by Julian Howard – Lead Investment Director, Multi-Asset Solutions

Review

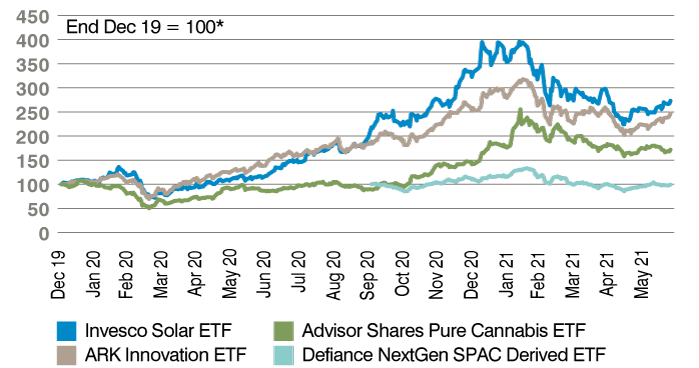

The second quarter of 2021 saw the MSCI AC World Equity Index in local currency terms gain 7%, adding to the 6% that had already been posted in the first quarter. A heady combination of US economic recovery amid significant ongoing monetary and fiscal policy support saw investors happily support equity markets. Such dips as there were along the way were quickly bought into by the wall of liquidity sitting on the sidelines. However, debate heated up about inflationary pressures in the global economy generally, and the US economy in particular. The latter posted a Consumer Price Index print of 5% on the previous year for May, well in excess of the Federal Reserve’s (Fed’s) 2% target, albeit using a slightly different measure. In meetings and interviews, Fed Chair Jay Powell stuck to the line that near-term inflation was ‘transitory’, implying that near-term interest rates would not have to be raised. The market’s indecision about whether to buy into this or not played out in style leadership: cyclical and value stocks fared well in April and May but by June the baton had returned to the growth style, including large-cap technology stocks. Either way, the strong relative performance of the US economy lent support to a strengthening US dollar in June, hampering progress in emerging market equities whose trade receipts and external debt are often denominated in US dollars. In fixed income, long-dated government bond yields in the form of the 10-year US Treasury fell to around 1.5% off a 2021 high of 1.7% at the start of the quarter as global bond investors both sought yield and downplayed long-term inflation expectations. Corporate bonds also remained expensive, with high yield ‘junk’ offering barely 2.8% more yield than the US Treasury note. This raised the issue of investor exuberance amid the wall of central bank-supplied liquidity. ‘Story stocks’ such as the Ark Innovation and Invesco Solar exchange traded funds saw significant volatility, but perhaps the most extreme example of investor speculation was the meteoric rise in the stock of US furniture maker Ethan Allen Interiors. While the firm is structurally well positioned to benefit from the US housing boom currently in progress, it is also noteworthy that it shares its market ticker ETH with the Ethereum cryptocurrency.

Chart 1: Evidence of speculation in the ups and downs of the ‘story stocks’

Source: Bloomberg. Past performance is not an indicator of future performance and current or future trends. Data from 31 Dec 2019 to 23 Jun 2021.

Positioning

The earnings yield for most developed market equities remained significantly above the corresponding risk-free rate, and in the US this equity risk premium hovered around 3% for most of the quarter. This suggested continued equity engagement across our multi-asset strategies. Within equities, we had pragmatically made some concessions to value stocks since the Pfizer vaccine announcement in November. This took the form of reducing some exposure to US large-cap technology, increasing our European equity allocation which could benefit as growth prospects improve and removing our allocation to quality stocks which have tended to mirror the performance characteristics of said US large-cap tech stocks. Tactically, we maintained a market-neutral value position and a short US Treasury stance, based on continued upward revisions to growth and inflation expectations. This process of being less insensitive to the recovery was concluded during the second quarter and now our equity allocation is mildly biased towards those stocks that could benefit from a low-growth, low-interest rate world in the long term having previously been heavily skewed towards it. Away from equities, our capital preservation exposure remained dominated by fixed income and credit, aiming for consistency and reliability over time. These included agency and non-agency mortgage-backed securities, insurance-linked bonds and very short-dated investment grade securities. Finally, our modest alternatives allocation was made up of an equity long / short and a merger arbitrage strategy. Simplicity and proven reliability remain relatively elusive in this asset class, but we recognise that the opportunity set remains significant.

Outlook

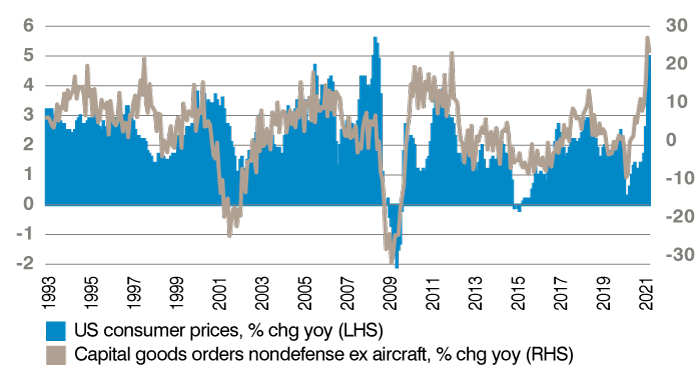

The economic rebound from over 12 months of on / off lockdowns around most of the world is a transitional period and as such, a poor one from which to judge the long-term trajectory of growth and inflation. Consumers had built up savings while marooned at home and are now keen to spend them. Such ‘revenge consumption’ is driving up prices in those sectors most hurt by lockdown measures, including hospitality, leisure and autos. At the same time, labour shortages are persisting as the withdrawal of furlough and other government support for workers is outpaced by re-opening and – in the US at least – the rapid withdrawal of guidance around social distancing. These inflationary trends are likely to abate as the year goes on and supply curves shift to meet demand. Furthermore, higher prices today are stimulating enormous corporate investment in automation and technology, a trend that has historically limited future inflation (please see chart 2). It is therefore highly likely, in our view that both pricing pressures and economic growth itself will settle back down going into 2022 and beyond. The International Monetary Fund’s latest World Economic Outlook has forecast US GDP growth of 1.4% for 2023, compared with the 2.2% actual growth rate posted for the last full pre-pandemic year of 2019. Beyond the immediate recovery and all its distortions, therefore, a more familiar pre-pandemic world awaits. The old challenges that together form the dismally compelling argument for secular stagnation will likely reassert themselves, namely: excess savings, low economic growth, inequality, ageing workforces and climate change. On this basis, monetary policy support is likely to stretch long into the future, supporting equity markets generally and long duration assets like technology stocks and long-dated government bonds in particular. Secular themes such as environmental, social and governance (ESG) investing along with the near-certain ascendancy of China within global capital markets will play key additional roles in investor portfolios in the coming years. Strategically market-timing the noise around near-term inflation or speculative story stocks therefore makes little sense when capital can instead be deployed to take advantage of longer-term trends with more solidly anchored fundamentals.

Chart 2: Inflation historically self-limiting as it encourages corporate investment

Source: Bloomberg. Past performance is not an indicator of future performance and current or future trends. Data from 28 Feb 1993 to 31 May 2021.