by Denny Fish – Portfolio Manager | Research Analyst

In recent weeks, investors have coalesced around the notion that the US and global economies will continue to slow – if not enter recession – as the lagging effects of aggressive rate hikes continue to bite. At first blush this may appear to be yet another headwind for the technology sector. While mindful of the risks posed by slowing business investment and personal consumption, we take the view that we are nearing a time of potential opportunity for tech investors focused on the long term.

Behind our cautious optimism are the related forces of volatile markets and compressing stock valuations. We expect the former to continue as the market more fully prices in an economic downturn. And yet sector-wide selloffs can result in dislocations where the beaten-down valuations of individual companies don’t align with their more auspicious long-term prospects. The full-year 2023 price/earnings (P/E) ratio for the MSCI All-Country World Information Technology Index has already compressed by 14% since August, sending the metric below its five-year average.

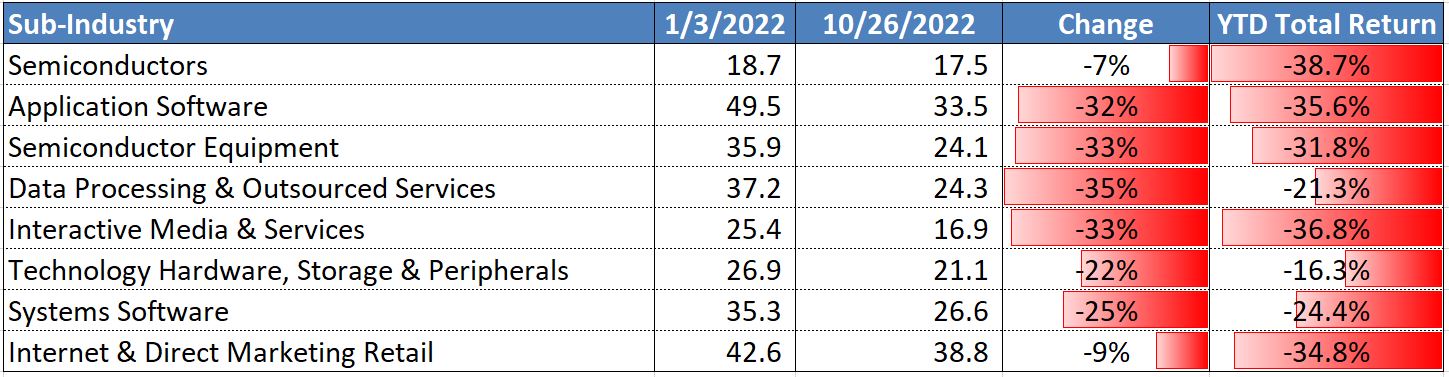

Tech and internet price/earnings ratios in 2022

The compression of earnings multiples was an initial factor in the year’s tech selloff as investors incorporated higher discount rates into stock valuations, and this has been more recently followed by downward earnings revisions as a slowing economy is priced in.

Source: Bloomberg, as of 26 October 2022. P/E ratios are based on blended forward 12-month earnings estimates.

If we had to choose

The past nine months have been a challenge for the global tech sector. A key driver of negative returns has been dramatically higher discount rates lowering the present value of companies’ future cash flows; this is the simple arithmetic of equities valuation. It’s also a reversal of the multi-year trend that saw tech valuations – boosted by low rates – rise to levels that far exceeded their long-term average.

In addition to the math of discounting, tech stocks in recent years also benefited from the search for growth where one could find it – often in tech names leveraged to secular themes and, once the pandemic hit, in companies profiting from increased demand for the Internet, communications, and e-commerce services that helped the global economy navigate lockdowns and remote work.

While the tailwinds of low rates and a surge in pandemic-related demand have abated, an enduring driver is the continued presence of the secular themes of artificial intelligence, the cloud, the Internet of Things, and 5G connectivity. Unlike a simple input in a mathematical formula, these tailwinds impact stock valuations by offering the potential for compound earnings growth over a long horizon as expenditure targeted toward the tech sector commands an ever greater share of the global economy. Given the choice, we’d opt for the latter, more durable, tailwind.

Doing one’s homework

Capitalizing on volatility, however, does not equate to indiscriminately buying the index. Cyclicality is inherent in many tech subsectors. And while we believe so-called cyclical growth stocks should register both higher peaks and higher troughs as future business cycles unfold, many of these names will not be immune to a slowing economy.

The possibility of dimming economic prospects could lead to additional earnings downgrades for semiconductor companies (semis), but this is not an indictment of the health of the industry. The chip market has undergone considerable rationalization and future economic growth will only create more powerful tailwinds for the industry as semi content becomes more ubiquitous. The industry has also tended to bottom months ahead of the economic cycle, meaning lost ground could be quickly recovered should the current slowdown be short-lived.

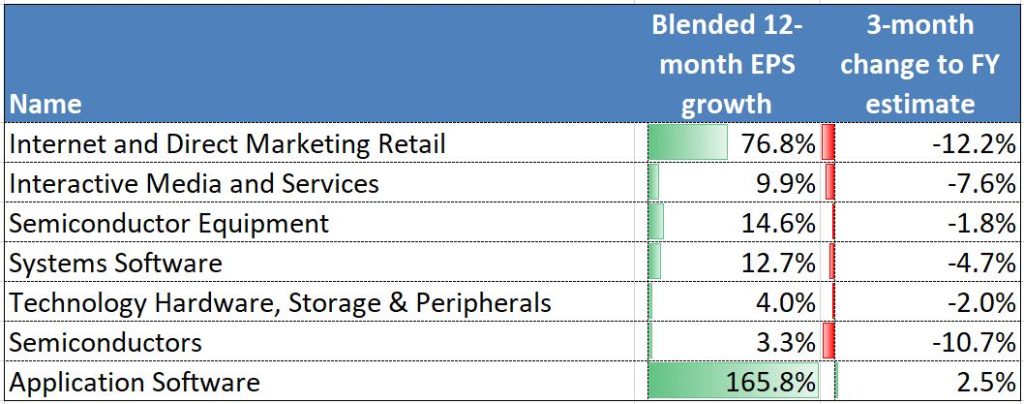

MSCI All-Country World Technology Index earnings estimates by sub-industry

Facing a slowing economy, earnings estimates of more cyclical tech segments have already been revised downward considerably, while software names are proving more resilient given their subscription-based business models.

Source: Bloomberg, as of 26 October 2022.

While still exposed to cyclicality, we think cloud and other software companies should fare better than semis during a downturn thanks to the resilience of their subscription-based business models. Furthermore, as corporate customers face revenue pressure, they are likely to depend even more on productivity-enhancing software to defend margins.

We believe investors should be more cautious on companies leveraged to digital advertising as these face both cyclical pressure and a more stringent privacy framework. Also at risk are companies that overextended their businesses during the pandemic, mistaking that outlier period for a new status quo.

Assessing the tides

In contrast, secular-growth tech companies, in our view, should be less vulnerable to a weakening economy. In fact, as witnessed during the slow-growth periods over the past decade, these stocks can benefit from a tepid economy as investors seek out the elusive businesses capable of increasing earnings in a consistent manner.

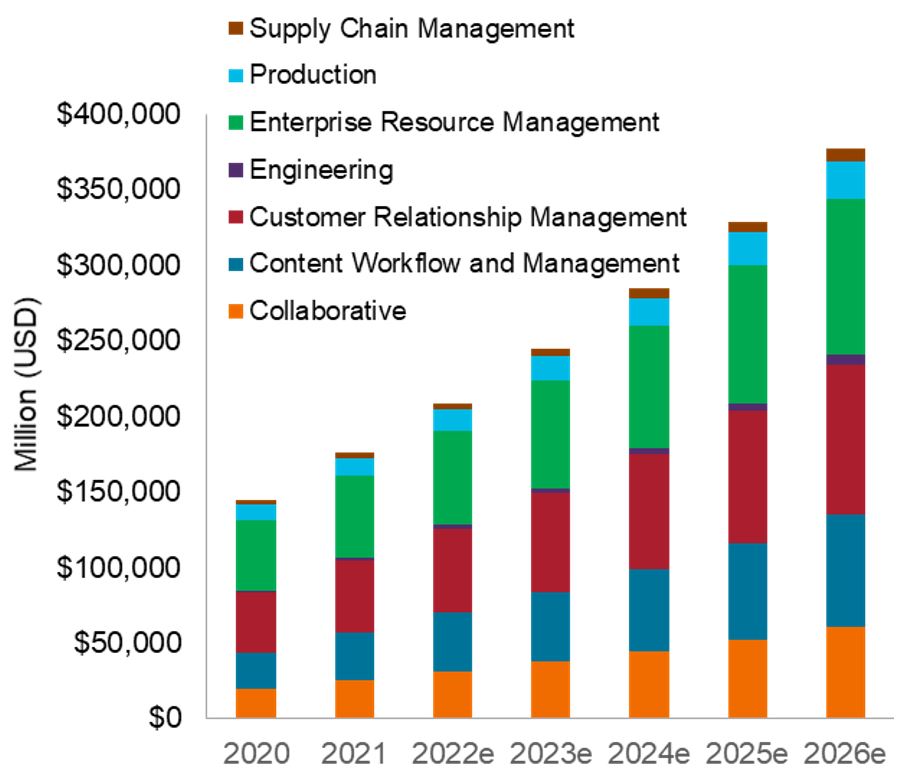

Projected Software as a Service corporate expenditure

Over the next five years, corporate expenditure dedicated to cloud computing applications is expected to continue its recent torrid pace.

Source: Bloomberg Intelligence, as of 30 September 2022.

We have long believed the quality of a company is best measured during economic turbulence rather than in periods where rising tides lift all boats. With the global economy slowing, there is already a bifurcation in tech companies’ financial performance. Higher quality names – not only in the secular-growth space but also within cyclical-growth names – have continued to deliver solid financial performance.

Conversely, many companies are falling victim to another aphorism about tides: who’s exposed when the sea recedes. Some of these are legacy tech names that, through the strength of their cash flow generation, can perform well during periods of market weakness but have nonetheless found themselves on the wrong side of a rapidly digitizing global economy. Despite the potential for attractive near-term yield potential, we believe these names’ secular slide will resume once the economy reestablishes its footing.

IMPORTANT INFORMATION

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.