The second big week of the US March earnings season ahead with 164 S&P 500 companies (and five of the Dow 30) down to report and so far it is looking a bit better than forecast.

The coming week will be dominated by reports from Alphabet (Google) early tomorrow, our time and Apple (early Wednesday morning, our time), General Motors and General Electric.

A better than expected result from Apple will see the market bounce higher – a weak result will undermine confidence in the stock and tech sector despite Amazon’s outperformance.

Others reporting include Loews, US Steel, Mastercard, Amgen, Pfizer, CBS, Discovery, Dow, DowDupont, Expedia, Under Armour, CVS, Gannett, Kraft Heinz, Sprint, Qualcomm, KKR & Co, McDonald’s, Baker Hughes, Conoco Phillips, Volkswagen, Mondelez, Yum Brands, Kellogg, Fiat Chrysler and HSBC.

Saturday sees the legendary annual meeting of Berkshire Hathaway in Omaha to be presided over by Warren Buffett, plus Berkshire’s third-quarter results.

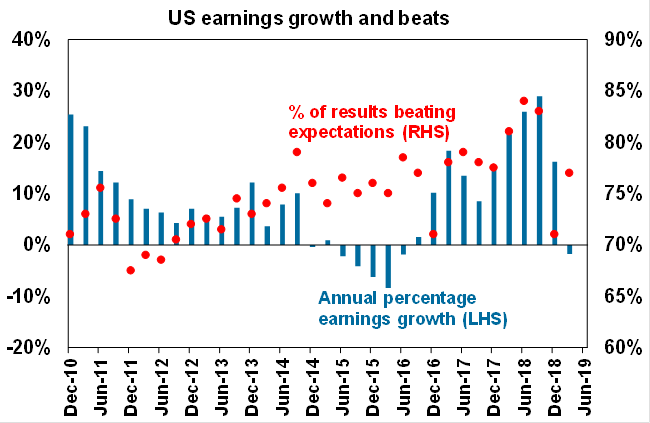

With around 48% of the 500 companies in the S&P 500 having already reported up to Friday’s close 77% have beaten market forecasts on earnings and 54% on revenue (see graph).

According to the AMP’s Chief Economist, Shane Oliver “With a normal beat rate earnings growth is likely to end up around 2.5% higher on a year ago and this is likely to mark the low point for this year.”

As a result of the better than expected flow of results (Amazon, Facebook, but not 3M Co which shocked with a weak result last week) profits at S&P 500 companies now appear on course for another quarter of growth instead of the fall predicted as late as a week ago.

A year ago, S&P 500 profits grew 26.6% year-over-year, and at present, this year’s first-quarter earnings are forecast to be flat, although profits among companies that have reported so far are up around 7%.

Technology, since the start of the year, has been the best performing of the major S&P sectors, with a gain of 26%. Financials are up 18.4%, but health care has been the worst performing sector, up just 2.5%