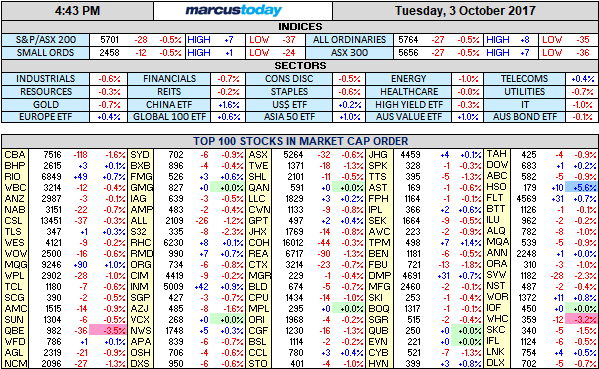

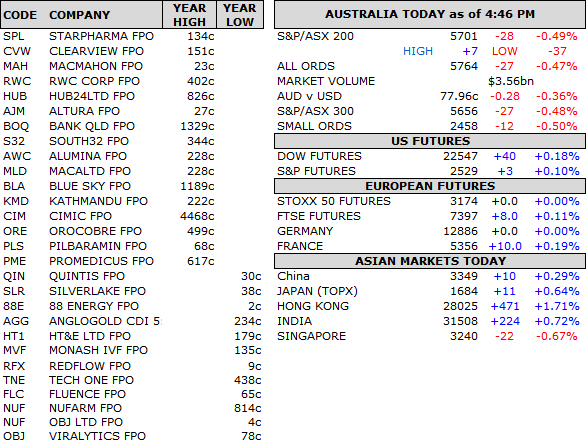

Market summary

- ASX 200 falls 28 to 5701 as rally fades on metal weakness.

- QBE downgrade hurt sentiment early.

- High 5736 Low 5694.

- RBA leaves rates unchanged.

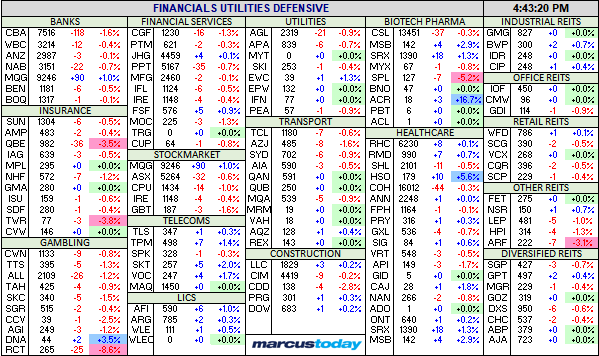

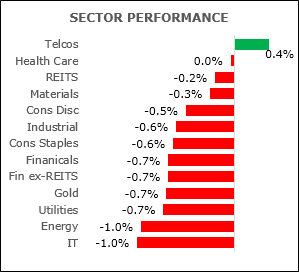

- Banks and financials mixed.

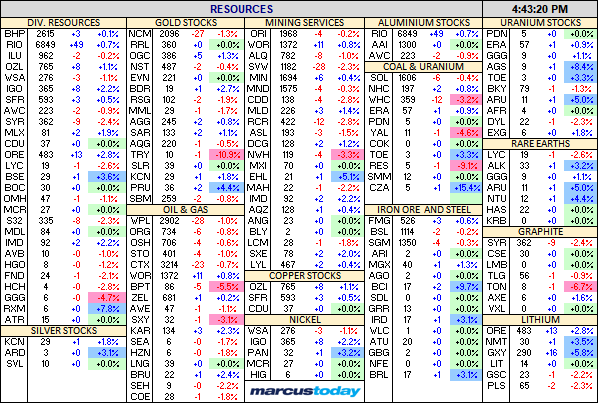

- Miners slip. Energy under pressure on crude falls.

- Healthcare stocks slip with staples weaker.

- AUD falls below 78c on RBA news.

- US Futures up 40.

- Asian markets pushing ahead though China closed. Hong Kong up 1.70% and Japan up 0.89%.

MT STUFF: No new trades. Stop loss moved up in one.

Movers and Shakers

- HT1 -12.20% after losing Adshel contract with Yarra trams. Wins Metro trains contract.

- A2M -2.59% on broker downgrade.

- SM1 -0.97% broker downgrade and profit taking.

- PAC -13.37% agrees to sell 40% stake in Investors Mutual for $120m.

- ORE +2.77% lithium stocks continue to attract attention.

- BLA +3.77% on the annual report and chairman’s letter.

- ASB +5.79% wins new supply contract with Navy.

- MQG +0.98% string buying continues.

- GXY +5.84% agreement with Panasonic to provide lithium.

- EUC +17.65% on more ground secured for metals project at Dobsina.

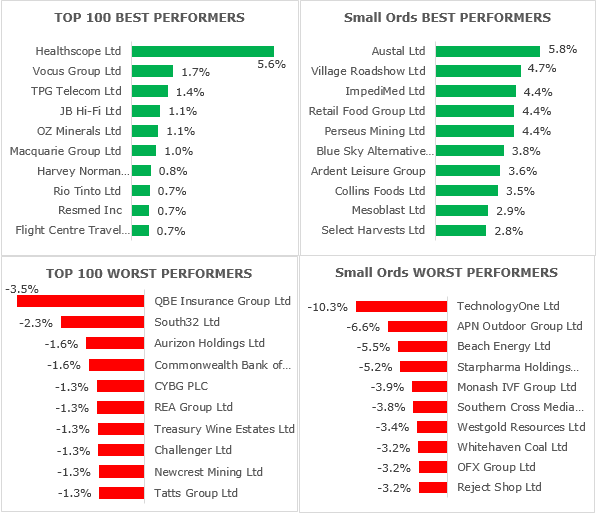

- HSO +5.63% rises on takeover speculation.

- SHL -0.52% wins UK JV contract with NHS.

- Speculative stocks of the day: CTM +66.67% after identifying high grade iron ore targets at Salobo West.

- Biggest risers – GXY, ASB, HSO, CKF, RFG and MSB.

- Biggest fallers – HT1, TNE, BPT, WHC, QBE, HSN and AHY.

FUTURES AND HIGHS AND LOWS

TODAY

- iSelect (ISU) -0.63% increased its interest in iMoney, the largest regional consumer product comparison site in South-East Asia, from 23.8% to 51.5%. The transaction was worth US$4.15m of shares. ISU also intends take control and invest US$4m in iMoney’s growth strategy, with the power to appoint three of the five board members.

- Vocus Group (VOC) +1.65% Started the renewal of its board members over the next year. The current chairman, David Spence has not stood for re-election, Robert Mansfield is the new Deputy Chairman and Vaughan Bowen is the new chairman.

- Sonic Health Care (SHL) -0.52% its UK joint venture, Health Services Laboratories (HSL) has won a 12-month contract to provide pathology/clinical laboratory to the Barnet Hospital and the Chase Farm Hospital. The contract is worth £12m per annum. Sonic Health Care owns 51% of the joint venture.

- QBE (QBE) -3.54% Increased its large individual risk and catastrophic claims allowance to $1.75bn following a period of wide spread natural disasters. The company says this will likely be the costliest year in the history of global insurance companies and the group moves its combined operating target range to 100.0%-102.0%. This is likely to impact earnings by $600m.

- Mineral Resources (MIN) +0.36% signed a non-binding agreement with Hazer Group (HZR) for the development and scaling of a commercial synthetic graphite facility. The companies have said they intend to sign a binding co-operation agreement in the near future. The facility aims to produce ultra-high grade graphite. Initially a test facility will be developed and if successful, a commercial plant will be developed with the capacity to produce 1000tpa of graphite. The end goal is to expand to production levels of 10,000tpa.

- Northern Star Resources (NST) -0.41% has entered into an agreement to buy Tanami Gold’s interest in the western Tanami Project for a proposed transaction of $4m.

- Technology One (TNE) -10.26% downgraded profit growth guidance to between 7%-9% from 10%-15% after a slower than expected return to profitability in its consulting business. Company forecasts revised to $5.4m instead of previously forecast $8.2m, and is now expecting an underlying profit of 20% after what the CEO described as “one of the most challenging” years in 30 years of business.

- Short positions in the big four banks have risen 7 bps on average to 0.82% over the last week, CBA being the exception.

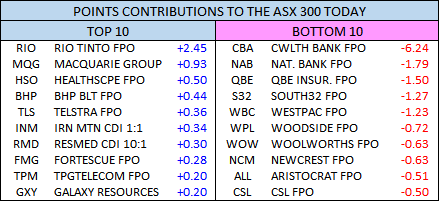

POINTS

BEST AND WORST

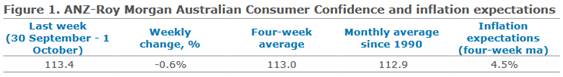

ECONOMIC NEWS

RBA leaves rates unchanged at 1.5% as expected. Full statement available here.

- Conditions in the global economy improved.

- The Australian economy expanded by 0.8% in the June quarter.

- Inflation remains low and expected to pick up gradually as the economy strengthens.

- Wage growth remains low. This is likely to continue for a while.

- The higher exchange rate is expected to contribute to continued subdued price pressures in the economy.

- Low interest rates continue to support the Australian economy.

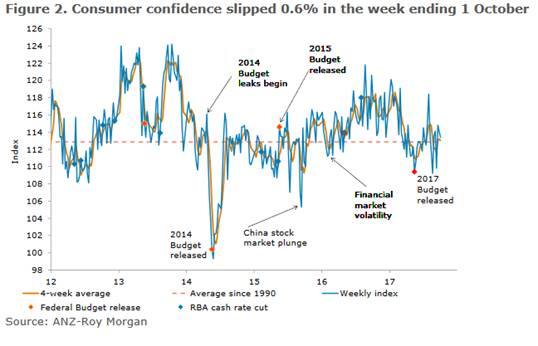

- Residential building approvals for August were largely as expected, up 0.4% m/m against expectations of a 1.0% increase (NAB: 1.7%). Detached house approvals are showing strength while apartment approvals have stabilised.

- Toyota closed its Victorian car manufacturing plant today after Ford closed its doors in October last year and Holden closed its Adelaide plant on October 20.

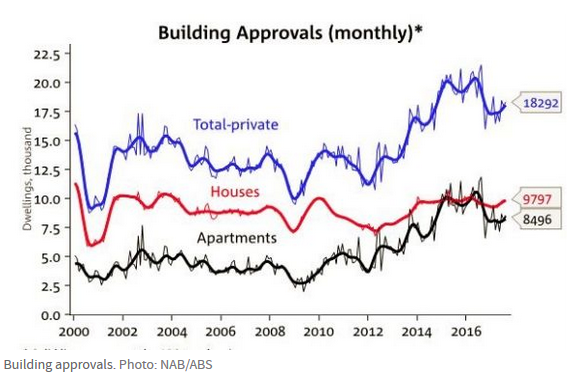

BOND MARKET UPDATE

ASIAN MARKET

- China will launch a national emissions trading scheme by the end of the year.

EUROPE AND US MORNING HEADLINES

- Monarch Air files for bankruptcy. UK biggest airline failure. British government to arrange return of 110,000 passengers.

- Tesla fails to deliver with only 260 Model 3s built in the last quarter against forecasts of 1500. Tesla produced 25,336 vehicles in the third quarter, down slightly from the three months ended in June. Tesla has a market cap of US$57bn. BMW has a market cap of €56bn.

- Euro at 6-week lows as Catalan vote weighs on sentiment. Moody’s issued a warning on negative credit implications from any succession.

- The Bank of England unveiled new requirements to the UK banks to be able to ‘bail in’ money in times of trouble. 28% of the debt that banks issue by 2022 will have to be the type that can be readily swapped for equity in certain conditions. Banks need to set aside another £116bn in debt to satisfy the new requirements.

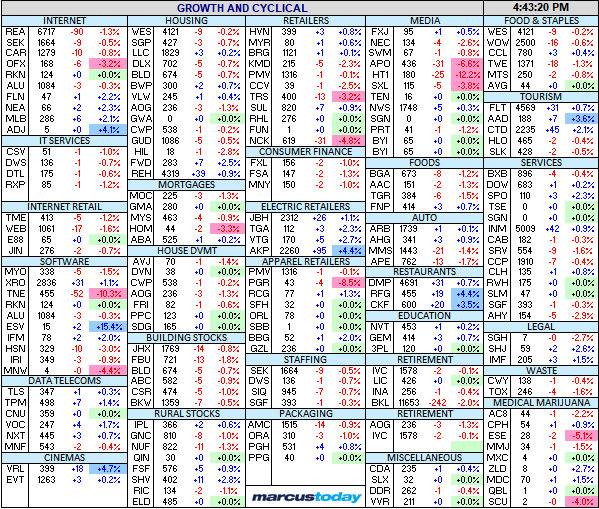

MARKET MAP