It was ‘a flash in the pan’ according to the National Australia Bank in its monthly survey of business conditions and confidence yesterday as it revealed business conditions and confidence both fell in September.

In fact business conditions last month fell their lowest in four months as soft forward orders prompted destocking and competitive pricing that appeared to have weighed on profitability, a move the NAB said “appears to have been a flash in the pan.”

The news didn’t bother the stockmarket which was in full flight – upwards in a rare positive day’s trading – more a big relief rally though than anything substantive.

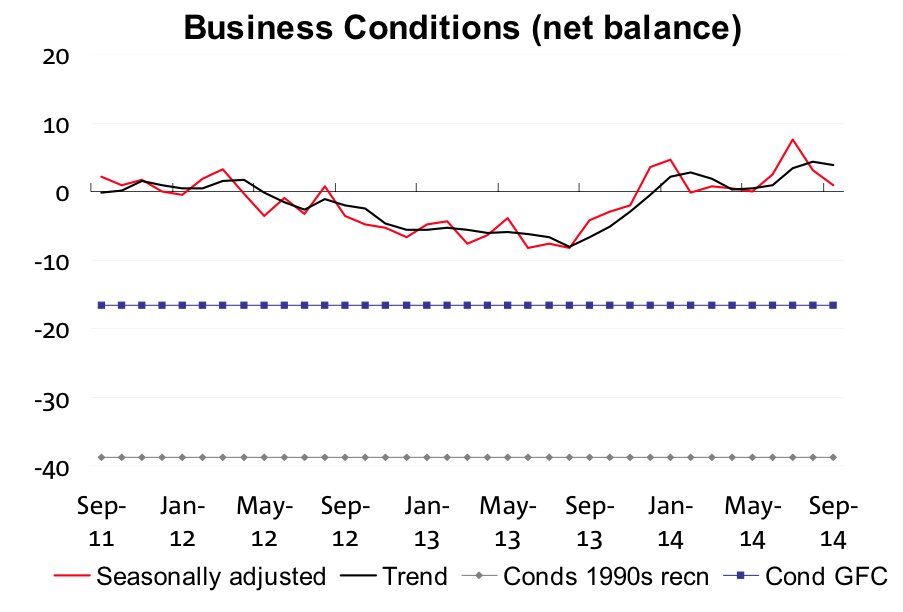

The NAB’s survey of more than 400 firms showed its index of business conditions fell to +1 from +3 in August, retreating further from July’s multi-year highs.

“Most industries recorded a drop in September, although transport & utilities were surprisingly strong (falling oil prices and removal of carbon tax?),” the NAB said.

"Forward orders eased again, implying Q3 domestic demand will remain soft. Capacity utilisation also fell noticeably.

“A drop in profits and employment drove conditions lower, with the latter moving significantly into negative territory – in contrast to some other labour market partials.

"Forward indicators are soft, but trend conditions in the ‘bellwether’ wholesale industry are a little less weak. Our wholesale leading indicator implies soft underlying conditions and below trend growth in Q3,“ according to the bank.

Better conditions eroding away

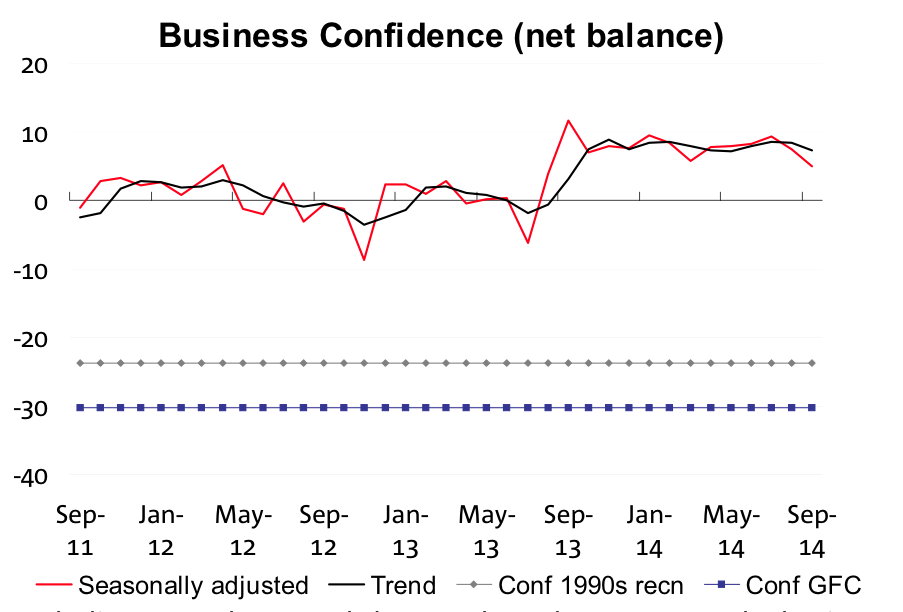

And the report’s index of business confidence also dipped, losing 2 points to +5, while its measure of employment fell to -4 from -1, pointing to a subdued labour market.

In fact it is the lowest level for confidence since before the September 2013 Federal poll.

"Forward orders remained soft, prompting de-stocking and competitive pricing which appears to have weighed on profitability. Confidence varies significantly across industries, with services firms the most optimistic,” the NAB said yesterday.

"The effects of soft national income growth – a function of lower commodity prices, excess capacity and cautious spending behaviour – are being felt across the economy," said Alan Oster, chief economist at NAB. “This has been reflected in most industries."

Confidence surprisingly robust

Looking through the monthly volatility, NAB said while the trend in business conditions still looked reasonable, it will slow significantly if things don’t improve soon.

For the Australian economy, the NAB said a combination of slowing global growth, weaker Q3 and terms of trade means Australian GDP forecasts revised down modestly: 2014/15 2.8% (was 2.9%) and 2015/16 3.2% (was 3.4%). Unemployment rate still to peak at around 6½%.

“We continue to expect no change in cash rate until a tightening cycle begins near the end of 2015,” the NAB said.