There was nothing in yesterday’s data flow to change anyone’s thinking on the health and direction of the economy – still ambling along, growing below trend and not showing any signs of exuberance.

Retail sales were higher, but slowed in February from their strong pace in January, the trade surplus was again solid at more than $1 billion, car sales had their best month for 10 months, but activity in our huge services sector slowed noticeably.

The data had little impact on the Aussie dollar which again remained comfortably above 92 USc yesterday.

The solid trade data was notable as February saw Chinese exports and imports drop because of the long Lunar New Year holiday at the start of the month.

But Australian shipments held up and iron ore exports were only down around $37 million, according to ABS estimates.

For retail sales, they rose 0.2% seasonally adjusted, which was the 10th month in a row of rising sales.

For the AMP’s chief economist, Dr Shane Oliver the retail sales and trade data "add to confidence that Australian economic growth will pick up pace this year. It’s consistent with our view that interest rates will remain on hold for now, ahead of the RBA starting to raise interest rates later this year."

Seasonally adjusted data from the Australian Bureau of Statistics show that retail sales rose an estimated 0.2% in February after the 1.2% rise in January.

But on the more accurate trend basis sales were up an estimated 0.7% in February 2014 after similar rises in January and December (which gives an annual rate of more than 8%).

In trend terms, Australian turnover rose 5.9% in February compared with February 2013. That’s up from the trend growth rate of 5.6% for the year to January.

While volatile department stores sales fell, other retailing sectors took up the slack including a strong gain in household goods sales.

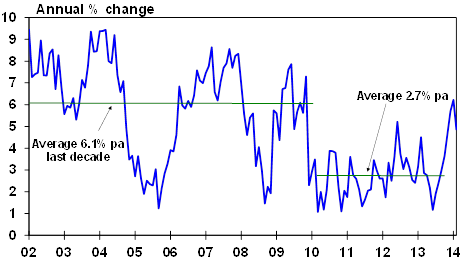

Retail sales much stronger after a four year malaise

Source: ABS, AMP Capital

Dr Oliver said yesterday, "There is clear evidence of the two speed economy going into reverse with trend monthly retail sales growth of 1% in NSW and 0.7% in Victoria compared to just 0.2% in Western Australia.Retail sales are continuing to shake off a four year malaise.

"While news of job losses and the soft labour market generally are dampeners for spending, this is being more than offset by the combination of low mortgage rates, rising wealth levels flowing from higher share markets and property values and the commencement of a housing construction boom that will drive demand for household goods."

The ABS said the largest contributor to the rise was household goods retailing (up 2%), followed by other retailing (1.9%), cafes, restaurants and takeaway food services (0.1%) and clothing, footwear and personal accessory retailing ( also 0.1%). Department stores plunged 4.7% and food retailing was down 0.2%.

"The state which was the largest contributor to the rise was Victoria (0.5 per cent), followed by Western Australia (0.4 per cent), New South Wales (0.1 per cent) and Queensland (0.1 per cent). These rises were partially offset by falls in Tasmania (-1.4 per cent), the Northern Territory (-0.6 per cent) and the Australian Capital Territory (-0.1 per cent). South Australia was relatively unchanged (0.0 per cent)," the ABS said yesterday.

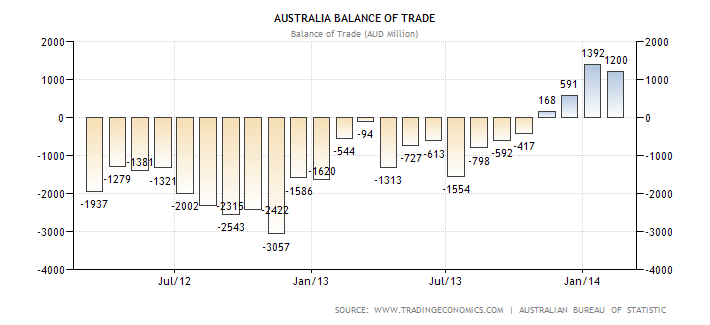

And the trade account produced another surplus – $1.2 billion seasonally adjusted, in February ($1.229 billion on a trend basis), which was $400 million more than forecast and a surprise given the fall in iron ore prices in the month, as well as the strength of the Aussie dollar.

Dr Oliver said yesterday the "trade balance continues to surprise on the upside with another strong surplus in February of $1.2bn on the back of continuing strong exports as the completion of various resources projects boosts export volumes and constrained imports.

"Trade is likely to be a continuing contributor to growth in Australia as the mining investment boom gives way to stronger resource export volumes and less resource related capital goods imports," Dr Oliver said.

Another trade surplus in February

Car sales were strong in March with Australians purchasing 97,267 new motor vehicles, according to industry figures released by the Australian Chamber of Automotive Industries.

That was up 7.7% from the 90,218 vehicles sold in March 2013 and higher than the 88.818 sold in February.

March was the first month this year where sales have exceeded the figure for the same month in 2013.

In fact it was the first rise in monthly sales (compared to the same month in the previous year) since July of last year.

Government purchases increased 9.6% in March 2014, compared to March 2013. In particular, government buyers bought 22.4% more passenger cars and 1.7% more SUVs. Private purchases increased 4%. Private buyers bought 11.3% more light commercial vehicles and 12.8% more SUVs. Business purchases fell 4.7%.

Toyota was the top selling brand in March 2014, with 18,275 sales. Toyota was followed by Holden (9,851), Mazda (9,203), Hyundai (8,606) and Ford (7,037).

But the news from the monthly survey of services was less encouraging with the March survey showing a fall in the pace of activity.

The Australian Industry Group’s (Ai Group) performance of services index fell sharply in March after recording its first expansion in two years in February, jumping to 55.2 – above the 50 level that separates expansion from contraction.

But in March the index fell 6.2 points to 48.9 as respondents reported that sales fell and employment contracted.

"Concerns over the economy and uncertainty around spending cuts in state and federal budgets were cited as impacting demand for services in March," the report said.