Key Takeaways

- After providing commercial-free entertainment for more than a decade, Netflix has decided to do the unthinkable: team up with advertisers. As signups slow, the streaming-TV service is joining Disney+ in introducing an ad-supported subscription tier.

- Together, Netflix and Disney have lost more than US$270 billion in market value this year as investors view the change in strategies as a distressing signal.

- As the industry reins in spending and courts advertisers, the “streaming wars” may finally begin to feel less war-like—and no company stands to benefit more than Netflix and Disney.

Netflix ignited the so-called streaming wars by plowing billions of dollars into commercial-free, on-demand content, drawing Disney and other later entrants into a battle to add digital subscribers at razor-thin margins. But now, with new users getting harder to come by, Netflix and Disney are becoming the latest companies to capitulate to a rather familiar revenue model—advertising.

Investors are out of sorts as they watch the industry’s high-stakes streaming endeavor come full circle, back to the very business model that Netflix disrupted 15 years ago and was adamant it wouldn’t adopt. Shares of Netflix have cratered 60% this year alongside a 40% drop at Disney, erasing more than US$270 billion from their combined market values.

The market’s consternation centers on two prominent business models (and acronyms) of the streaming era: SVOD, or subscription video on demand, and AVOD, advertising-supported video on demand. Netflix pioneered SVOD, in which membership fees are the sole source of revenue, while AVOD services also make money from commercials. But it’s increasingly common to see media companies offer both, making an AVOD option available to viewers willing to tolerate ads in exchange for a lower monthly fee. An AVOD version of Disney+ is coming to the US in December for US$8 a month, at which point the ad-free subscription rate will jump from US$8 to US$11. Netflix’s own ad-supported offering will arrive soon after Disney’s and is expected to cost less than US$10 a month, a discount to its standard US$15.49 plan.

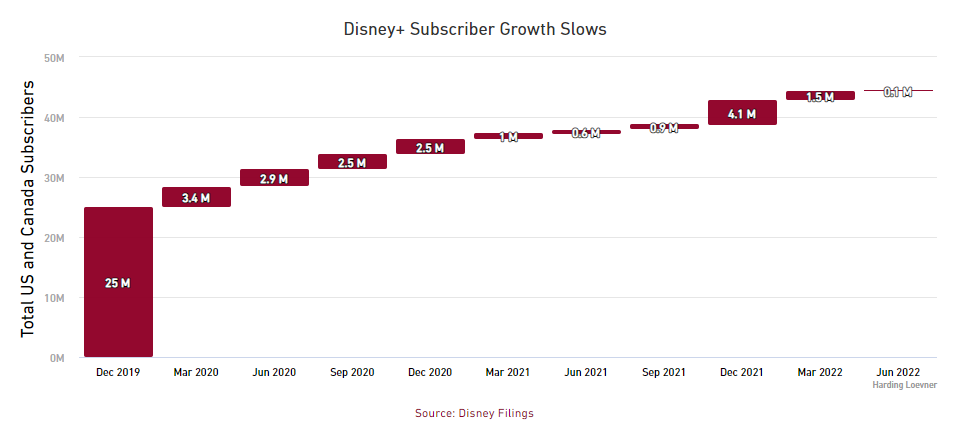

While other services such as HBO Max and Paramount+ have already gone down this path, Netflix and Disney+ are most popular, and so a sudden deviation in strategy raises eyebrows. Shareholders worry it’s a sign of competitive weakness, something that seemed to be confirmed by the companies’ latest operating results. Netflix lost customers in every region except Asia Pacific in the first half of the year, and Disney+ experienced a notable slowdown in US and Canadian subscriber growth. Losses in Disney’s streaming division, which also includes its Hulu and ESPN+ apps, widened to US$1.1 billion last quarter from US$293 million in the same period last year.

According to Harding Loevner analysts Uday Cheruvu, who covers Netflix, and Igor Tishin, who covers Disney, the market is misreading the situation. Cheruvu and Tishin see the new strategies as an effective step to keep revenue growing as the industry matures. Below, Cheruvu and Tishin compare notes on how incorporating ads could help stabilize profits and the competitive environment in the long run—as long as tech giants don’t get in the way.

Igor Tishin: The best path to sustainable high profits for a streaming business is to maximize average revenue per user (ARPU) while managing content costs. A growth strategy predicated on a continuous high volume of new programming couldn’t work long term. It makes sense that Netflix and Disney are abandoning that approach as they reach higher penetration levels and saturation in the US.

Uday Cheruvu: Some would say that’s a convenient view to hold now. I certainly didn’t expect these companies to have to press the AVOD button so soon—did you?

Tishin: No. I’ll admit I underestimated the degree to which streaming signups would accelerate during the pandemic. That acceleration came at the cost of future growth, causing the subscriber gains to stall out sooner than I anticipated. But ballooning content spending has been my concern all along and something I expected Disney to rein in once it achieved a critical mass of subscribers.

My point is that the move to AVOD is being misconstrued as a sign of weakness when in fact Disney+ is jacking up prices in the process. People will be paying the same rate to watch commercials that they had been paying for the ad-free plan, while the cost to avoid commercials goes up. Disney felt empowered to do this because its competition is also cornered and reaching saturation, at least in the US. As an investor, I like this display of confidence by Disney is in reaction to a durable constraint in subscriber growth rather than an intention to spend more on content.

Cheruvu: Investors are worried that the rapid-growth phase of the streaming industry is coming to an end. They’re failing to see that it’s shaping up to be a new period of rationalization and improved profitability as these services leverage their scale. This dichotomy between AVOD and SVOD also is only a recent phenomenon. Magazines and newspapers have nearly always featured subscription fees and ad revenue alongside one another. The same goes for cable TV. Even paying moviegoers sit through ads. A rational equilibrium between consumer pricing and advertising has often existed in media, and each time it produced durable profits for long periods.

The transformative feature of Netflix was never about the S or A (subscription or advertising) but the VOD. Video on demand is displacing traditional live TV because viewers can watch when and how they want. Incorporating ads isn’t a breakdown of the Netflix model, but a recognition that consumers have an entertainment budget reaching its limits and an attention budget that hasn’t been fully tapped yet.

Tishin: My “attention budget” has limits, too! No one is eager to go back to sitting through long stretches of ads. But I do think that if it’s done right, the revenue upside could be quite material with minimal degradation of the consumer experience. Disney+ is capping commercial breaks, as others have done, at 4 minutes per hour.

Incorporating ads isn’t a breakdown of the Netflix model, but a recognition that consumers have an entertainment budget reaching its limits and an attention budget that hasn’t been fully tapped yet.

Cheruvu: Just look at Disney’s other service, Hulu. It shows how valuable a few minutes of consumer attention can be: Hulu has more than 42 million video-on-demand subscribers, and we figure about 70% of those are on the AVOD plan. Hulu generates close to US$13 a month in revenue per user on average, or more than US$2 billion of advertising revenue per year. This suggests net revenues from the US$7 AVOD plan and US$13 SVOD plan may be quite similar because the users who don’t want to pay that additional US$6 a month are willing to watch US$6 worth of ads. That’s equilibrium pricing at work.

Now, look at Netflix’s current share price. It assumes muted user growth and muted ARPU. This is overly bearish. The ARPU accretion that Hulu has achieved implies that Netflix’s AVOD plan will increase margins and attract consumers who remain unwilling to pay SVOD rates.

Tishin: My suspicion is that the margins from AVOD are likely to end up even higher than SVOD as advertisers come to appreciate that direct-to-consumer services offer greater precision in targeting viewers than the old days of TV.

Cheruvu: That’s plausible, but let’s get at the question investors have grappled with most: How can streaming services be profitable while providing more content for a lower price than traditional cable? It’s because the VOD model displaces a big part of the linear-TV value chain, the distributors.

Distributors, such as cable providers or satellite companies, served as powerful middlemen between programmers and viewers. They consumed a chunk of the industry’s profits, frequently earning between 30% and 40% EBITDA margins. Now, users are bypassing cable providers, which creates savings. Netflix and others have been transferring this savings to viewers in the form of increased output and relatively low prices so they could quickly amass users.

Tishin: Another feature of the streaming business model is that at a certain level, there is a low correlation between the number of subscribers to a service and the amount of content available on that service.

Cheruvu: That’s true. The relationship between content growth and subscriber growth breaks down at a certain point. There is only so much time people can spend streaming. Once a content library has both breadth and depth, subsequent content outlays have little effect on the total addressable market or stickiness of current users. Different packages at different prices are needed to sway consumers who are holding out.

This ties back to why we’re seeing VOD platforms including Disney+, Netflix, and HBO Max start to curb content spending. The cost structures are becoming more rational, and the savings from not paying the distributor margins will start to be withheld to improve profitability.

Tishin: That is the key point investors are overlooking. Adopting an AVOD strategy doesn’t just introduce another revenue stream. It allows the companies to switch their focus from subscriber growth to widening the profit margin on each customer. What we’ll need to watch for is any impact on churn, or the rate of cancellations.

The relationship between content growth and subscriber growth breaks down at a certain point.

Cheruvu: Netflix has had the lowest churn in the industry and will need to be especially careful in how it implements ads so it doesn’t tarnish the user experience. It can manage churn and retention costs to some degree through changes to content frequency. For example, Netflix released the latest seasons of Stranger Things and Money Heist in two blocks instead of all at once. This motivates users to stay subscribed. It’s possible that Netflix, whose rivals generally release episodes week to week, will even ditch its binge model entirely.

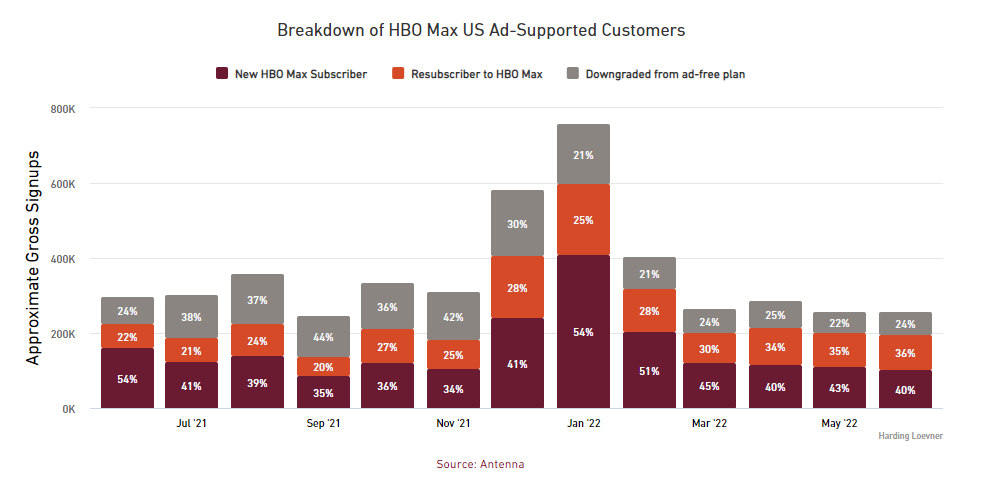

In any case, subscriber trends at rival HBO Max, which is now owned by Warner Bros. Discovery, are encouraging for Netflix and Disney. Data from Antenna show that HBO Max’s US$10-a-month AVOD plan is bringing back users who had previously canceled the US$15 commercial-free version. This suggests AVOD has the potential to reduce churn materially.

Tishin: The more adept the top players get at managing demand across different entertainment budgets, the less room they leave for competitors to fill those holes. Disney has a long and successful history of utilizing these sorts of price-discrimination strategies and managing demand elasticity, but in its theme-parks business. For example, as domestic park attendance has bounced back, per-capita guest spending has more than recovered, jumping 40% from pre-pandemic levels. Disney is wringing out more money from each customer just like it’s trying to do on the streaming side.

Cheruvu: At the end of the day, the best markets are those in which a small number of participants have a disproportionately high influence on competitive dynamics, as Disney and Netflix do in streaming. The value of this influence isn’t being fully realized yet, though, which is what drew an activist investor to Disney. (The investor is urging the company to spin off ESPN and acquire the rest of Hulu from Comcast, among other ideas aimed at streamlining the organization.)

Tishin: I’m not convinced that Disney should part with ESPN, but I agree that it can put Hulu to better use. Bob Chapek, Disney’s chief executive officer, recently said he’s considering making Hulu part of Disney+. Hulu can be the brand through which it provides R-rated content to create a more complete offering worthy of a higher subscription fee. I see an opportunity to build a parallel R-rated universe anchored by Hulu and enhanced by augmented-reality (AR) and virtual-reality (VR) capabilities that are particularly suitable for action content.

Cheruvu: Speaking of AR and VR, Disney and Netflix need to be thinking about technologies that threaten to disrupt TV entertainment next. Among the things that could break the oligopolistic dynamics these companies are beginning to enjoy is the risk of consumer behavior changing because of some new disruptive medium, such as the metaverse. We saw how drastically consumer behavior changed once the pandemic hit.

Tishin: Sure, but it’s not like Disney and Netflix have to be the only streamers left standing. So far, consumers are demonstrating that there’s room in their entertainment budgets and “attention budgets” for several services. The tail of competition could be long and niche with minimal harm to the top players.

The main threats are well-capitalized entities looking to monetize content through means other than subscriptions or ads. Amazon Prime Video and Apple TV+ (home to series such as The Boys and Ted Lasso, respectively) could make more significant content investments aimed at driving Prime memberships and device sales. While these “free” streaming offerings aren’t taking anything extra from consumers’ wallets, they do threaten to reduce Netflix and Disney’s pricing power and the time users spend on those apps. Engagement is key to making an AVOD strategy work.

Cheruvu: When it comes to pitching advertisers and monetizing an audience, Disney is of course well ahead of Netflix, which is teaming up with Microsoft.

Tishin: Netflix is off to a good start, though. Two top executives from Snap—a social-media platform that generates more than US$1 billion of ad revenue each quarter—just left to run ad sales for Netflix.

Cheruvu: This is a very good start for Netflix indeed. With internet companies slowing hiring and retrenching (even TikTok is reducing staff), there is room for Netflix to quickly build an effective team at a reasonable cost. It’s a rare opportunity.

With internet companies slowing hiring and retrenching, there is room for Netflix to quickly build an effective team at a reasonable cost.

Tishin: So, key ad folks are starting to make the leap from social media to streaming. It makes you wonder, will the ad dollars follow?

Cheruvu: Social media’s superior ad-targeting capabilities are what drove ad budgets from traditional TV over to mobile platforms such as Snap and Facebook. Armed now with their own granular user data, Netflix and Disney have a chance to reverse the flow back to the TV screen. It’s not going to be easy. But just when investors seem to be giving up on these streaming services, they finally have a long-term business model.

Contributors

Analysts Uday Cheruvu, CFA and Igor Tishin, PhD contributed research and viewpoints to this piece.