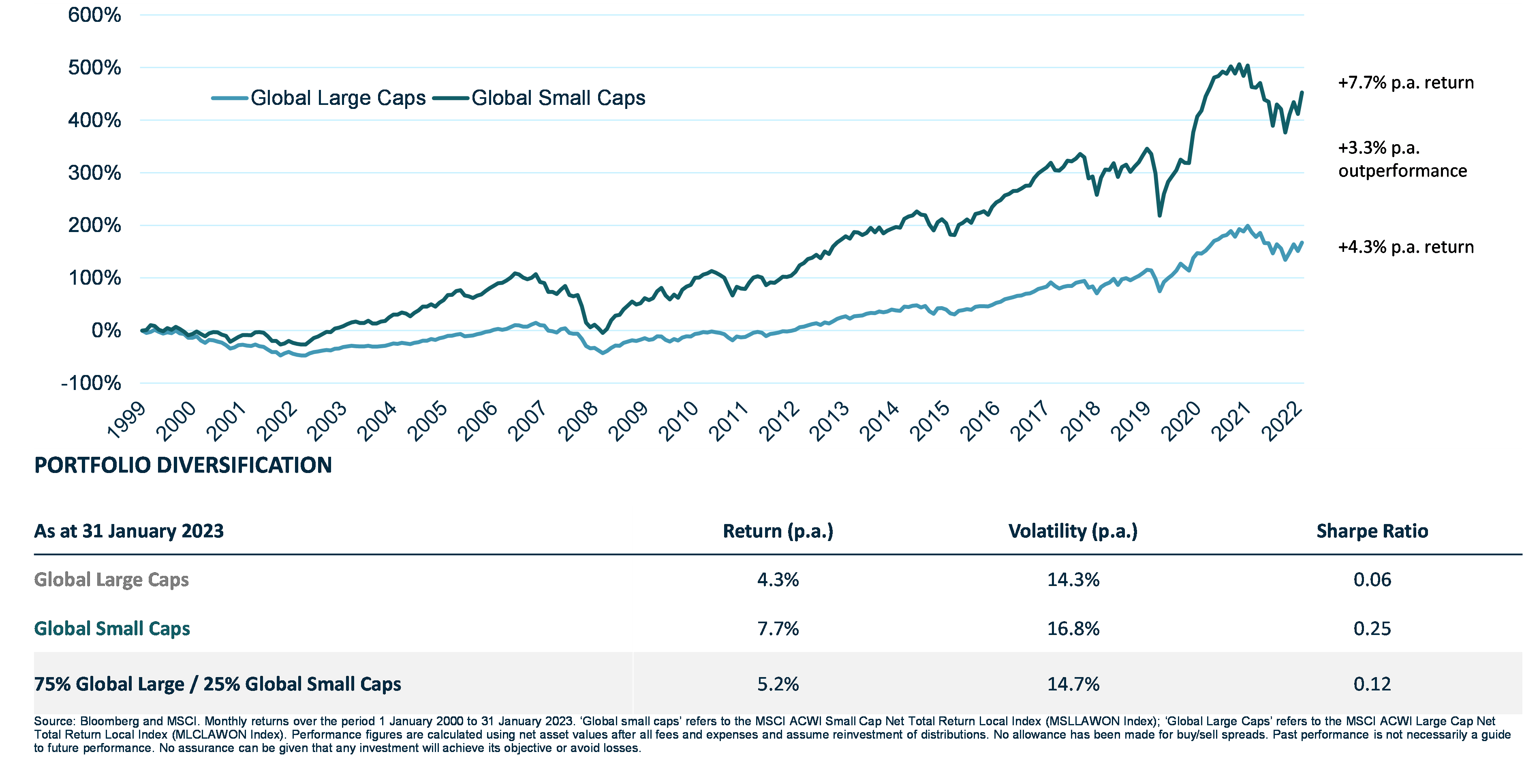

Research indicates that small-cap stocks deliver higher returns over the long term. Research by US-based global small-mid cap specialist investment manager Lizard Investors found that smaller companies on average outperformed larger companies by 3.3% per annum between 2000 and 2023.

Historically higher returns – Since 2000, small caps have outperformed large caps

Smaller companies have greater scope to expand their operations rapidly as opportunities emerge, potentially delivering higher capital gains to investors. This gives the asset class an inherent growth bias.

Smaller companies are more likely to be financed by equity rather than debt. Less variable financing costs can make earnings more resilient in times of sustained higher interest rates.

However, small-cap investing does bring certain inherent risks to consider:

- Greater share price volatility

- Market illiquidity can make it harder to exit a stock

- Home market focus brings greater country/currency risk

- Less sophisticated risk management processes

- Less established corporate governance oversight

Are small-cap stocks fairly priced?

Markets for the largest global companies tend to be reasonably efficient, with shares easily bought and sold at low transaction costs. They are closely analysed by many professional investors, bringing more effective price discovery (i.e. identifying a company’s fair value).

In contrast, the market for smaller companies tends to be less efficient, covered by far fewer analysts, providing the opportunity for astute investors to identify mis-priced stocks. This enables small-cap stocks to outperform over the long term. However, this requires an active management strategy to identify under-valued businesses with a competitive advantage in growing markets.

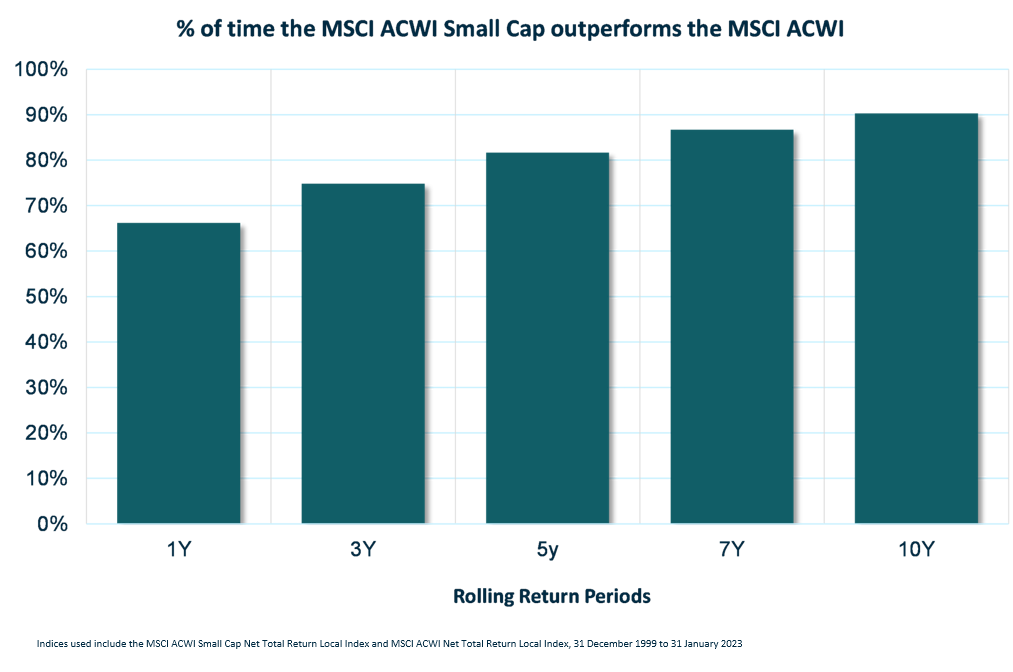

Unfortunately, smaller companies do not outperform larger companies continuously. Historical analysis indicates that in any 12-month period there is a 65% chance of outperformance, but this increases to over 80% for a five-year holding period and 90% when held for ten years.

Globally Small companies have outperformed – The longer you hold them, the more chance of outperformance

What does this mean for investors?

Small-cap stocks are highly under-owned by most investors, leading to under-diversification. They comprise around a third of total global share market capitalisation, but a much smaller allocation of the typical investor’s portfolio. Harry Markowitz’s famous quote shows how a wider exposure to the share market through small-cap investing can deliver superior risk-adjusted returns.

Smaller companies can take decisions more quickly, enabling them to react to opportunities, driving rapid growth in earnings and share prices. Hence, small-cap stocks have the potential to rebound faster than the broader market, outperforming in the early stages of a share market recovery.

Australian retail investors have the opportunity to boost expected long-term risk-adjusted returns by improving portfolio diversification through increasing smaller company allocation. Our next article will look at whether 2023 is a good time to increase exposure to the sector.

Download PDF HERE.