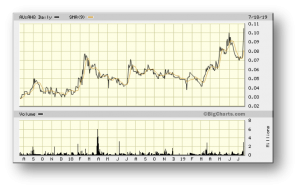

Allegiance Coal – (ASX: AHQ, Share Price: $0.105, Market Cap: $46m, coverage initiated @ $0.022 in June 2017 – current gain of 377%)

Key Catalyst

Acquisition of fully constructed and permitted New Elk hard coking coal mine in Colorado, USA that bridges the gap between permitting and construction of its Tenas Project in Canada.

AHQ has performed strongly since our coverage initiation during June 2017, with an almost five-fold price gain. AHQ nevertheless remains somewhat of a quiet achiever, with a relatively low market profile despite the tremendous advances made at its Tenas metallurgical coal project in northwest British Columbia. The project is an enormously attractive development opportunity, with its primary attractions being the potential for low-cost production, strong operating margins and modest start-up costs. The project is being methodically de-risked, with two PFS completed and the recent on-time release of a Definitive Feasibility Study (DFS). The project’s attractive fundamentals have generated strong interest from Asian steel mills and led to a formalised binding agreement with Japan’s Itochu to establish the Telkwa Metallurgical Coal Joint Venture, which will help fund the Tenas project into development.

Latest Activity

New Elk Mine Acquisition

AHQ has broadened its North American coal exposure with the planned acquisition of the New Elk Coal Mine in Colorado, USA. The mine is fully constructed, permitted and production-ready, with a National Instrument 43-101 hard coking coal resource comprising 656Mt. Completion of the purchase must take place before 14 July 2020, although AHQ hopes to complete the transaction significantly earlier. AHQ aims to bring the New Elk mine out of care-and-maintenance.

AHQ has entered into a binding and conditional terms sheet to acquire all of the shares in New Elk Coal Company (NECC), which owns the New Elk hard coking coal mine in southeast Colorado. The mine has been on care-and-maintenance since late 2012, following the fall in coking coal prices and the subsequent bankruptcy of NECC’s shareholder, Cline Mining Corporation.

The purchase price for the shares in NECC is US$1, with NECC being debt-free except for debt owing to Cline totalling C$55M. The debt will be repaid by NECC to Cline as follows: US$3M in cash on completion of the acquisition of the shares in NECC; US$3M in AHQ shares issued upon completion; US$5M to replace the Colorado State Mine reclamation bond upon completion; balance to be repaid from an agreed percentage of mine operating cash flow.

Under the Terms Sheet conditions, AHQ must complete the following:

- Undertake legal and financial due diligence by 14 September 2019

- Review the mine geological model by 14 October 2019

- Undertake a feasibility study to develop a mine plan for production by 14 April 2020

- Raise US$5M to replace the Colorado State Mine reclamation bond by 14 June 2020

- Raise US$3M to meet the cash payment part of debt reduction by 14 June 2020

- Raise sufficient working capital to bring the mine back into production by 14 June 2020

- Obtain shareholder approval for the purchase by 14 June 2020

- Enter into transaction documentation with Cline by 14 June 2020

- Complete transaction no later than 14 July 2020

Project Overview

The Raton Basin hosts low-sulphur, mid to high volatile hard coking coals, typically with excellent plasticity that is an important element in the blending of coking coals in blast furnace steel production.

The New Elk Mine was originally named the Allen Mine that commenced production during 1951, supplying coking coal to the Pueblo steel mill located 100 miles to the north. During the late 1970s, the Pueblo mill transitioned from blast furnace steel production to electric arc furnace, no longer requiring hard coking coal. Notwithstanding this, the Allen Mine continued production through to 1989 by supplying coal to local power utilities, whilst the wash-plant continued operating until 1996 by servicing neighbouring mines.

Figure 1: Historical Portal Entry into the Allen Mine

While existing rail near the mine could transport coal 950 miles to the Gulf of Mexico, a lack of nearby coal handling facilities at ports meant the coking coal could not access the export seaborne market. That has now changed with a coal terminal nearby in Houston Bay and a dry bulk handling facility at Corpus Christi that can also be developed into a coal terminal.

More recently the mine was acquired by Cline during 2008 for C$17 million and in 2010 was re-opened as the New Elk Mine. Cline upgraded the mine infrastructure, including the wash-plant and supporting infrastructure, developed a second underground portal entry and recommenced production – all at an estimated capital cost of some C$150 million.

Production recommenced in 2011 with production of saleable coal intended for sale on the global seaborne market via the port of Corpus Christi, with plans to increase production once the underground headings were fully developed (allowing several production panels) and rail from the mine to the loadout had been re-installed.

The mine operated for several months, but was forced to close in July 2012 when world hard coking coal prices plummeted. Cline subsequently filed for bankruptcy protection that resulted in all liabilities being extinguished, with the senior secured creditor ultimately taking ownership of Cline and its subsidiary NECC. The mine has remained on care-and-maintenance ever since.

Technical Significance

AHQ has been on the lookout for a quality hard coking coal mine in north America that could generate cashflow in the very near-term and bridge the gap between permitting and construction of its flagship Tenas metallurgical coal project in British Columbia. The rationale is clear – with AHQ’s management team based in Vancouver to support the development of its Tenas project – North America has been the logical place to grow the company’s coal production ambitions.

New Elk meets all of AHQ’s key criteria, comprising – mine permitting, low start-up capex, low opex and good quality hard coking coal. The mine also boasts thicker coal seams compared to that typically seen in US coal mines, potentially making it one of the lower-cost producers of hard coking coal in the USA.

Previous owner Cline during 2011 invested US$62.5M in surface and underground equipment, including a US$8.5M upgrade of the wash-plant. These assets remain intact and on-site, and appear to have been well maintained.

Figure 2: Aerial view of the New Elk Coal Mine today – ROM and Product pads, CHPP and twin storage silos.

Summary

With its New Elk coal mine acquisition, AHQ has obviously looked to leverage off its knowledge and connections with respect to North American coal. The acquisition makes sense, given AHQ’s development of its Tenas coking coal mine in Canada and the location of its management in Vancouver. Furthermore, the deal helps plug the gap between the timeline associated with Tenas’ development and the company’s desire for near-term earnings. AHQ will now have the best part of 12 months to complete due diligence and formalize the New Elk acquisition.