The slow recovery in the housing sector continued in June, but it was mostly driven by people wanting finance to buy existing homes, rather than by people wanting to build or buy new homes.

In terms of providing a new driver of growth for the wider economy, that’s pretty self-defeating. What the RBA wants to see is more money going into new home construction, which creates more value for the wider economy and jobs.

But lending for new home building or purchases of new homes is rising, and has been doing so now for a number of months.

The June data for housing finance from the Australian Bureau of Statistics showing a 2.7% rise in the number of home loans to 51,001 (seasonally adjusted). That’s around 9% above the 46,859 home loans in June of 2012.

The home loan approvals though do sit a little oddly with the fall of more than 3% in the number of housing approvals because lending for the construction of new dwellings rose 0.2% in June.

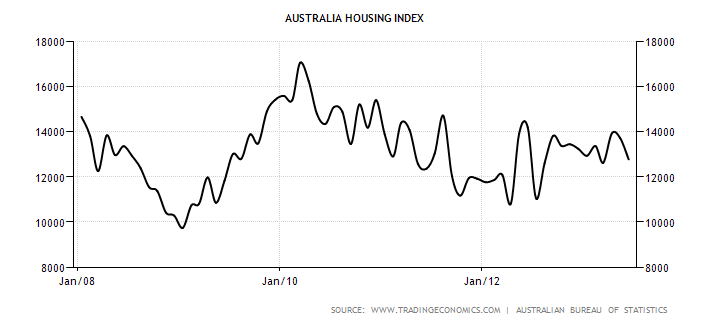

5Y Housing Index – Housing sector shows signs of life

But lending commitments are up 13% on June of 2012, so there’s growth, and the number of new first home buyers rose to 15.1% in June from 14.6% in May, but down on the 18.3% rate reported for June last year.

The data shows new home building loans continue to rise, as does the purchase of new houses.

The trend series attempts to smooth out the month to month fluctuations in the seasonally adjusted series.

The ABS said yesterday that in trend terms the number of commitments for owner-occupied housing finance rose 1.9%, the number of commitments for the purchase of established dwellings rose 2.1%, the number of commitments for the purchase of new dwellings rose 1.8% and the number of commitments for the construction of dwellings rose 0.9%.

"The total value of owner occupied housing commitments (trend) rose ($229m, 1.5%) in June 2013. Rises were recorded in commitments for the purchase of established dwellings (up $189m, 1.5%), commitments for the purchase of new dwellings (up $20m, 2.0%) and commitments for the construction of dwellings (up $20m, 1.3%). The seasonally adjusted series for the total value of owner occupied housing commitments rose 2.1% in June 2013," the ABS reported.

"The number of finance commitments for the purchase of new dwellings for owner occupation (trend) rose 1.8% in June 2013, following a rise of 2.8% in May 2013. This is the sixteenth consecutive rise since March 2012. The seasonally adjusted series rose 0.2% in June 2013, after a fall of 0.1% in May 2013."

Unemployment figures for July will be out today. Most economists are forecasting a loss opt jobs and a rise in the jobless rate to 5.8% fro, 5.7%.