by Andy Acker, CFA – Global Life Sciences PM

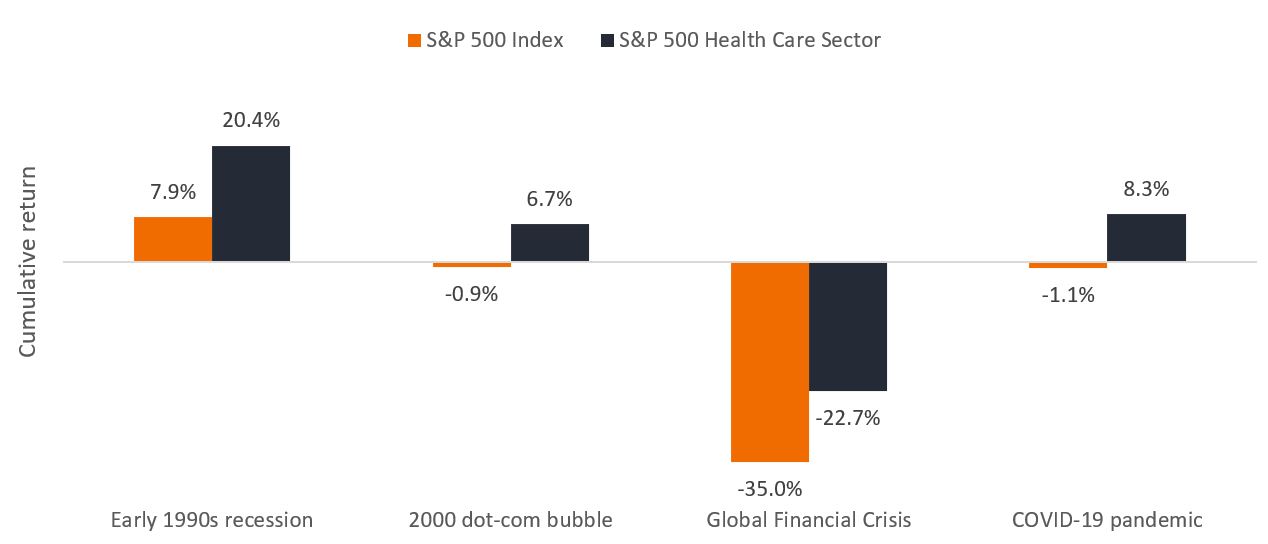

Historically, the healthcare sector has tended to outperform the broader equity market during downturns. In 2022, that pattern continued with the S&P 500® Health Care Sector delivering -3.4% as of midway through November compared with -15.6% for the S&P 500® Index.1Heading into 2023, with inflation still at generationally high levels and central banks aggressively lifting rates to try and tame it, we believe investors could continue to gravitate toward defensive sectors such as healthcare.

Managed care and pharma flex their pricing power

To date, managed care, large-cap biopharma, and pharmaceutical distributors have been major drivers of the sector’s resilience. Many of these firms have visibility around their earnings potential and can lift prices to offset rising costs. Heading into next year, these attributes will likely continue to appeal to investors. For example, in the U.S., managed care providers that participate in the public marketplace for health insurance and/or offer commercial plans through employers have been able to increase premiums for 2023 to offset potentially higher labor costs and medical utilization rates as people resume routine care post-pandemic.2 Demand for health insurance is also on the rise: Enrollment in Medicare Advantage – a private-sector alternative to Medicare, the government-administered health insurance program for the elderly – rose 8% in 2022 and now covers 48% of all Medicare beneficiaries, a number that is projected to expand to 61% by 2032.3

Pharmaceutical companies, meanwhile, have resilient demand and have been able to raise prices in line with or above the rate of inflation.4 And although the Inflation Reduction Act, signed into law in August, will limit drug price increases in Medicare starting next year, the cap is equal to inflation. In our view, the legislation, which includes other provisions related to drug pricing, should be manageable for the industry (costing around 2% of total drug revenues over 10 years, according to estimates). It also removes uncertainty about drug pricing reform, which has been an overhang on biopharma for the better part of six years. Meanwhile, newly launched injectable drugs and biosimilars are benefiting pharmaceutical distributors, which realize higher profit margins on these complex treatments than with branded oral medicines.

Thus, even if major economies enter a recession in 2023, we believe the healthcare sector could offer investors some safe harbor. In the past, the sector has outperformed in the months leading up to and during economic downturns; the same could hold true again.

Figure 1: In past recessions, healthcare has outperformed

Source: Bloomberg, NBER. Notes: Data reflect peak-to-trough returns during recessionary periods as defined by the National Bureau of Economic Research (NBER). Dates are July 1990 to March 1991; March 2001 to November 2001; December 2007 to June 2009; and February 2020 to April 2020. Past performance cannot guarantee future results. Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

Still, to minimize volatility, investors will want to be selective, as not all areas of healthcare have been as resilient as those discussed above in today’s inflationary environment. Some hospitals and other healthcare providers pulled earnings guidance during the third quarter of 2022 because of uncertainties around labor costs. Healthcare technology firms – whose valuations soared during the digital-first boom of the pandemic – have also struggled as rising rates lower the value of these firms’ cash flows (which tend to be realized farther in the future). And some medical technology companies, facing stiff competition, have been unable to pass through price increases.

Biotech outlook brightens

Even as economic growth slows, the sector continues to innovate, with many advances proving too difficult for investors to ignore. This dynamic has been especially true for small- and mid-cap biotechnology firms. From early 2021 through the first half of 2022, these stocks suffered their worst relative period of underperformance on record as clinical trial setbacks, regulatory uncertainty, and worries about drug pricing reform collided with rising interest rates.5 The sell-off led to hundreds of companies trading below the value of cash on their balance sheets. Starting in June, however, sentiment began to change, thanks to a series of positive clinical trial data in large disease categories such as cancer, obesity, pneumonia vaccines, liver disease, and Alzheimer’s disease. In many cases, the data represented clinical breakthroughs in areas of high, unmet medical need, sending shares significantly higher and allowing companies to complete successful capital raises.

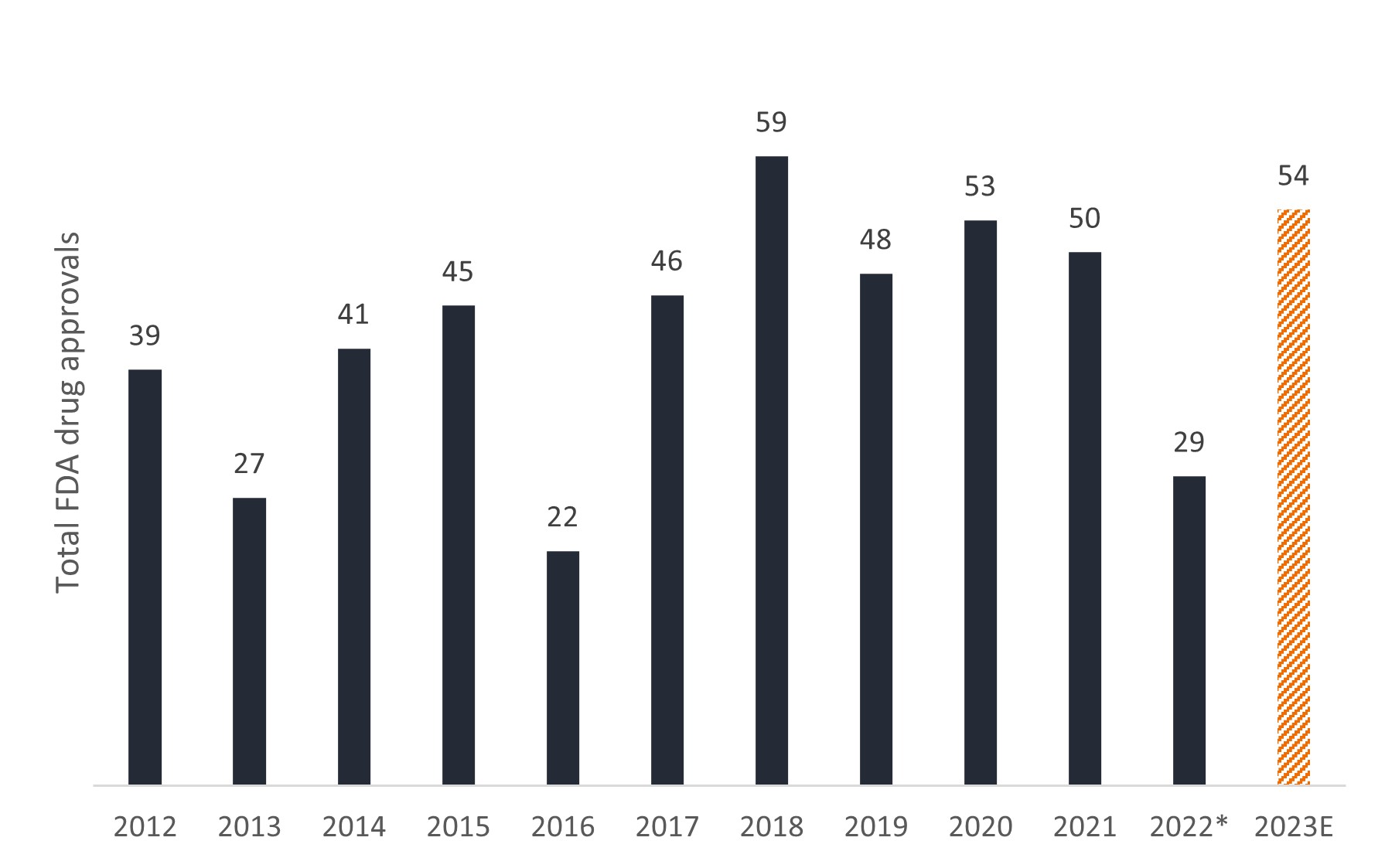

While rising interest rates will continue to be a headwind for biotech, we believe sentiment toward the industry has improved and the market should continue to reward innovation. On that front, the coming months could be eventful. The Food and Drug Administration (FDA) – which lacked a permanent commissioner for more than a year after the Biden administration took office in 2021 – is now playing catch-up. Roughly a dozen new drug applications are pending before the end of 2022, and another 54 are slated for 2023. (As of mid-November, the FDA had approved only 29 new therapies for 2022, down from more than 40 for the same period the year before.)

Figure 2: 2023 could be a busy year for drug approvals

Source: Food and Drug Administration. Notes: *2022 data as of 17 November 2022. Data for 2023 reflect pending new drug applications set to be reviewed during the year.

Some of these drugs could be revolutionary, including the first gene therapies for Duchenne muscular dystrophy (a fatal, muscle-wasting genetic condition in children), hemophilia, and sickle cell disease. We could also see two new disease-modifying therapies for Alzheimer’s and the launch of an obesity treatment with weight loss approaching levels achieved through gastric bypass surgery. Other potential launches include a first-of-its-kind microbiome therapy for C. difficile infection (a leading cause of hospital-acquired infections). Meanwhile, exciting new medical devices could also be coming to market in 2023, including improved continuous glucose monitoring devices and computer-aided peripheral vascular systems that could potentially remove clots more quickly and safely than existing products.

Biotech’s growing momentum has led some to call for initial public offerings to resume in 2023 after the market essentially shuttered in 2022. We remain somewhat cautious, given the likelihood that the macroeconomic backdrop may continue to pressure the market. In our view, we think it is important to focus on companies with attractive risk/reward profiles. These can include companies with upcoming milestones where the odds look favorable (e.g., a positive clinical trial readout) or firms with promising newly launched medicines. These companies will likely be able to raise capital in secondary markets, or they could be attractive acquisition targets. Indeed, with valuations suppressed, we have seen an uptick in mergers and acquisitions in the second half of 2022, a trend that could continue into next year and provide potential upside for investors.

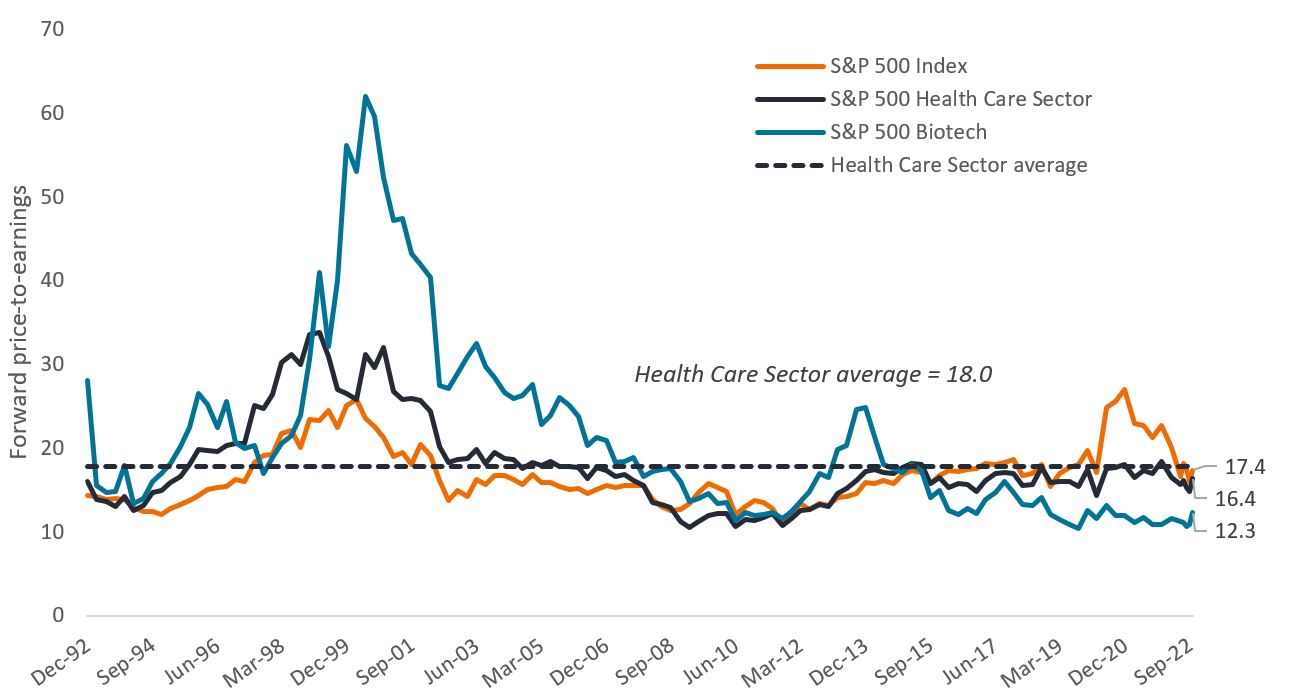

More broadly, the healthcare sector still trades at a discount to the S&P 500, despite holding up better than most sectors in 2022 (see Figure 3). To capitalize on this discount, we believe it remains important for investors to look for firms with high earnings visibility, strong free cash flow, differentiated products, and/or promising pipelines. Doing so could not only reduce volatility for investors but open the opportunity to invest in long-term growth at what may prove to be compelling valuations.

Figure 3: Health care valuations remain attractive

Source: Bloomberg, data from 31 March 1993 to 31 October 2022. Notes: Data are quarterly except for Q4 2022, when monthly data are used. Price-to-earnings based on forward, 12-month earnings estimates.