The second busiest June 30 reporting period is ahead of us this week with 41 ASX 200 companies due to report.

Fortescue and Super Retail Group (Monday), Ansell, Oil Search, Scentre and Stockland (Tuesday), Adelaide Brighton and Worley Parsons (Wednesday), Flight Centre and Nine (Thursday) Harvey Norman, Boral and Woolworths (Friday).

Seven West Media and Seven Group Holdings will also report (Seven West Media is no longer a member of any major index) except the broad All Ords)

Apart from them there’s only a handful of outliers to report after Friday – Brickworks, Soul Patts, Myer, Premier Investment, Kathmandu and the NAB, Bank of Queensland, ANZ, Westpac and Incitec Pivot and Nufarm.

AMP chief economist, Shane Oliver says the June profit reporting season is now 70% complete by companies and 80% complete by market capitalisation.

“While its clear that company earnings and dividends have been hit hard by the coronavirus shock, the hit has not been as bad as feared and most companies appear quite resilient and this, in turn, has enabled a majority (or 59%) of companies share prices to outperform the market on the day they reported and for the market as a whole to rise so far through August,” he wrote in his latest weekly note.

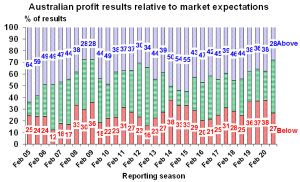

“In this sense its been similar to the US June quarter earnings reporting season. So far only 28% of results have exceeded expectations compared to a norm of around 44% but at least misses have only been 27% so beats have roughly matched misses.

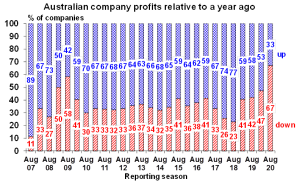

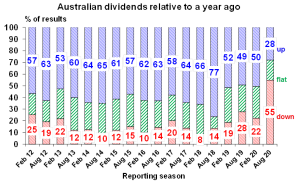

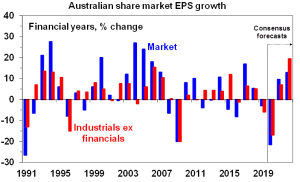

“Only 33% of results have seen earnings rise from a year earlier (compared to a norm of 66%) and 55% have cut dividends (compared to a norm of just 16%). So far consensus earnings expectations for 2019-20 have fallen slightly to -21.6% (from -21% two weeks ago) and this will be worse fall since the early 1990s recession,” Fr Oliver noted.

Financials are being the hardest hit with the consensus expecting a -29% slump in earnings led by insurers and the banks, followed by industrials with a -15% fall in earnings and resources with -12%, though Fortescue’s results this week could very well change that.