The US Presidential Election: Some Investment Considerations – ZYUS and ZGOL

Key Points:

- Both US Presidential and Congressional elections are important and could bring about different outcomes in financial markets.

- Defensive equities aim to reduce exposure to market volatility:

- ANZ ETFS S&P 500 High Yield Low Volatility ETF (ASX code: ZYUS) offers exposure to the US equity market with a bias towards low volatility stocks.

- Year to date total return of 10.42% p.a. (Source: Bloomberg as at 26 September 2016)

- Historically gold has served as an event risk hedge:

- ANZ ETFS Physical Gold ETF (ASX code: ZGOL) gives exposure to physical gold

- Year to date total return of 14.31% p.a. (Source: Bloomberg as at 31 October 2016)

US Elections – Not just the Presidential Election

Besides the presidential election, another focus of the US elections is the rivalry between Democrats and Republicans for the congress seats.

The Republicans currently control more than 50% in both the Senate and the House of Representatives. Despite the latest polls indicating that Clinton is more likely to win the presidency, whether the president’s party can also win majority seats in at least one chamber in the Congress, has become another key question.

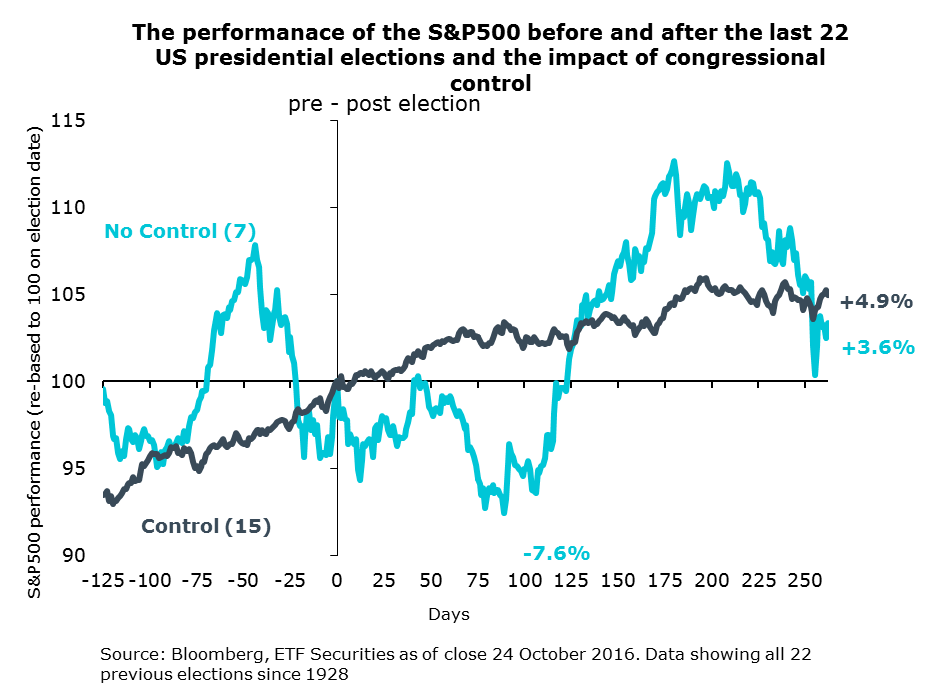

To assess the impact to the market under different scenarios, ANZ ETFS’ joint venture partner ETF Securities Limited has analysed all 22 previous US elections since 1928. On the situation in which the sitting president has no control of either the House or the Senate, political uncertainty and inability to push through promised reforms take their toll on market confidence. Historically, in the first quarter after the election, the S&P 500 had dropped an average of 7.6% p.a.

Presidential Election – Changing the Party Controlling Presidency

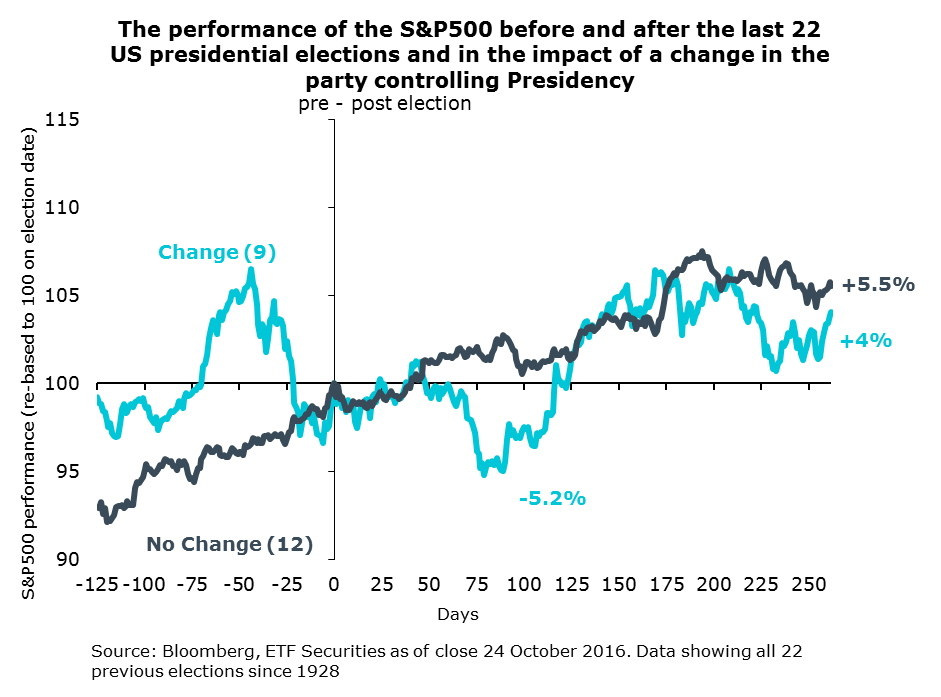

Whilst it is hard to quantify the market impact if Trump were to win, we are able to compare the past performance of different assets when the party controlling the presidency has changed (Republicans to Democrats or vice-versa).

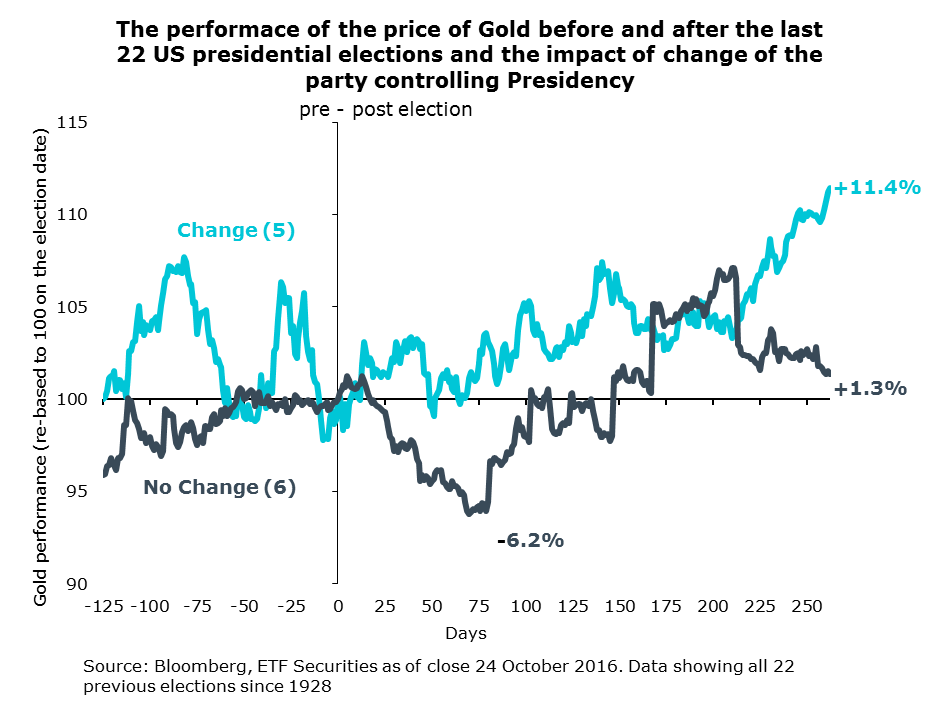

By comparing the performance of S&P 500 and gold prior to and a year after each election, we see that a change in the party had created a more volatile equity environment and often led to equity market sell-offs, which is very similar to those where the sitting President has no control of Congress.

The above chart shows that gold, which is usually regarded as a safe-haven asset, can be used to hedge event risk. As you can see, gold usually experiences a sell-off within the first quarter when there is no change to the Presidential Party. On the other hand, when there has been a change in the Presidential party, gold has historically fluctuated but rallied over the longer term.